- Ripple CLO has called for an end to SEC overreach in 2025.

- Variant Fund CLO warned of slow but positive regulatory outlook for crypto.

US crypto executives expected better regulatory clarity in 2025 under the new Trump administration.

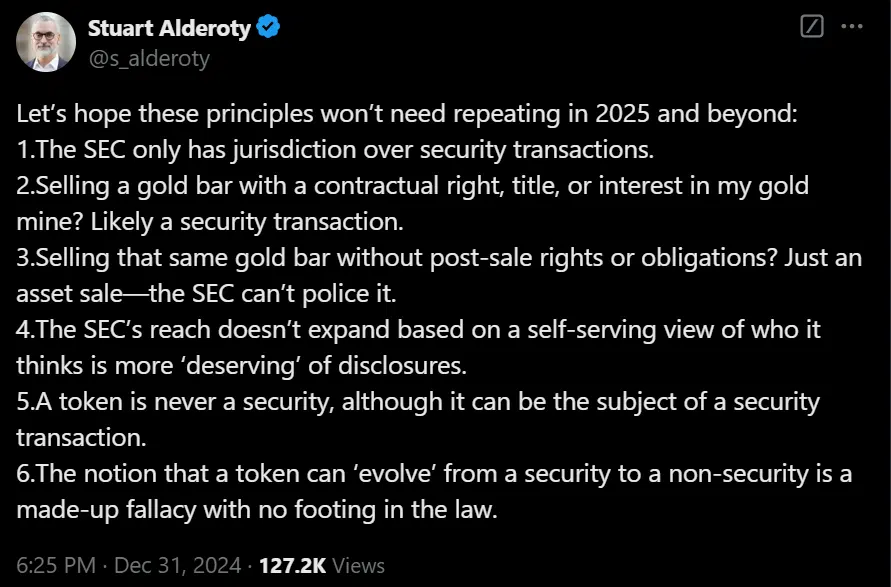

In a recent X (formerly Twitter) jobStuart Alderoty, Ripple general counsel, called for an end to SEC overreach in 2025.

Source:

Some issues highlighted are related to the ongoing Ripple-SEC lawsuit. For the uninitiated, the agency sued Ripple for selling XRP without a security record.

Although the courts determined that the sale of XRP on exchanges did not constitute an offering of “security,” the institutional sale was an offering of security.

The regulator must appeal in mid-January. However, with pro-crypto SEC Chairman Paul Atkins, most analysts expect the new administration to reject the call.

Crypto Regulation Outlook for 2025: Slow but Positive

Despite his hope, Jake Chervsinsky, CLO of the crypto VC Variant Fund, warned community members to lower their expectations for a radical and accelerated policy change. He said,

“The market can overestimate what can be done in a day. DC is moving slowly and real change takes time and hard work. But all the stars are aligned for crypto in 2025.”

For his part, Coinbase CLO Paul Grewal gave a summary of crypto regulations in 2024 and declared,

“If crypto’s most lasting contribution in 2024 is the reminder that US law comes from Congress, not agencies, as enforced by the courts, I’m OK with that.”

In other words, he emphasized that real policy change begins with the U.S. Congress.

Interestingly, the industry understood this and led a massive lobbying effort during the 2024 US elections. Now, space is poised to have the most pro-congress and president. crypto history.

The industry’s resounding resolve behind the pro-crypto Trump candidacy was illuminated by the SEC’s reported overreach and nefarious regulatory enforcement approach.

Besides Ripple, the SEC sued Coinbase and Binance and intended to charge DeFi leaders like Uniswap.

However, all that could change when President Donald Trump officially takes office on January 20, at least according to community expectations.

That said, the industry has been pushing for better crypto regulation through Stand With Crypto (SWC), a global crypto advocacy organization.

