Explore the crypto opportunity of the alt season and learn how to maximize your cryptocurrency investments as Altcoins retest breakouts.

As the world worries about a stock market crash, smart money is buying new breakout tests on popular altcoins, perhaps the last cheap crypto opportunity.

Red days in the markets usually scare people, and retail money stays away until it turns green again. But that means they get less return on their investment – as the age-old saying goes: “buy fear.”

Last weekwe have seen many altcoins break out of rectangular formations or remain range-bound during relatively long consolidation periods. But this week the price of Bitcoin .cwp-coin-chart svg path { Stroke: ; line width: ; }

Price

Trading volume in 24 hours

Last price movement over 7 days

undergoes a correction, which triggered a market-wide sell-off. For marginalized people, these corrections represent the best buying opportunity.

How Do Altcoin Breakouts Behave Against Falling Bitcoin Prices?

Building on last week’s analysis, we will revisit the coins analyzed last week when we explained rectangle trading and reexamine the levels at/near the top levels for the major altcoins.

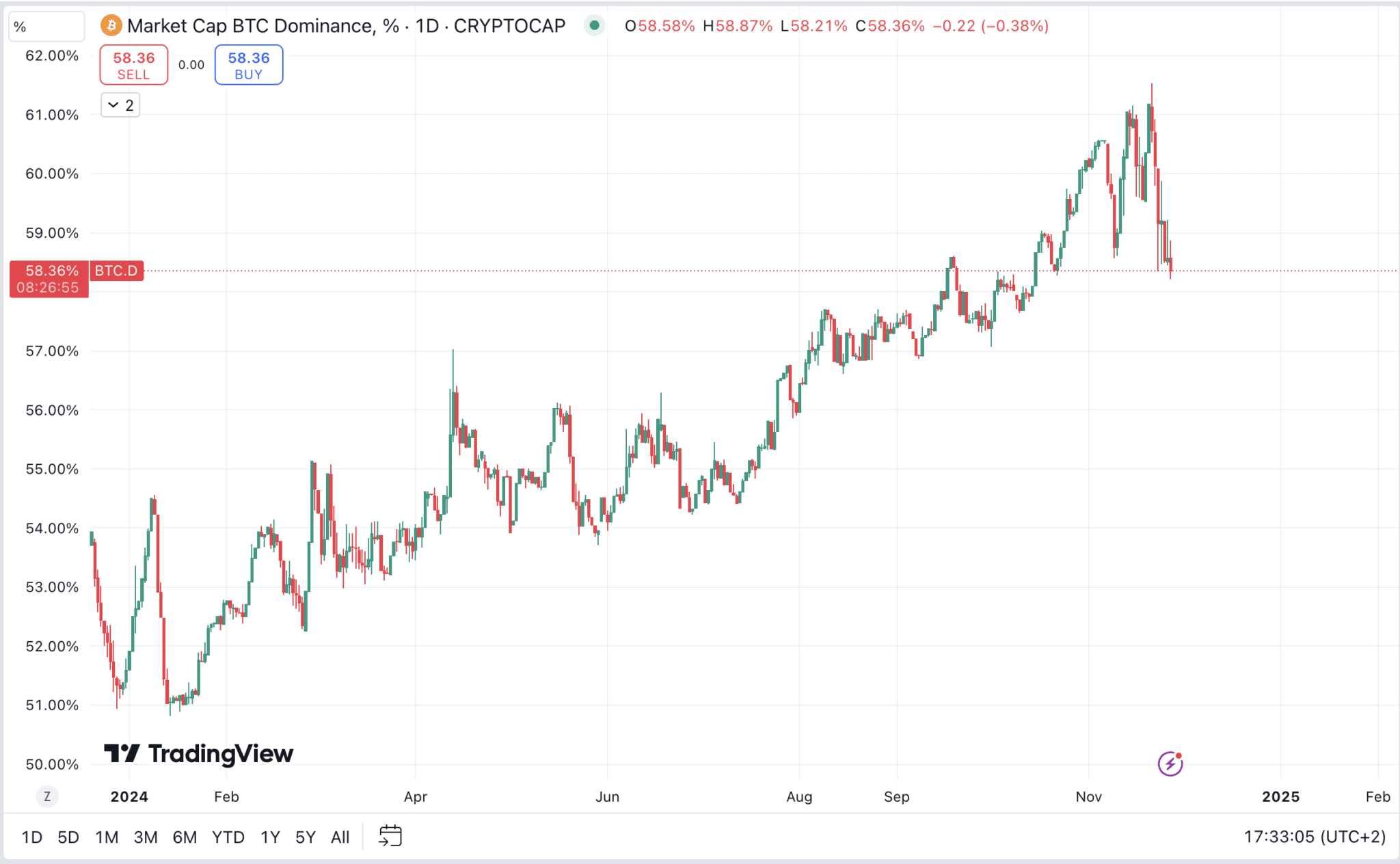

First, we want to look at Bitcoin’s dominance chart, which has been falling in recent days following Bitcoin’s overheating to $99.3k.

(BTC.D)

And that’s exactly what we’re looking for: the uptrend in this chart is interrupted as the price of Bitcoin falls relative to the altcoin market.

I should note that this does not mean that the price of Bitcoin will not increase; it will likely push into the 6 figures over the next few months.

