- Sui, Helium and Zcash were the biggest gainers last week.

- Lido DAO, Aave and Maker make up the list of top losers.

Some tokens diverged significantly from the trend in a week marked by volatility and downturns in the broader cryptocurrency market.

Sui (SUI) emerged as the best performer, posting an impressive gain after several consecutive days of decline, while Lido DAO (LIDO) and AAVE saw significant setbacks.

The biggest winners

Follow (SUI)

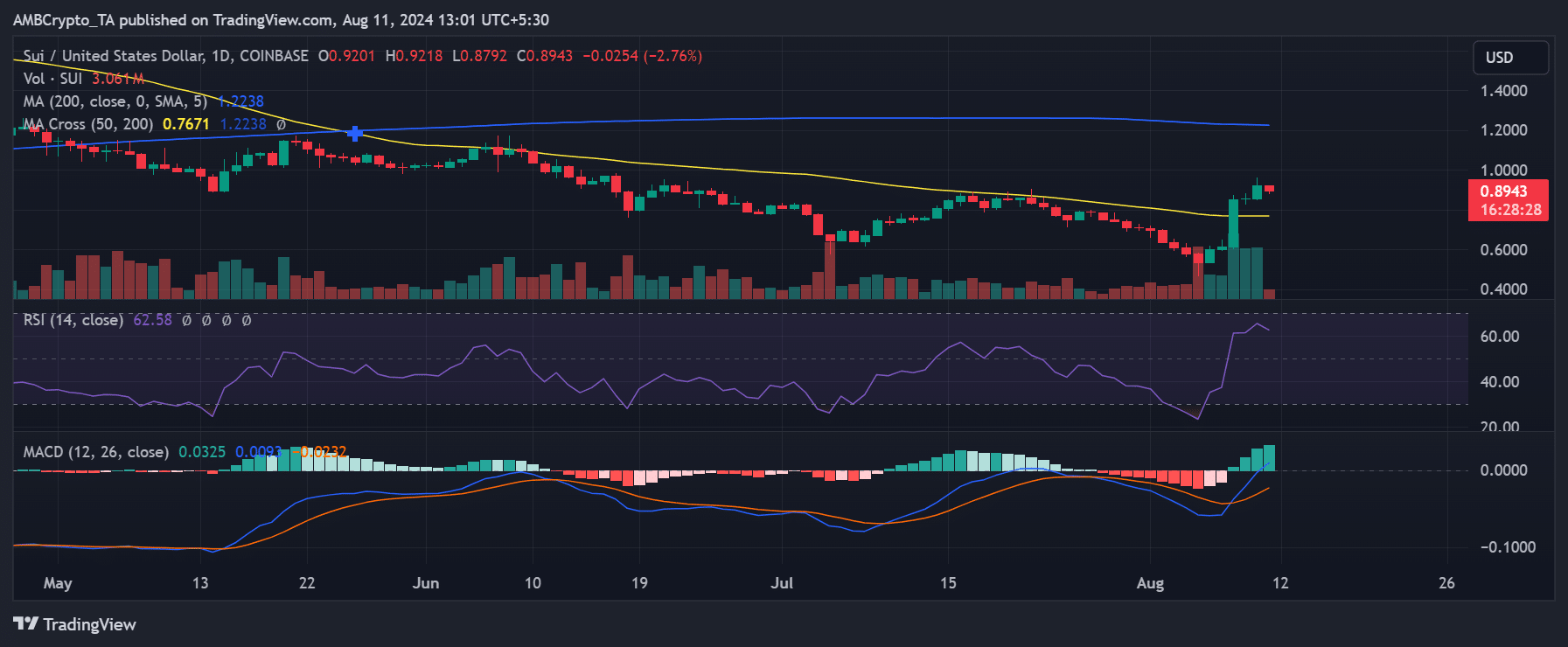

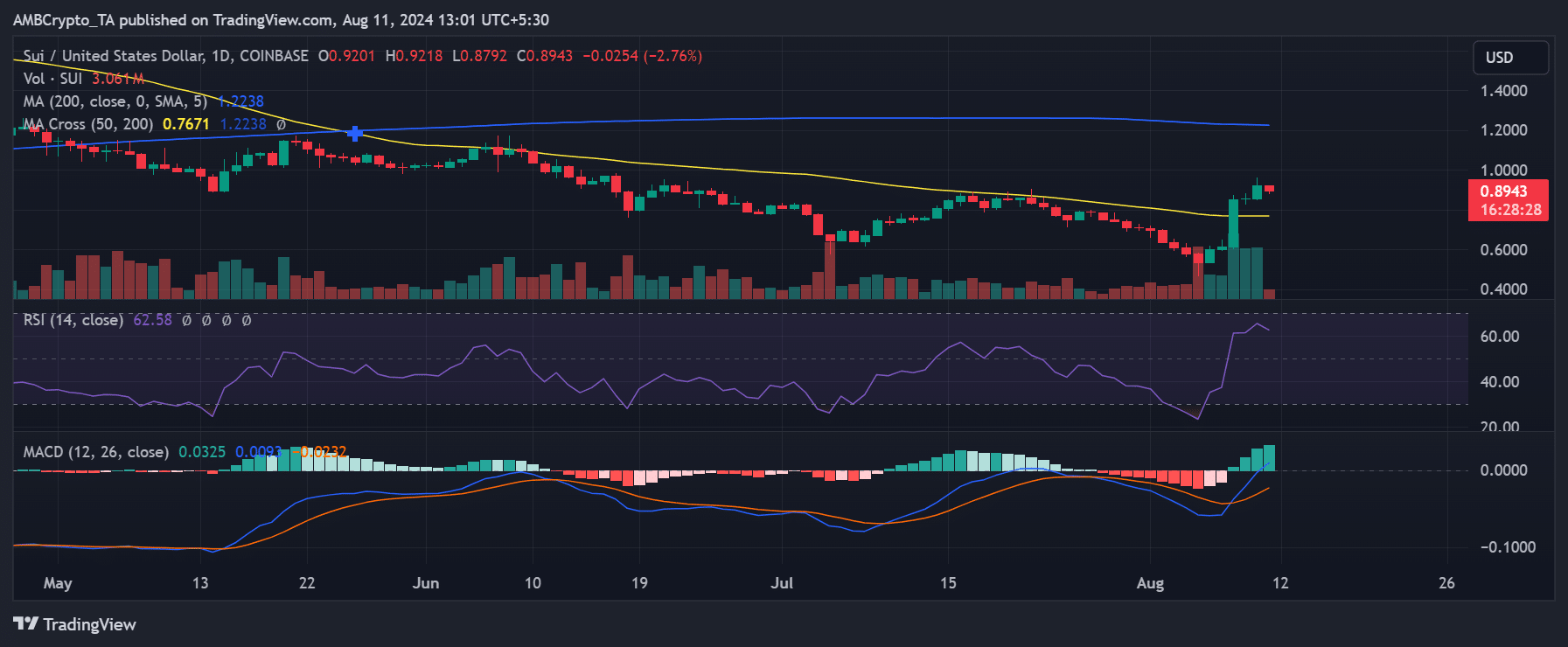

Analysis of Sui (SUI) on a daily time frame reveals a significant reversal after an extended decline. The week started with a continuation of the downtrend, with SUI dropping by 5.39% and dropping by another over 7% the next day.

The declines marked the 10th consecutive day, bringing its price down to $0.53.

However, the trend reversed dramatically on August 5, with SUI surging 12.55%, pushing the price to around $0.6. The biggest surge came on August 8, when SUI surged 38.58%, pushing its price to around $0.8.

The week ended with a 7.42% increase, pushing the closing price to around $0.9.

Source: TradingView

This series of increases led SUI to close the week with an overall gain of over 44%, ranking it as the best performer of the week, according to CoinMarketCap.

In addition, according to the latest data, SUI’s market capitalization was over $2.3 billion, with a trading volume exceeding $319 million. The trading volume increased by over 16% in the last 24 hours.

Helium (HNT)

Helium (HNT), like Sui, had a rough start to the week, posting a significant 7% drop, bringing its trading price down to around $4.2.

Despite this initial setback, Helium quickly reversed course and recorded consecutive gains throughout the week. Furthermore, the trend reversal included two days of double-digit gains.

The week ended with a slight decline of 3.98%; however, Helium managed to maintain its high price level, closing the week around $6.5. This recovery made Helium the second biggest gainer of the week, increasing by over 34%.

According to the latest data from CoinMarketCap, Helium’s market cap stood at over $1 billion, although it saw a slight decline in the last 24 hours. Additionally, trading volume dropped by over 50%, to around $13.7 million.

Zcash (ZEC)

Zcash started the week with a downtrend, starting at around $31. However, like other prominent players in the cryptocurrency market, ZEC saw significant uptrends throughout the week. By the end of the week, it was trading at around $41, marking a substantial recovery.

