Here is a quick summary of the cryptography landscape for Friday August 1 at 9:00 am UTC.

Get the latest information about Bitcoin, Ethereum and Altcoins, as well as an overview of the new key cryptocurrency market.

Bitcoin and Ethereum Price update

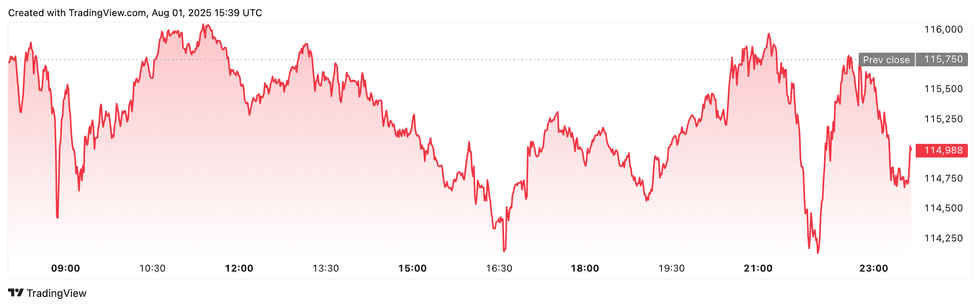

Bitcoin (BTC) was at the price of US $ 114,797, down 2.8% in the last 24 hours. Friday, its highest evaluation was US $ 118,696, while its lowest evaluation was US $ 114,322.

Bitcoin Performance Price, August 1, 2025.

Graphic via Tradingview.

The drop in Bitcoin prices followed American scanning prices, including a 35% levy from Canadian imports, which have passed off the risk assets. In parallel, the decision of the Federal Reserve to maintain interest rates from 4.25 to 4.5% and the stronger than expected inflation data attended the hopes of short -term rate drops, adding downward pressure to Bitcoin.

Ethereum (ETH) was at the price of US $ 3,595.75, down 5.2% in the last 24 hours. Friday, its lowest evaluation was US $ 3,591.61, and its highest was US $ 3,809.48.

Altcoin price update

- Solana (soil) was at the price of US $ 167.55, down 5.4% over 24 hours. Friday, its lowest valuation was US $ 165.43, and its highest was US $ 179.17.

- Xrp Exchange against US $ 3.03, down 2.2% in the last 24 hours. Its lowest evaluation of the day was US $ 2.91, and its highest was US $ 3.13.

- Sui (sui) Negotiates to US $ 3.52, down 6.7% in the last 24 hours. Its lowest evaluation of the day was US $ 3.45, and its highest was US $ 3.81.

- Cardano (ADA) was negotiated at US $ 0.7321, down 4.1% over 24 hours. Its weakest Friday assessment was US 0.7137, and its highest was US $ 0.7731.

The news of today’s crypto namely

Coinbase is missing income as negotiation volumes

The actions of Coinbase Global (Nasdaq: Coin) fell 12% in pre-commercial exchanges on Friday August 1 after the Crypto Exchange missed Wall Street expectations for revenues in the second quarter.

While the company’s revenues increased by 3.3% in annual slipping to reach 1.5 billion US dollars, it failed to estimate US $ 1.59 billion and is down compared to 2 billion US dollars in the previous quarter.

However, net profit increased to 1.43 billion US dollars, largely unabled to assets and cryptographic investments.

Coinbase continues to diversify and noted that he tests the traditional trade in actions, FX and raw materials. The company was recently added to the S&P 500 (Indexsp: INX) in May.

Assess will widen access to token titles with API Plug-And-Play

The Austria-based commercial platform, ASSETHERA, has launched an API in accordance with MIFID which allows the exchanges of crypto which offer token titles, including the American treasury bills and first-rate actions, without the need for their own license to regulate.

The service is currently providing more than 60 financial instruments and manages all compliance responsibilities, including KYC and anti-flask checks. Assess the cryptographic platforms in the EU and the European economic field, aimed at breaking the domination of the main players such as Kraken and Gemini in token workers.

The company said that it was in discussion with several top 20 global trade in cryptography and provides that 1 billion euros in negotiation volume during its first year.

The benefit of US $ 10 billion in the strategy does not impress investors

Despite the publication of a profit of $ 10 billion for the second quarter, the course of the Action of Strategy (NASDAQ: MSTR) fell by 1.4% in exchanges after working hours on Friday, highlighting the concerns of investors concerning the future of the company beyond Bitcoin.

The strategy, formerly focused on corporate software, has increasingly transformed into a corporate bitcoin treasure. The company now holds more than 628,000 BTCs, which represent more than 3% of the total supply and are valued at $ 74 billion.

Michael Saylor’s pivot inspired imitators like Japanese Metaplanet (TSE: 3350, OTCQX: MTPLF), which converted the hotel’s active ingredients to crypto. Despite the drop in this week’s action price, the next strategy movements include the collection of $ 4.2 billion through a new STRC offer to buy more bitcoin.

Do not forget to follow us @inn_technology for new -time new updates!

Disclosure of securities: I, Giann Liguid, does not dispute any interest in direct investment in any company mentioned in this article.

From your site items

Related items on the web