Publicly traded crypto treasuries are turning defensive as market volatility causes a wave of company share buybacks in the digital asset treasury (DAT) sector.

Recently, Nasdaq-listed Upexi authorized a $50 million share repurchase program, showing a broader shift toward capital preservation even as companies continue to hold huge reserves of Solana on their balance sheets.

Upexi, a Solana-focused digital asset treasury company and operator of consumer brands, said its board approved the buyout to provide “the flexibility to purchase shares in the open market” depending on market conditions.

The company emphasized that the program reflects confidence in its long-term strategy while maintaining a strong cash position.

CEO Allan Marshall also added that the buyback is a tool to increase shareholder value and will only be executed when returns are attractive.

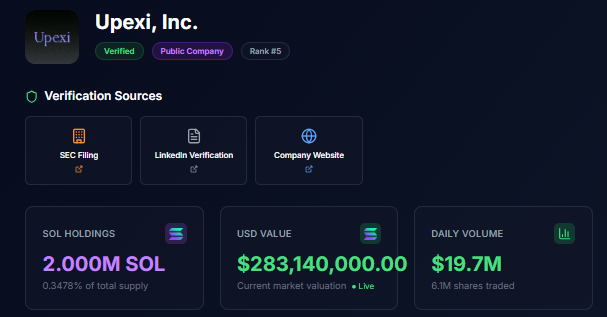

The company’s treasury holds approximately 2 million SOL, valued at $283 million, representing approximately 0.35% of Solana’s total supply.

Despite a recent drop in Solana’s price, from around $143 to $134, Upexi’s on-chain reserves remain among the largest institutional holdings in the ecosystem.

The company’s crypto-backed stance, however, has been reflected in high volatility in its own shares, which have fallen nearly 47% over the past month, from a high of $6.50 to around $3.43.

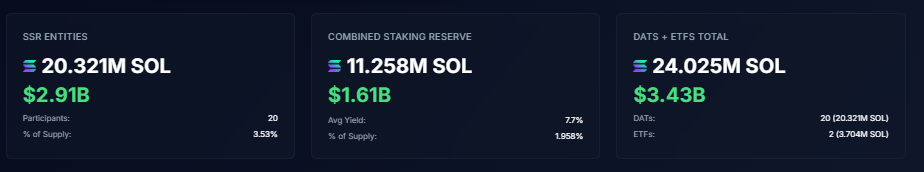

Upexi’s decision comes at a time of turbulence for Solana-related treasuries. According to institutional reserves data, the top 20 holders of Solana Treasuries and ETFs control 24 million SOL worth approximately $3.4 billion, or 3.5% of the total supply.

About half of these securities are staked for an average yield of 7.7%, while the remainder remains liquid for balance sheet management.

Forward Industries (FORD) leads with 6.8 million SOL worth nearly $966 million, followed by Solana Company (HSDT), DeFi Development Corp (DFDV), Sharps Technology (STSS), and Upexi rounding out the top five.

These companies represent approximately 76% of all institutional holdings in Solana, demonstrating how companies are using digital assets strategically.

Solana Treasury Companies Trade Below Asset Value as Institutions Maintain Positions

Market data shows that despite Solana’s price falling nearly 7% in 24 hours, institutional positions remained largely intact, and no major liquidations were reported.

Analysts view this stability as a sign of long-term confidence in the fundamentals of the Solana network and its growing role as blockchain for corporate treasuries.

Valuations on the public market differ. Most Solana Treasuries are currently trading at a discount to their net asset value (mNAV), indicating investor caution.

Upexi’s mNAV stands at 0.68, while that of Forward Industries sits at 0.82, suggesting cautious sentiment in the stock markets despite strong on-chain balance sheets.

The divergence between the value of treasury securities and stock performance has been a defining characteristic of the DAT sector.

Upexi, which reported a net profit of $66.7 million in its most recent quarter, largely thanks to $78 million in unrealized gains on Solana, still faces investor skepticism linked to broader crypto market fluctuations.

Its stock previously surged more than 600% after revealing its Solana strategy earlier this year, but has since fallen sharply as digital assets weakened.

Other treasures act the same way. On November 6, Forward Industries authorized a $1 billion stock repurchase program for flexibility amid volatility.

Despite the short-term price decline, the overall trend in Solana corporate holdings remains upward.

The rise of Solana-focused treasuries marks a shift from the Bitcoin treasury strategies that dominated previous cycles.

These companies use Solana not only as a store of value, but also as a yield-generating asset through staking and validator participation.

Companies like DFDV, which holds all of its 2.2 million SOL, illustrate how cash management in crypto is becoming increasingly active and revenue-driven.

The article Crypto Treasuries Turn Defensive as Solana Upexi Buyback Adds to Growing DAT Trend appeared first on Cryptonews.

https://t.co/6e8YsQ5DeF

https://t.co/6e8YsQ5DeF Forward Industries – the Solana treasury company – has filed its resale prospectus supplement with the

Forward Industries – the Solana treasury company – has filed its resale prospectus supplement with the