According to the latest data from CoinMarketCap, Zcash became the third-biggest gainer of the week, registering an impressive increase of over 27%. This notable price increase propelled its market capitalization to over $672 million.

Despite this strong price performance, Zcash’s trading volume has shown a significant reduction, dropping by more than 40% in the last 24 hours to around 80.9 million.

The biggest losers

Lido DAO (LIDO)

Lido DAO (LIDO) had a rough week, leading the losers chart. The week started with LIDO trading at around $1.2, but it saw a downward trajectory, eventually closing the week at around $1.1. This represents a decline of nearly 18% over the week.

LIDO’s market cap also reflects this negative trend, standing at around $988 million, which includes only minor declines despite the asset’s price decline.

Additionally, trading volume for LIDO declined over the week, falling more than 7% to approximately $70.3 million.

Creator (MKR)

Maker (MKR) had a rough week, starting at over $2,200 but facing significant declines in the following days. By the end of the week, the price of MKR had fallen to around $1,961. This downward move placed MKR as the second-biggest loser of the week, down over 13%, according to data from CoinMarketCap.

MKR’s trading volume also saw a substantial decline, dropping more than 30% in the past 24 hours to around $45 million. Additionally, Maker’s market cap reflected unfavorable price movements at around $1.8 billion.

Aave (AAVE)

