- The recent cryptocurrency crash will likely have the same effect as Covid-19.

- Will the Fed cut rates as many analysts have anticipated?

Kyle Chasse, a popular market analyst on X, has informed Investors should not panic over the latest cryptocurrency market crash.

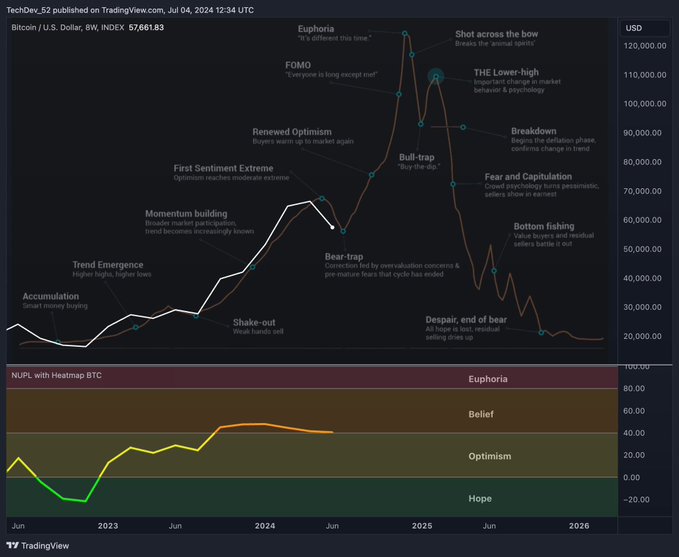

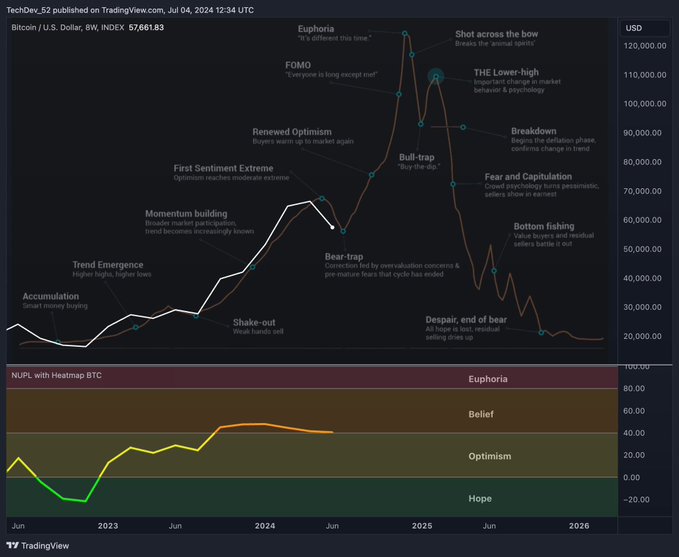

He pointed out that the NUPL indicator, which tracks Bitcoin (BTC) sentiment, still shows that the market is in the belief stage, indicating that we have not reached the exit point.

Chasse stressed that investors should not be discouraged by potential long-term gains since the market is only in a bear trap and today’s crash may have set the stage for the next move higher.

Source: TradingView

Will the latest crypto crash have the same effect as Covid 19?

The recent crash marks one of the worst days on record for the market, with over $1 billion liquidated from cryptocurrencies in the past 24 hours.

The crash resembles the one in 2019/20 that occurred during the COVID-19 cycle, leading to an uptrend in 2021. The trends are similar, indicating a potential opportunity for investors.

Another factor suggests that now is a good time to buy bitcoin and other cryptocurrencies.

