Crypto Venture Capital Company Archetype said that he had closed more than $ 100 million in capital commitments for his third fund, Archetype III.

The new fund is supported by institutional investors, including pensions, academic allocations, funds, sovereign funds and family offices, the company announced on Tuesday in a press release.

Archetype funds are behind cryptographic companies such as Monad, Privy, Farcaster, Relay and Ritual. The company targets startups at an early stage in the construction of onchain infrastructure, decentralized finances (DEFI) and emerging blockchain applications.

Capital will be deployed on projects working on stablescoins, payment solutions, ONCHAIN social networks, decentralized physical infrastructure networks (backdrop), mobile applications built on cryptographic rails and Crypto.

“Blockchains become the trade rails in the world, and the Chatgpt moment of Crypto should emerge at the top of the onchain infrastructure, a new powerful tool for tools,” Ash Egan, founder and general partner at Archetype in the press release.

Investors turn to proven models

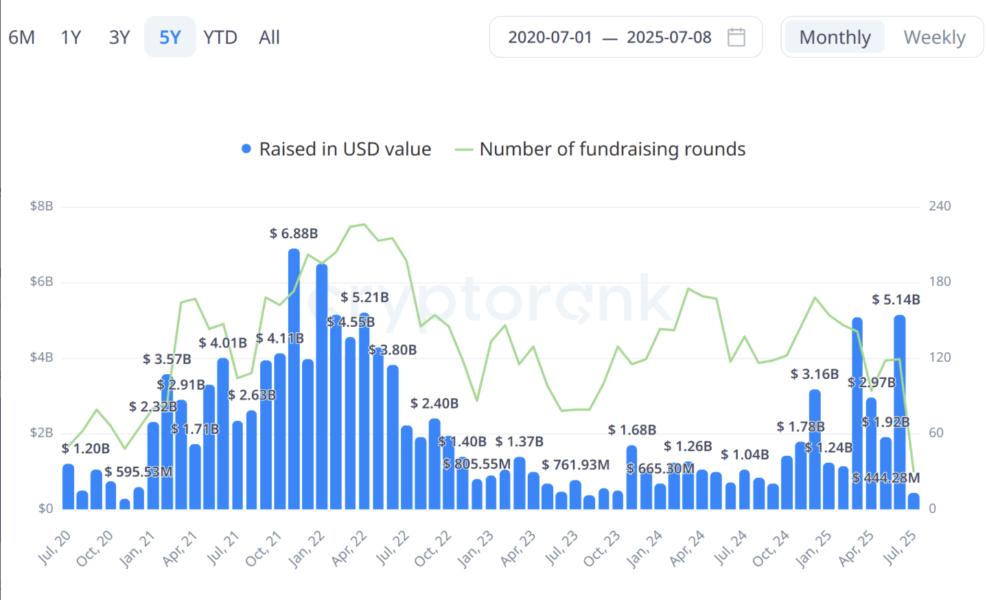

The passage of venture capital in the crypto produced mixed results. In May, Crypto Venture activity fell on its lowest number of transactions in more than four years, with only 62 rounds finished, even if these increases totaled more than $ 909 million.

This selectivity took place on the larger market, companies moving away from pre-series bets and the same 2021 Taurus Taureau to projects with proven commercial models and predictable income.

As Cointtelegraph reported in July, the interest in Bitcoin projects increased, the emerging sector of Bitcoin DEFI increased $ 175 million in 32 offers in the first half of 2025.

At the same time, the venture capital funds channeled capital in the tokenization and the infrastructure of Stablecoin. Transactions included $ 28 million for stable, a blockchain focused on the attachments to extend USDT payments and $ 22 million for Spiko, a French fintech offering monetary market funds.

Inveniam Capital, an infrastructure provider of decentralized data, also invested $ 20 million in the Mantra of layer 1 blockchain to support the contribution of real institutional assets (RWAS) on the network.

The venture capital investment in the crypto totaled $ 10.03 billion in the second quarter of 2025, the highest level since the first quarter of 2022 at $ 16.64 billion.

Magazine: Baby-boomers worth $ 79 t finally get on board with Bitcoin