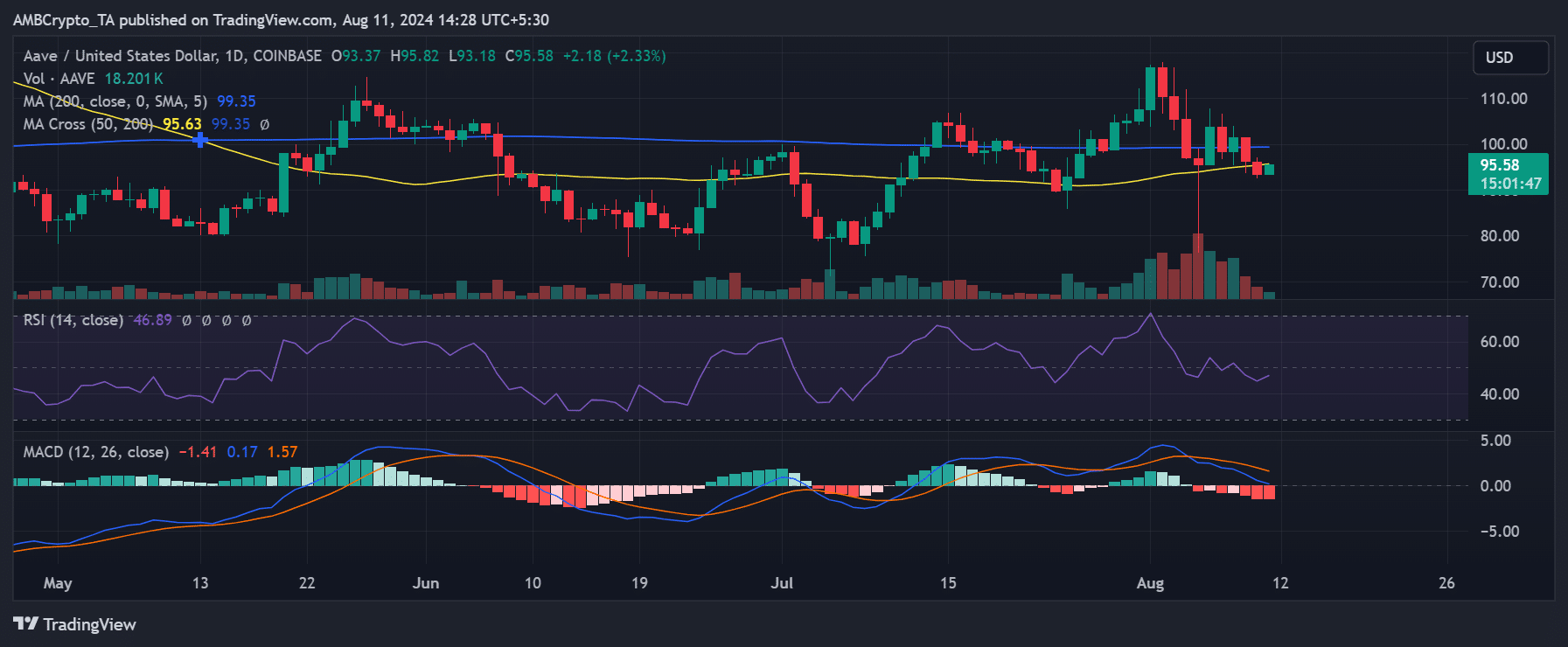

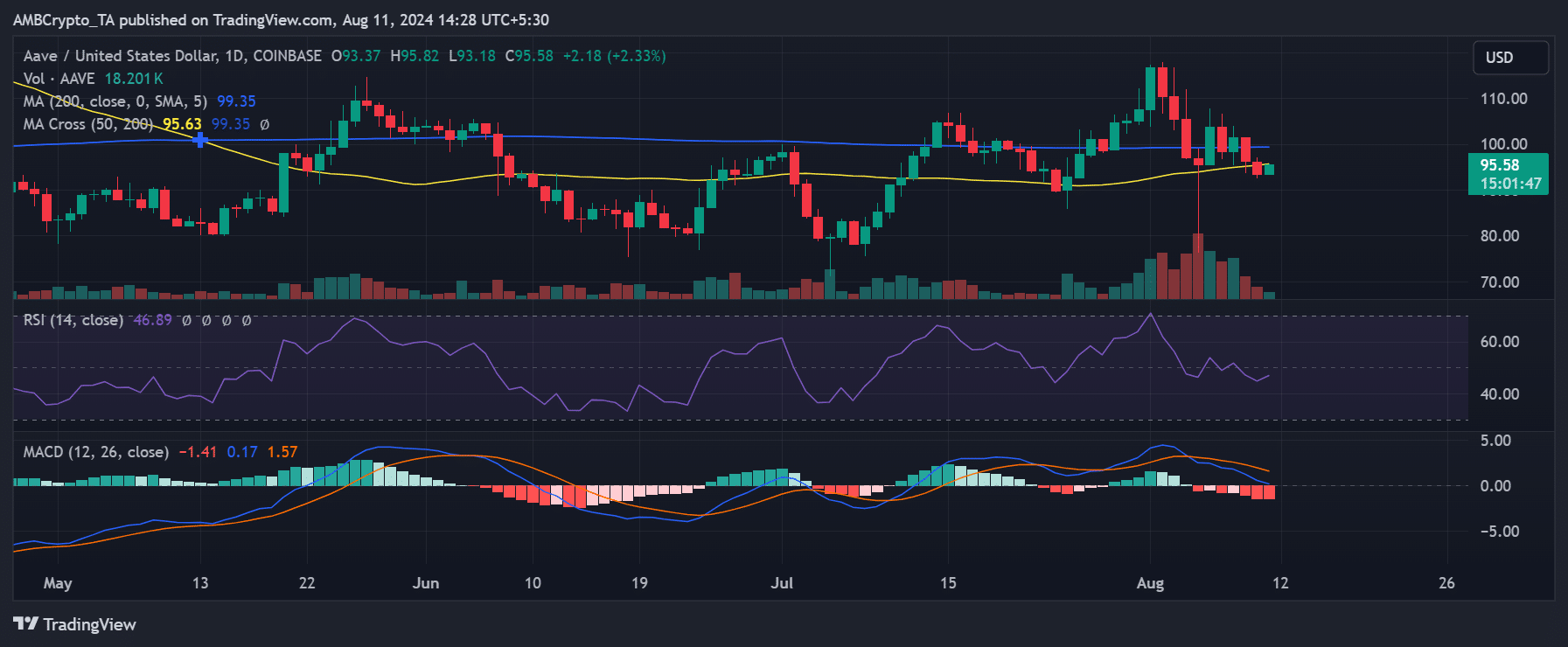

Aave (AAVE), the previous week’s biggest gainer, saw a reversal of fortunes, ranking among the biggest losers last week.

The price action analysis revealed that Aave started the week with a sharp 8% drop from around $105 to around $97. While there were some uptrends during the week, they were not enough to push Aave’s price back into the $100 range.

By the end of the week, Aave was trading at around $93, marking a further decline of over 2%. This resulted in a total weekly loss of over 12%, according to data from CoinMarketCap, making it the third-biggest loser of the week.

Source: TradingView

The Relative Strength Index (RSI) was also recorded at 46, indicating a bearish trend. Furthermore, Aave’s market capitalization was estimated to be around $1.4 billion.

In addition, trading volume also declined significantly, dropping by more than 18% to around 87.2 million.

Conclusion

Here is the weekly recap of the biggest gainers and losers. It is essential to keep in mind the volatile nature of the market, where prices can move quickly.

So it is best to do your own research (DYOR) before making any investment decision.