This article is also available in Spanish.

Ethereum, the second largest cryptocurrency by market capitalization, has yet to regain the $3,000 price level since early August. Since the beginning of September, Ethereum has generally traded below $2,600, but this week brought a glimmer of hope to investors as it finally managed to surpass the $2,600 threshold.

Now that this resistance threshold has been crossed, the next prospects This is a continued rise up to the $3,000 price level. Analysis on the CryptoQuant platform indicates a potential catalyst for this upward development. This analysis notably identifies an emerging bullish trend in Ethereum funding rates as a key catalyst.

Upward change in financing rates

According to a ETH analysis on CryptoQuant According to ShayanBTC, the 30-day moving average of Ethereum funding rates has seen a slight but noticeable bullish change after a long period of decline. This change suggests that traders are once again become more confident in Ethereum’s price performance, especially after the recent interest rate cut by the Fed.

ETH funding rates refer to periodic payments made between traders to keep the price of perpetual futures contracts close to the cryptocurrency’s spot price. When funding rates move positively, it often indicates that long positions are more dominant, which can create upward pressure on prices.

The analyst highlighted the importance of funding rates, especially given the prospect of a bullish fourth quarter of the year. Notably, they echoed that for Ethereum to continue its recovery and aim for higher price levels, demand in the perpetual futures market must continue to increase in the coming weeks. A slight drop in funding rates could result in a decline in bullish momentum.

Is Ethereum Preparing a Return to $3,000?

Ethereum’s recent breakout above $2,600 is the first signal of a major shift in market sentiment. After weeks of trading below, the $2,600 price level now appears to have become a key support zone for the cryptocurrency. Interestingly, this breakout paves the way for ETH to return to $3,000, with funding rates playing a vital role.

At the time of writing, Ethereum is trading at $2,610 and is up 8% over the past seven days. Notably, this price increase is most visible since the low of $2,171 on September 6, reflecting a 20% increase since then.

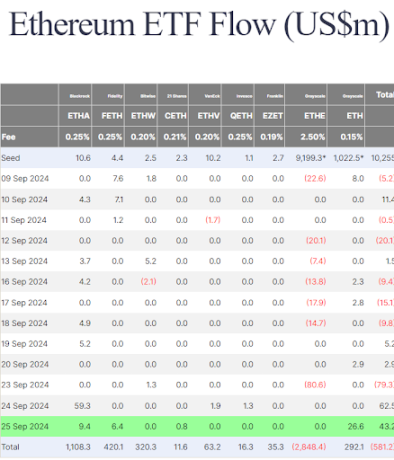

The positive sentiment around Ethereum is also moving towards institutional investors, which is reflected via Spot Ethereum ETFs. According to flow data, ETFs, which initially began the week with a net outflow of $79.3 million on Monday, have now seen two consecutive days of $62.5 million and $43.2 million, respectively. , Tuesday and Wednesday. The combination of these flows could play a significant role in Ethereum’s ability to breach the $3,000 price level and sustain above it in the coming weeks.

Featured image created with Dall.E, chart from Tradingview.com