The supercycle narrative, once treated as gospel, took a serious hit as BTC USD slipped to $60,000 and ETH USD fell below $2,000. Is this just another brutal upheaval or the moment when the supercycle myth finally broke? Regardless, BTC USD and ETH USD are now inseparable from the lower sentiment.

Cryptocurrency Fear and Greed Chart

1 year

1m

1w

24h

What made us feel the crisis is that we just don’t know where the fire is coming from. No surprise rate hikes, no currency collapse, no overnight regulatory hammer. The total crypto market cap fell to $2.3 trillion after a sharp daily decline of 7%, almost half of the high of $4.2 trillion.

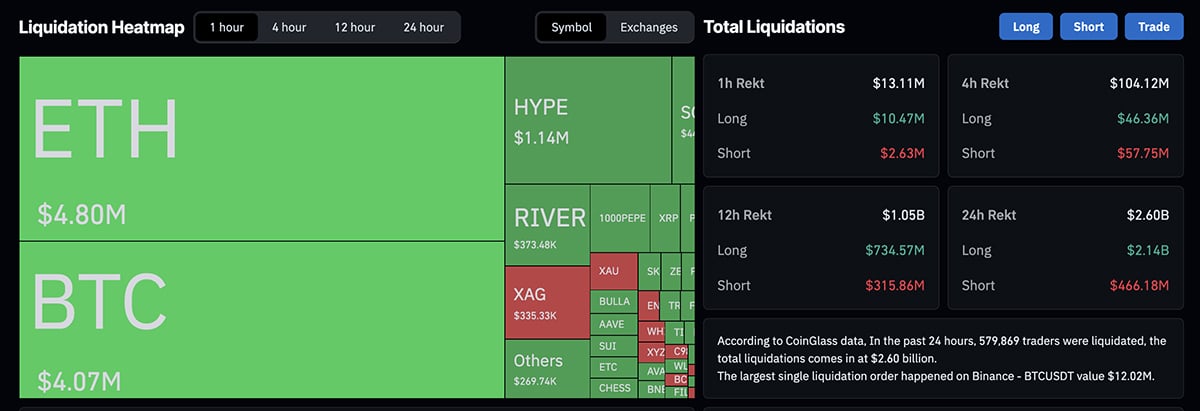

More than $2.6 billion disappeared in a single day as Bitcoin losses hit past black swan events. Long positions worth more than $2.1 billion were wiped out; it was just a brutal bloodbath. Nobel laureate Paul Krugman called it a “crisis of faith” as ETH and BTC fail to live up to the narratives. The supercycle debate becomes emotional before becoming analytical in a low cycle.

If it’s a supercycle, it’s not the smooth, ascending version people sell on podcasts. If.

(source – coin mechanism)

Testing Supercycle Resistance for BTC USD and ETH USD

The strategy’s CEO, Phong Le, said BTC USD would need to crash to $8,000 and stay there for years to truly threaten corporate balance sheets. At the same time, $4.3 billion worth of Bitcoin was distributed on Binance in just two days, more than on any other exchange, even though on-chain data showed long-term holders were barely moving.

Phong Le: #Strategythe balance sheet remains resilient, and #BTC it would have to fall to $8,000 for years to threaten its convertible debt. pic.twitter.com/8blEcLbYHL

– Coin Paper (@coinpapercom) February 6, 2026

The market has lost almost $1 trillion since mid-January, with analysts now openly offering $40,000 scenarios for BTC just as the bears maintain their momentum. Meanwhile, ETH USD continues to struggle with its own identity crisis as layer 2 drama and ecosystem politics muddy the waters. The supercycle limps if it exists.

Despite the noise, the adoption headlines have not stopped. Russian Sberbank is preparing cryptocurrency-backed loans for businesses. Binance’s CZ continues to promote the idea that every national currency belongs on-chain. Brian Armstrong of Coinbase likened cryptography and AI to the “Siamese twins” of applied mathematics, destined to reconnect. Builders build while prices bleed.

Sovcombank has reportedly discussed possible cryptocurrency-backed loans, particularly for miners, as part of Russia’s evolving regulatory framework – but there is no official launch yet.

In addition, Sberbank tested a business loan backed by Bitcoin. pic.twitter.com/sFxYDmUsj0

– CryptoPotato Official (@Crypto_Potato) February 5, 2026

DISCOVER: 10+ Next Cryptos to 100X in 2026

Reality check: Is it a check?

From a technical perspective, BTC USD surging above $70,000 and hitting $60,000 pushed momentum indicators into extreme territory. The daily RSI fell near 22, a lower range than the “Covid Crash”. A good rebound could target the $75,000 area if volume helps the price, but a failure here opens the door to $40,000 based on Fibonacci retracements of the October highs. The 200-day moving average indicates that $55,000 is the line to watch.

ETH USD looks equally tense as it slides below $2,000, completing a descending triangle, with $2.2,000 now acting as stubborn resistance. The MACD remains bearish, but stochastic indicators are starting to diverge, pointing to a relief rebound. A push towards $2.5K is not impossible, but a clear break below $1.8K would likely take ETH towards $1.5K. So the question is whether the supercycle will really start again.

The total crypto market cap excluding BTC and ETH USD is down 16% this week, while DeFi TVL slipped to $93 billion, losing 7%. Feeling gauges are plunged into extreme fear. However, it is somewhat optimistic as it shows that most retailers have already left the room.

At the end of this week, remember that every cycle feels like the end when you hold on. Whether the supercycle survives or not, BTC USD and ETH USD have reached levels where patience pays off in many cases. Fire looks scary up close, but step back and look at how beautiful it is from afar.

For me, I will sing “Have a Cigar” for Bitcoin

Come in here, my dear boy, have a cigar, you will go far.

You will fly, you will never die.

And have we told you the name of the game, my boy?

We call this riding the gravy train.

DISCOVER:

- 16+ New and Upcoming Binance Announcements in 2026

- 99Bitcoins State of the Crypto Market Report for Q4 2025

Follow 99Bitcoins on X For the latest market updates and subscribe on YouTube for daily market analysis from experts.

There are no live updates available yet. Please come back soon!

The post Crypto News Today, February 6: Supercycle, they say! Sentiment Bottomed, BTC USD Touched $60,000, ETH Below $2,000 appeared first on 99Bitcoins.

Phong Le:

Phong Le:  Sovcombank has reportedly discussed possible cryptocurrency-backed loans, particularly for miners, as part of Russia’s evolving regulatory framework – but there is no official launch yet.

Sovcombank has reportedly discussed possible cryptocurrency-backed loans, particularly for miners, as part of Russia’s evolving regulatory framework – but there is no official launch yet.