But it does indicate that more money has been flowing into altcoins over the past few days, suggesting the emergence of an alt-season trend.

(ETH/BTC)

Next we look at the ETH/BTC chart and we can see that the price or ratio has returned and is retesting an area of interest. This has been an indicator of previous altcoin runs. We will see if history repeats itself for the current bull run.

In addition to this, at the time of writing, the price of Ethereum .cwp-coin-chart svg path { Stroke: ; line width: ; }

Price

Trading volume in 24 hours

Last price movement over 7 days

increased by 7% today!

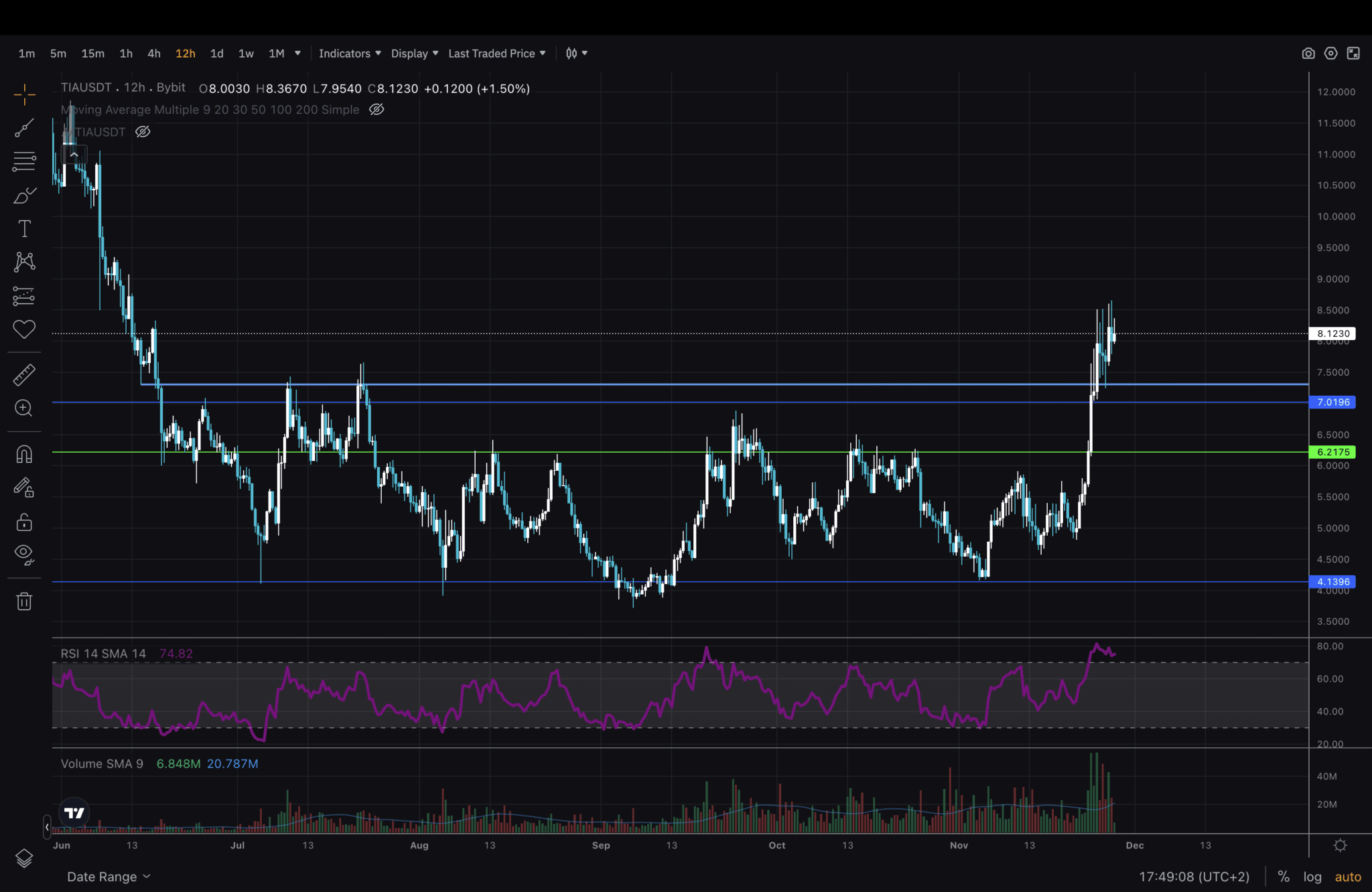

(TIA/USDT)

As an example of rectangle retesting in technical analysis, we look at TIA .cwp-coin-chart svg path { Stroke: ; line width: ; }

Price

Trading volume in 24 hours

Last price movement over 7 days

.

Based on the analysis of last week’s article, I added an additional level: light blue, which is only exploited twice in July.

Last week, the price moved up without much hesitation. It could be that the only retest we will see is on this light blue line and orders set at the $7 level are anticipated.

Go out and draw some lines. And remember to always use sound risk management!

EXPLORE: Crypto Crash Sends Shockwaves Through Market: Why Is Bitcoin Down and Bull Crushed?

Join the 99Bitcoins News Discord here for the latest market updates

The article Crypto Opportunity: Fears of a US Stock Crash Could Offer Discounts to Buyers appeared first on .