Source: TradingView

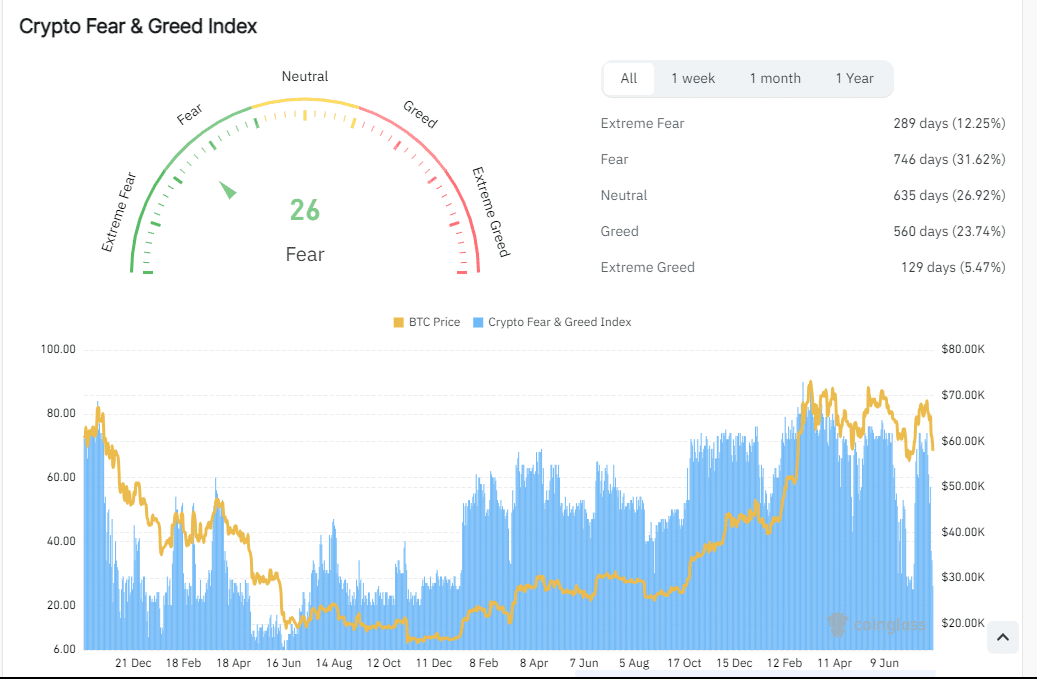

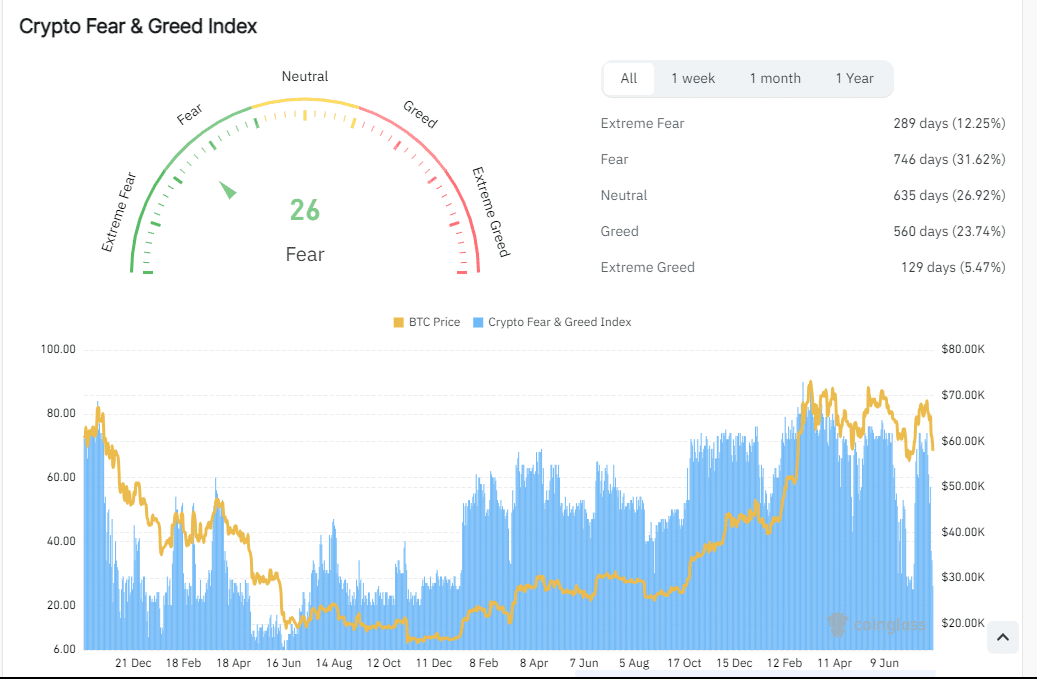

Big players capitalize on fear and greed index

Fears of a potential global conflict have caused instability in financial markets, but some in the cryptocurrency industry believe the crash is more due to recession fears.

The Fear & Greed Index was at 26 at the time of writing, indicating that large institutions are likely to buy now, taking advantage of low prices and selling when the market peaks.

This situation further indicates that this might be your last chance to invest in your cryptocurrency portfolio before prices increase.

