Here’s a quick recap of the crypto landscape as of Wednesday, February 11 at 9:00 p.m. UTC.

Get the latest information on Bitcoin, Ether and altcoins, plus an overview of the top cryptocurrency market news.

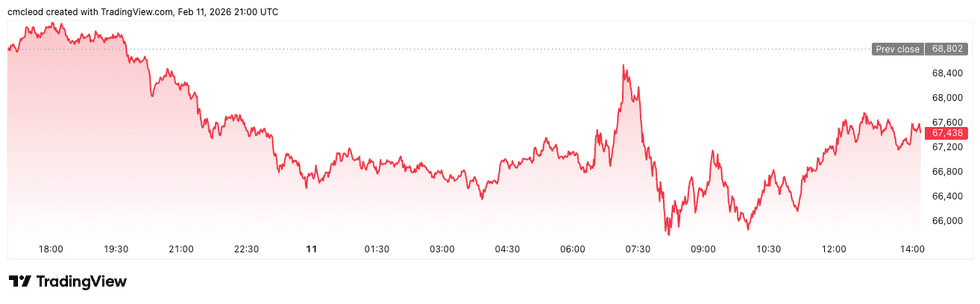

Bitcoin (BTC) was priced at US$67,551.42, down 18% in the last 24 hours.

Bitcoin Price Performance, February 11, 2026.

Chart via Trading View.

Lacie Zhang, research analyst at Bitget Wallet, told Investing News Network that short-term trading remains choppy and suggests that with fewer ETF outflows and more stable institutional behavior, selling pressure could ease:

“Bitcoin appears to be entering a stabilization phase ahead of its next directional move. In the short term, prices are expected to consolidate around the US$70,000 level as the market digests recent volatility and continued profit-taking, but the broader pattern points to a gradual recovery towards the US$85,000-$95,000 range by mid-2026.

“The main driver is institutional behavior: ETF outflows are slowing rather than accelerating, suggesting that forced selling pressure is easing and long-term allocators are becoming more selective rather than exiting outright. At the same time, regulatory advances – particularly around stablecoin frameworks and clearer market structure – continue to strengthen Bitcoin’s position as a maturing asset within global portfolios, especially as investors are seeking inflation hedges amid continued macroeconomic uncertainty.

“While short-term price action may remain uneven, innovation in DeFi and tokenized assets strengthens the underlying crypto ecosystem, creating conditions that have historically supported post-correction rallies and attracted long-term capital to Bitcoin.”

Ether (ETH) The price was $1,955.33, down 2.8% in the last 24 hours.

Today’s crypto news to know

Robinhood shares fourth quarter results

Robinhood Markets (NASDAQ: HOOD) released its latest quarterly report on Wednesday, revealing net income totaling $605 million for the fourth quarter of 2025 and $1.9 billion for the year.

The company reported record quarterly revenue of $1.28 billion, an increase of 27% year over year, but below estimates of around $1.36 billion. Its full-year 2025 revenue reached $4.5 billion, up 52%.

However, crypto revenue fell 38% to $221 million in the fourth quarter.

Despite a fundamentally strong quarter, with record earnings per share of US$0.66 in the fourth quarter and US$2.05 for 2025, shares fell between 7% and 12% after the release and closed down 9% on the day.

Separately, Robinhood launched a public testnet for Robinhood Chain, an Ethereum Layer 2 built on Arbitrum technology and designed to support tokenized digital and real assets.

Developers can begin building and testing applications ahead of a future mainnet launch. The testnet offers network access, development documents and compatibility with standard Ethereum tools, as well as early support from infrastructure providers such as Alchemy, Chainlink and LayerZero. Robinhood also said it would commit US$1 million to the Arbitrum Open House 2026 program to encourage developer activity on the testnet and eventual mainnet.

Banks Exploit Stable Coin Yield as CLARITY Act Stagnates

U.S. banks are toughening their stance on stablecoin rules, intensifying a political conflict that has left the long-awaited CLARITY Act stalled in Congress. At a meeting hosted by the White House and led by the administration’s crypto council, banking groups circulated a proposal calling for an outright ban on interest payments or other incentives to stablecoin holders.

The draft text states: “No person may provide any form of financial or non-financial consideration to a stablecoin holder” in relation to the holding or use of a payment stablecoin.

Banking groups have warned that allowing stablecoin yield could “lead to a deposit flight that reduces high street lending,” while crypto proponents have argued that innovation should not be stifled. The dispute centers on whether stablecoin rewards resemble bank deposits, potentially siphoning off funds from traditional lenders.

“As we noted during the meeting, this framework can and should embrace financial innovation without compromising safety and soundness, and without endangering the bank deposits that fuel local lending and drive economic activity. We look forward to ongoing discussions to advance market structure legislation,” the American Bankers Association said in a statement following the meeting.

The impasse has become the main obstacle preventing the CLARITY Act from moving forward, despite the earlier passage of the GENIUS Act, which created a federal framework for dollar-backed stablecoins.

Goldman Sachs Maintains Exposure to US$1 Billion Bitcoin ETF

Goldman Sachs (NYSE:GS) revealed in its latest filing with the U.S. Securities and Exchange Commission that it holds just over $1 billion in exposure to Bitcoin through exchange-traded funds (ETFs).

Exposure is spread across products including BlackRock’s iShares Bitcoin Trust ETF (NASDAQ:IBIT) and Fidelity’s Wise Origin Bitcoin ETF (NEO:FBTC). Bitcoin has fallen about 47% from its peak and is trading near US$67,000, part of a broader US$2 trillion drawdown in the crypto market. ETF flows have been volatile, with more than US$6 billion flowing out of spot Bitcoin funds since November, according to industry data.

Despite the crisis, Goldman has also expanded into Ether, XRP and Solana ETFs.

Monad Launches Nitro Accelerator

Blockchain company Monad announced on Tuesday (February 10) the launch of a new three-month accelerator program, Nitro, backed by notable companies such as Paradigm, Electric Capital, Dragonfly and Castle Island Ventures.

Nitro will fund up to 15 startup teams building on or around Monad, with a total of US$7.5 million and up to US$500,000 per team. The news was shared in an email to Investing News Network.

According to commentary provided during a press briefing accompanying the announcement, “The program is designed to address a common problem in crypto venture funding: teams often raise capital quickly but struggle to ship production-ready products or achieve product-market fit. Nitro is structured around execution, shipping cadence, and validation, rather than short-term growth metrics or token-based incentives.”

The press release notes that the Monad ecosystem has already seen $108 million raised through projects.

The three-month program includes an initial in-person month in New York and will be followed by two months of focused execution, concluding with a demo day for crypto and technology investors.

Interactive Brokers Adds Coinbase Nano Contracts

Interactive Brokers announced the addition of “nano contracts” from the derivatives arm of Coinbase Global (NASDAQ: COIN) to its trading platform. These contracts control fractions of a Bitcoin or Ether coin and require less initial investment.

Clients can trade these futures contracts, some with fixed expiration dates and others that track the current price over time, 24/7 in Interactive Brokers’ standard brokerage environment, alongside stocks and options.

The move aims to make it easier and cheaper for people to gain exposure to crypto prices and manage risk, while still using a regulated broker and exchange.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any of the companies mentioned in this article.