Next week, markets will be full of key economic reports, each of which has the potential to cause significant disruption!

From inflation figures to oil market trends and employment data, these updates can change the direction of crypto markets. With so much at stake, it is essential to understand how these events could influence the markets.

Read on to find out which economic data to watch and why it matters for crypto.

Previewing next week’s key economic events

Inflation data

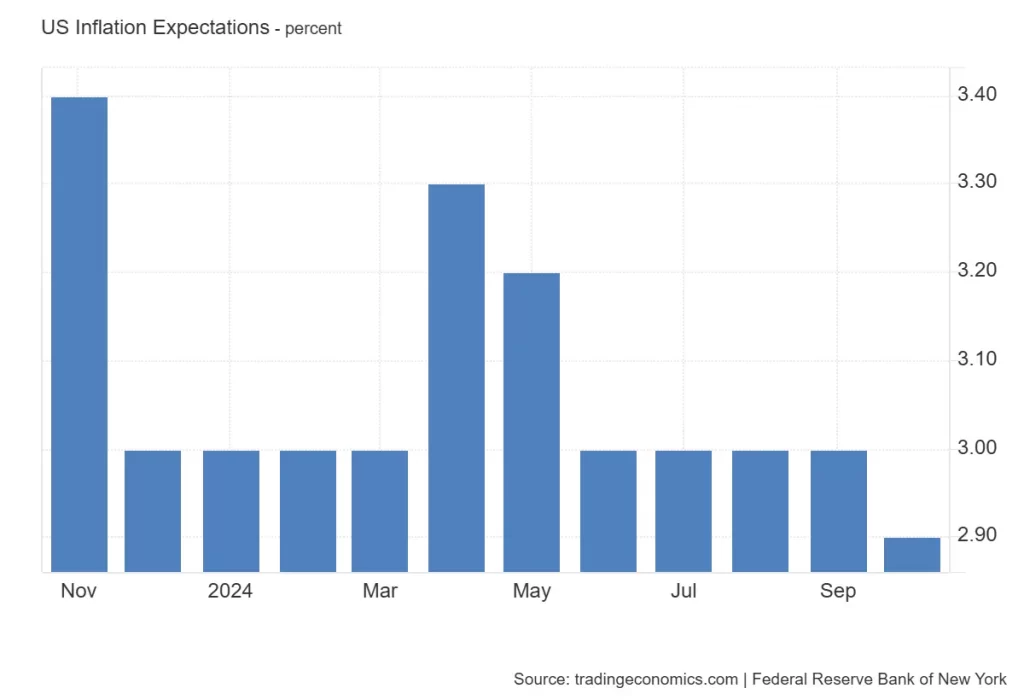

THE Consumer inflation expectations for November will be released by the New York Federal Reserve on December 9, 2024. In October, this figure fell to 2.9%, the lowest level since October 2020, after remaining at 3% for more than four months. For November, Trading Economics forecasts a slight increase to 3.0%.

On December 11, the Consumer Price Index (CPI) for November will be published. October’s CPI stood at 315.644, up from 315.3 in September. The forecast for November remains unchanged at 315.3 points.

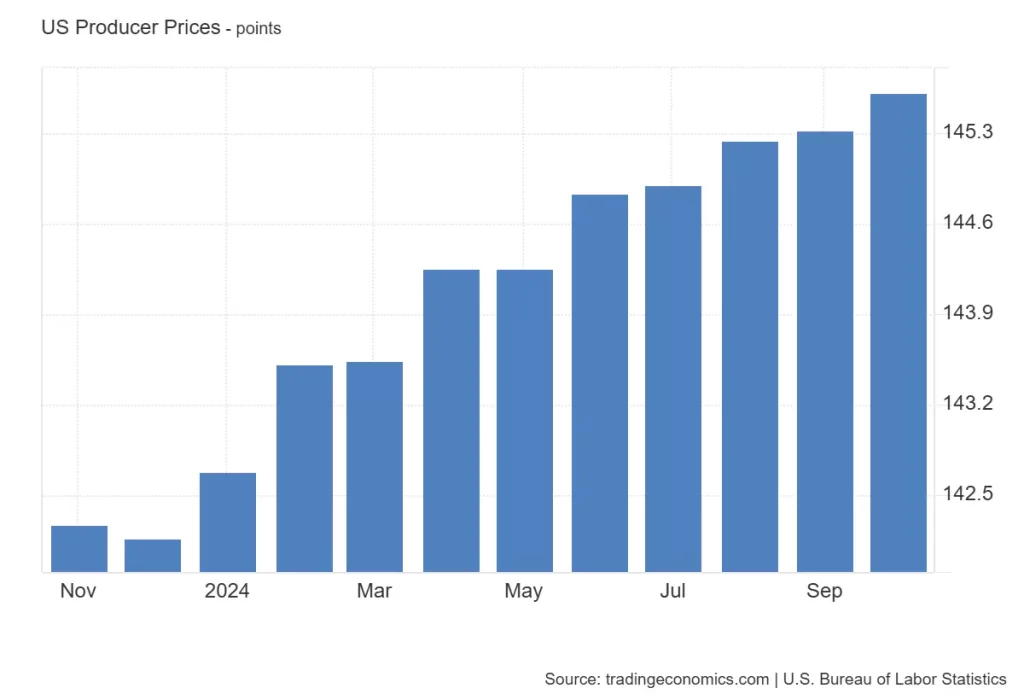

THE Producer Price Index (PPI) for November will be released on December 12. In October, the PPI index reached a record high of 145.615, compared to 145.329 in September. Experts predict a further increase to 146 points for November.