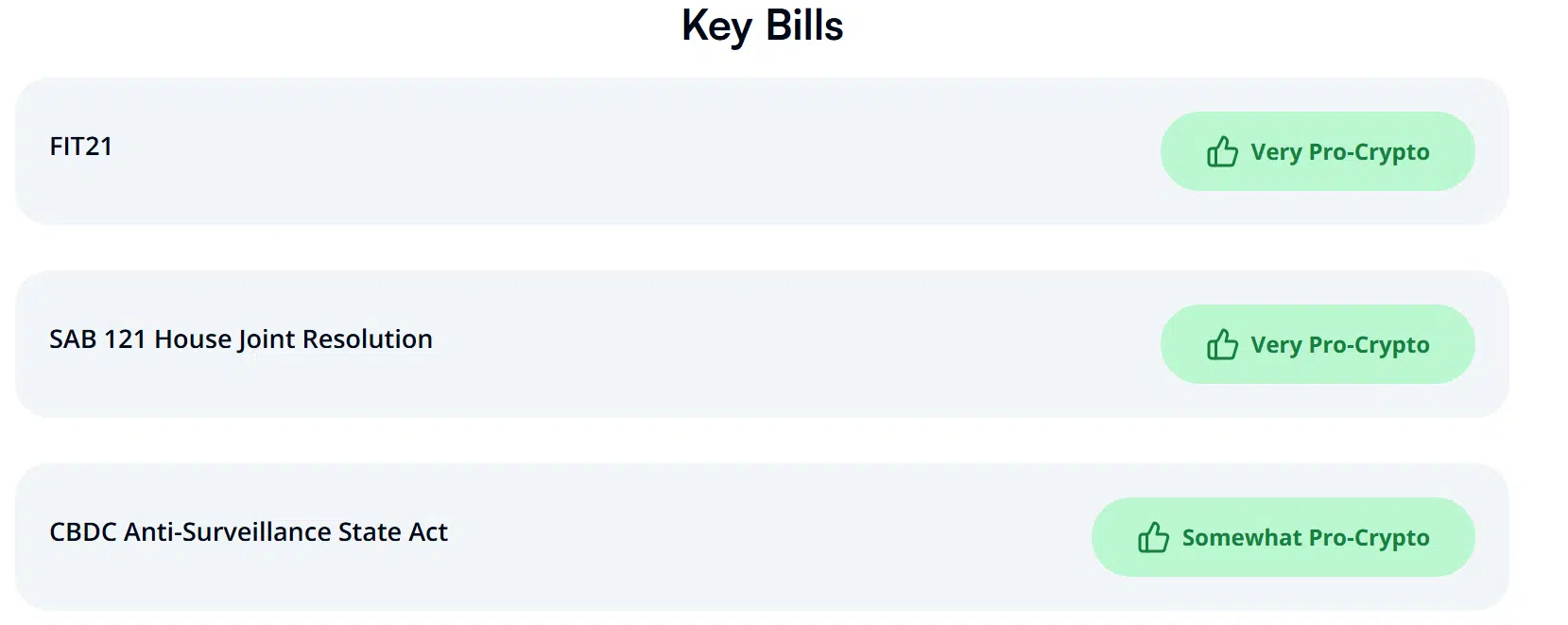

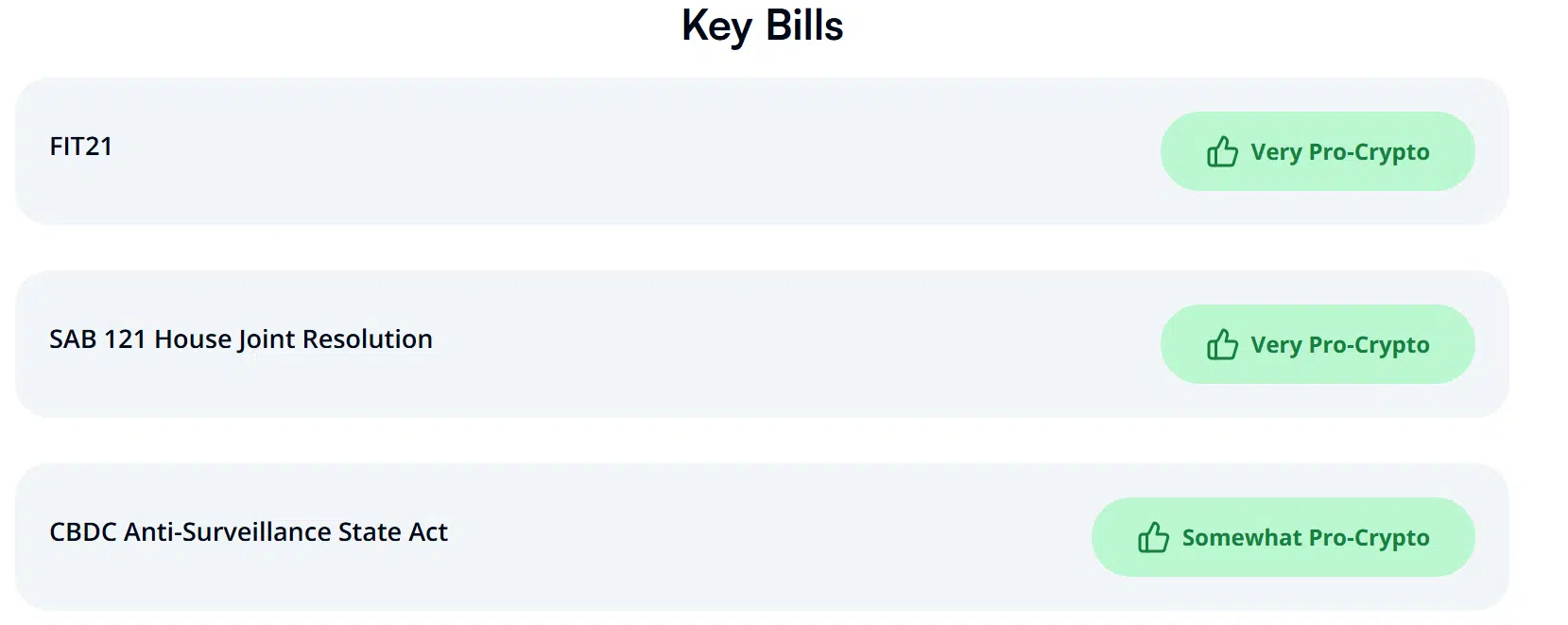

Some of the best crypto bills include the Market Structure Bill, dubbed the FIT21 Act, Joint Resolution SAB 121, and the CBDC Anti-Surveillance State Law.

Source: Support Crypto

Clearer regularity could allow the US to catch up with the EU MiCA Guidelinesentered into force on December 30, 2024.