Coinbase Ventures has laid out a roadmap for where it expects the next wave of crypto value creation in 2026, focused on real-world perpetual assets, specialized exchanges, “next-generation DeFi,” and the convergence of crypto with AI and robotics. The company presents the document as an answer to founders’ recurring question: “What should I build next?” and says it is “actively looking for the right teams to invest in across these categories.”

The team claims that 2025 will quietly reset the foundations of crypto. They highlight “stablecoin infrastructure reshaping payments,” cross-chain proofs reducing settlement times “that once took days,” and new DEX models that have enabled “markets for everything on-chain.” Regardless of current price action, Coinbase Ventures writes: “We are more optimistic than ever about what comes next. »

Top Crypto Trends for 2026

The first major theme concerns derivatives of real-world assets. Kinji Steimetz claims that “perpetual RWAs” are emerging as the fastest way to bring off-chain assets on-chain, describing perpetuals as “the most proven crypto trading product” and “a structurally faster and more flexible path than tokenization.”

Because perpetuals do not require custody of an underlying asset, Coinbase Ventures expects “the perpification of everything,” with “markets (formed) around virtually everything,” from private companies to printing economic data. Steimetz also relates this to macro integration, noting that as crypto traders become more sophisticated, they will seek on-chain exposure to “oil, inflation breakevens, credit spreads, and volatility.”

A second group focuses on market structure and trading interfaces. On Solana, Steimetz highlights “Prop-AMMs” where remaining liquidity is only executed through aggregators, insulating LPs from “predatory flows.” This “ancillary-focused approach,” the blog claims, could “significantly advance market structure innovation ahead of base layer enhancements” and is not limited to Solana’s spot markets.

Meanwhile, Coinbase Ventures considers prediction markets “one of the leading mainstream crypto applications,” but still hampered by fragmentation reminiscent of early DeFi. Jonathan King expects “prediction market aggregators” to become the “dominant interface layer,” consolidating over $600 million in liquidity and providing an Axiom-like terminal for event-driven contracts. He envisions trading terminals with “advanced order types, filters/charts, multi-site routing and position tracking, cross-site arbitrage insights, and much more.”

Under “Next-gen DeFi,” the company highlights three fronts: composable perp markets, unsecured credit, and privacy. Perpetual futures, he argues, are evolving from isolated locations to building blocks of capital-efficient systems where users can “simultaneously hedge, earn, and leverage without sacrificing liquidity.” Coinbase Ventures notes that perp DEX volumes reached around $1.4 trillion per month and grew around 300% year over year, and expects 2026 to see deeper integrations with lending protocols so that collateral can generate returns while supporting leveraged positions.

On credit, King calls unsecured, credit-based money markets “the next frontier of DeFi,” highlighting $1.3 trillion in revolving, unsecured U.S. credit lines as an exploitable opportunity. The blog envisions models combining on-chain reputation and off-chain data to unlock “unsecured lending at scale,” while warning that the main challenge is “designing sustainable risk models at scale.” If this can be achieved, Coinbase Ventures says DeFi will become “a true financial infrastructure that can surpass traditional banking rails.”

Confidentiality is presented as a prerequisite for institutional and mainstream adoption. Ethan Oak notes that institutions and professional traders “can’t trade if they constantly disclose their strategies” and that ordinary users don’t want their “entire financial history” exposed on-chain. The team sees growing developer energy around privacy-preserving assets such as Zcash, private order books and borrow-lend protocols, and “dedicated payments blockchains touting privacy as their raison d’être.” They highlight advanced cryptography – “ZKP, FHE, MPC, TEE” – as tools for blockchains to “maintain verifiability while reducing users’ public exposure to bad actors.”

The final category connects cryptography to AI and robotics. When it comes to robotics, Steimetz highlights the lack of “precise physical interaction data such as grip, pressure, or manipulation of multiple objects” and suggests that incentivized data collection programs inspired by DePIN “could offer a viable framework” for scaling these data sets.

Regarding identity, Hoolie Tejwani warns that we are “approaching the tipping point where everything you see on an internet-connected digital screen will be disassociated and indistinguishable from human versus AI-generated origin.” Coinbase Ventures claims that “a combination of biometrics, cryptographic signing, and open source development standards” will be crucial to any “proof of humanity” solution, noting that Worldcoin has been “ahead of the curve” but emphasizing that they “would like to support multiple approaches.”

Finally, King describes AI for smart contract development as nearing his “GitHub Copilot moment,” predicting that AI agents will allow “non-technical founders to (launch) on-chain businesses in hours, not months,” by handling “smart contract code generation, security reviews, and ongoing monitoring.”

Looking to 2026, Coinbase Ventures says it’s “energized by builders making big decisions and pushing the blockchain economy forward,” but admits that “the most exciting projects often come from places no one expects,” leaving the door open for theses that haven’t been written yet.

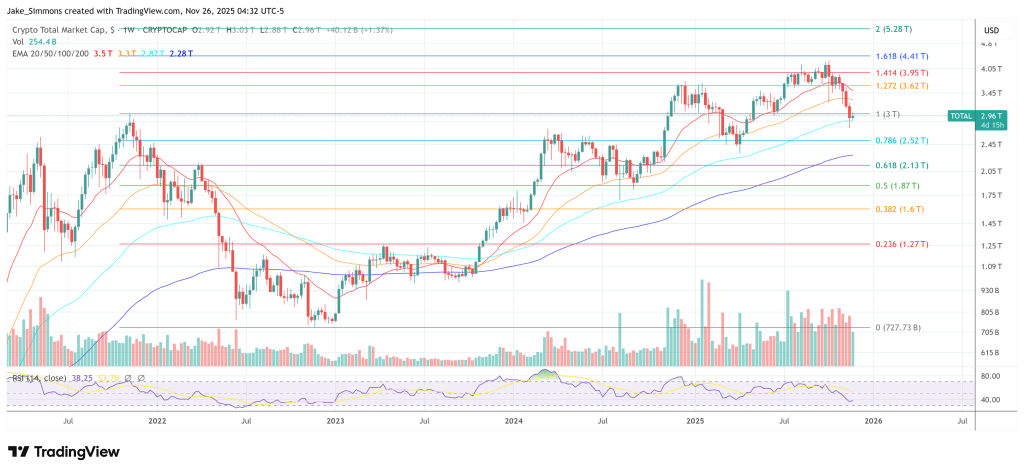

At press time, the total crypto market capitalization stood at $2.96 trillion.

Featured image created with DALL.E, chart from TradingView.com

Editorial process as Bitcoinist focuses on providing thoroughly researched, accurate and unbiased content. We follow strict sourcing standards and every page undergoes careful review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance and value of our content to our readers.