Higher CPI and PPI numbers could signal persistent inflation, which could prompt the Federal Reserve to raise interest rates. Tighter monetary policies generally reduce liquidity, which can negatively impact cryptocurrency prices.

- Read also:

- Crypto Bull ahead? $750 Million Unlocked Altcoin Expected to Shake the Market

- ,

Oil market trends

On December 11, OPEC will publish its Monthly Oil Market Reportproviding insight into global oil market trends. Oil prices have a direct effect on energy costs and investor sentiment, both of which can influence the cryptocurrency market.

If the OPEC report indicates a bull market in oil, it could lead to higher energy costs, increased spending on cryptocurrency mining operations and potentially affect the supply of cryptocurrencies.

Labor market: unemployment claims and economic sentiment

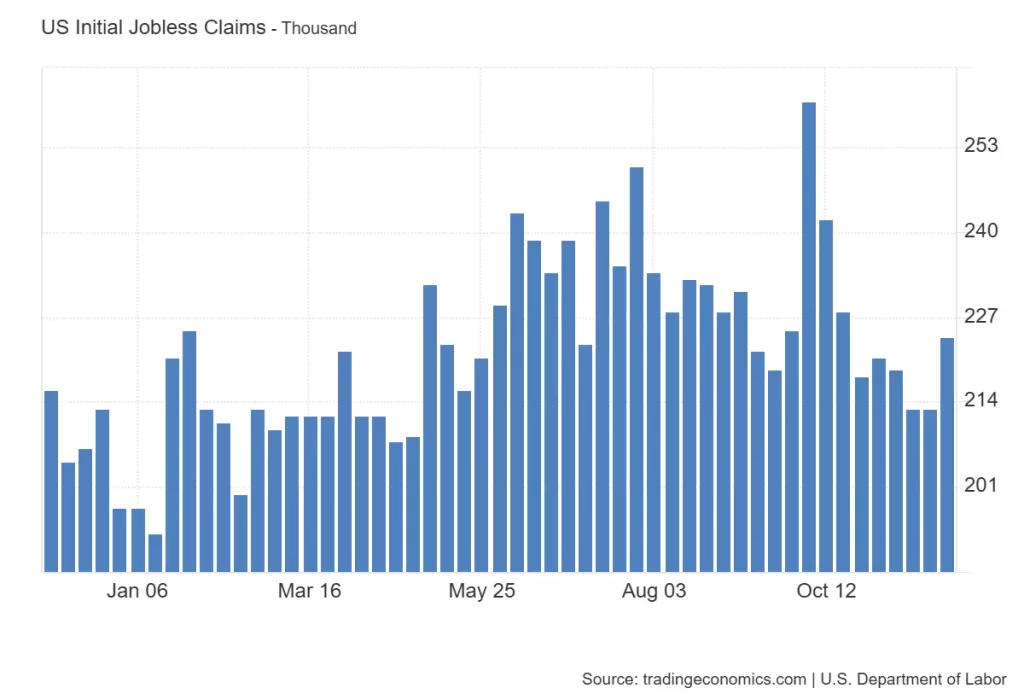

On December 12, the Initial Unemployment Claims data for the first week of December will be released. The previous report showed an increase to 224,000 applications as of November 30, compared to 213,000 the previous week. For December 7, consensus estimates place that number at 221,000, with some forecasts suggesting it could reach 225,000.

An increase in jobless claims may indicate economic difficulties, potentially leading investors to turn to cryptocurrencies as a safe haven.

Never miss a beat in the crypto world!

Stay ahead of the curve with breaking news, expert analysis and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs and more.