Source: Coinglass

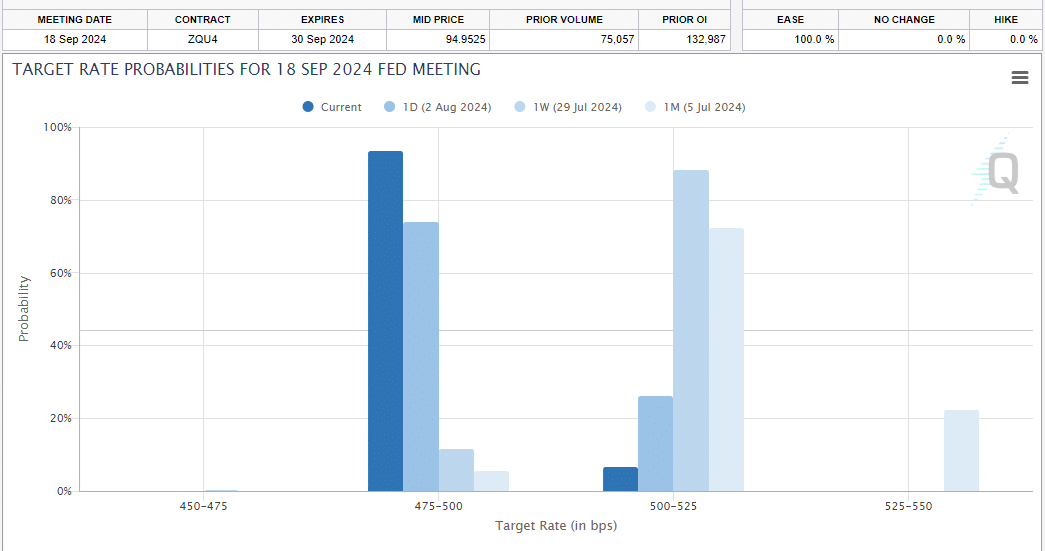

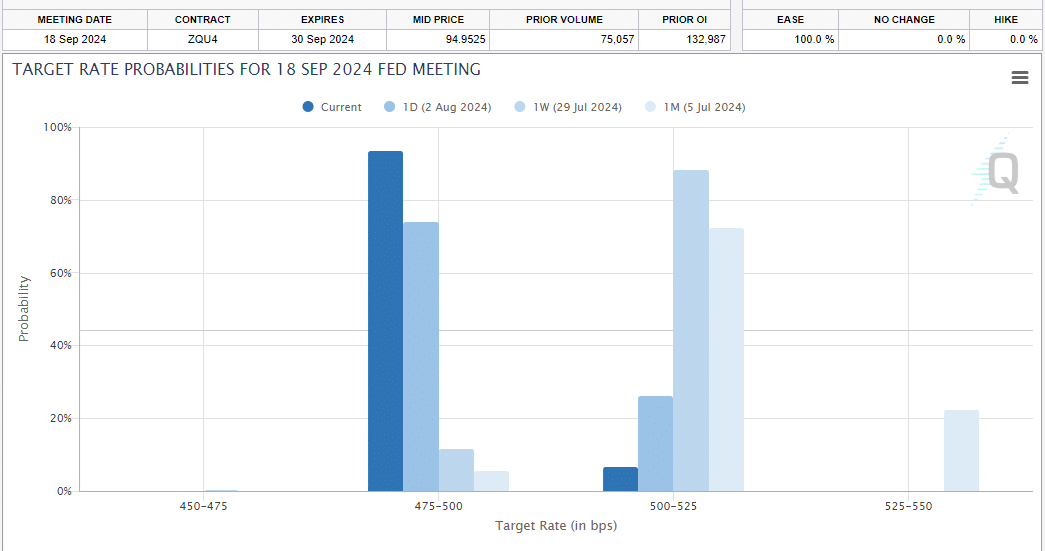

Impact of Fed Interest Rate Cuts

Finally, the Federal Reserve is expected to cut interest rates in September, with a 93.5% probability according to Fedwatch.

The forecast comes after a significant drop in the Japanese stock market. If the Fed does indeed cut rates, it could stabilize financial markets and benefit assets like cryptocurrencies.

With markets potentially at their lowest point in this cycle, investing now could offer substantial long-term gains as current conditions may represent the lowest levels before an eventual recovery.

Source: CME Group