Import and Export Prices: How Trade Affects Crypto

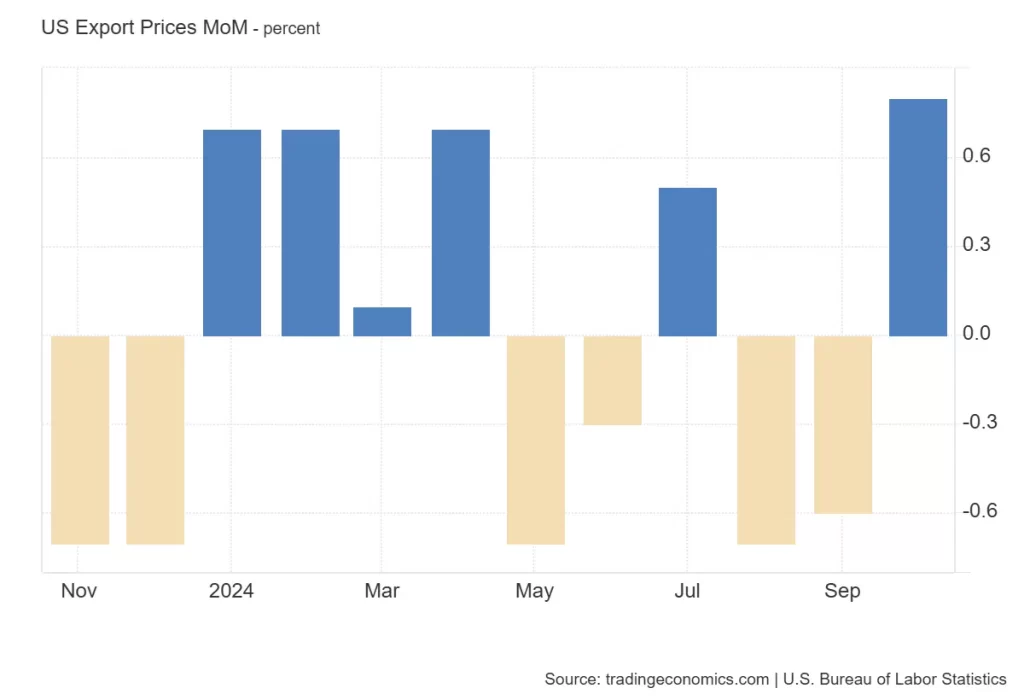

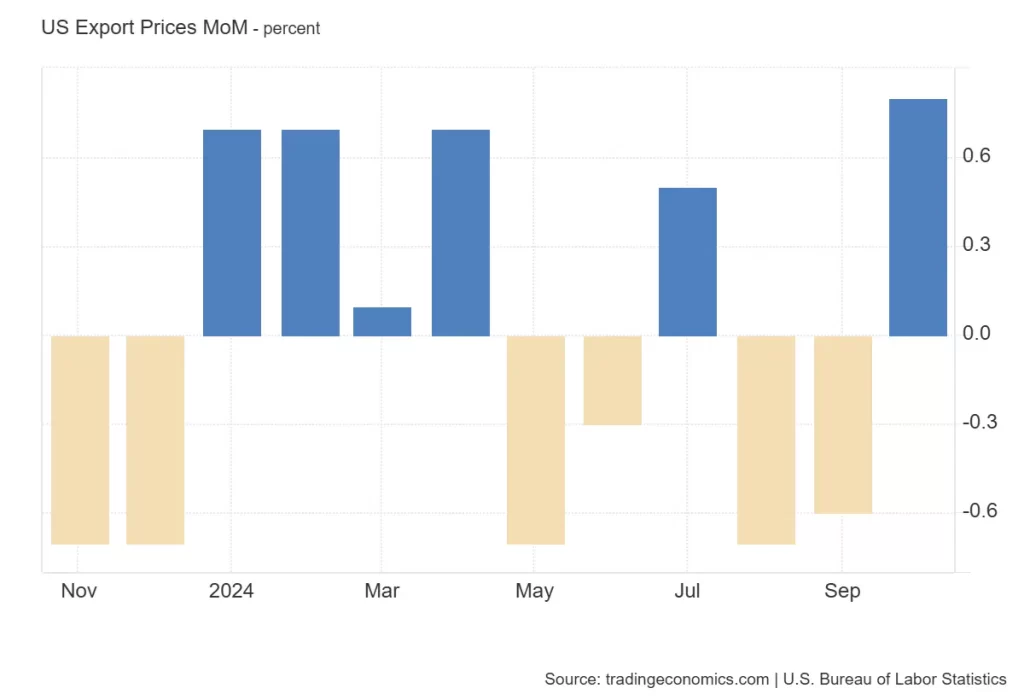

On December 13, the Import and export price indexes for November will be published. In October, the export index rose 0.8%, beating expectations for a 0.1% decline. For November, forecasts vary between a decrease of 0.3% and an increase of 0.9%. Meanwhile, the import index increased by 0.3% in October after a decline of 0.4% in September, with forecasts for November ranging from -0.3% to +0.2%.

Strong export price growth is generally a sign of a healthy economy, which could make cryptocurrencies less attractive as an investment. However, rising import prices could raise inflation concerns, increasing demand for cryptocurrencies as a hedge.

The crypto market’s response will be closely watched, with each data release adding fuel to an already volatile fire.

FAQs

Higher inflation indicators (CPI, PPI) could prompt tighter monetary policies, thereby reducing market liquidity and lowering cryptocurrency prices.

Rising oil prices increase energy costs, increasing crypto mining spending and influencing market sentiment, potentially reducing supply and demand.