Pseudonymous crypto analyst TechDev claims that Bitcoin (BTC) and digital assets are in the middle of a massive bear trap before the next leg higher.

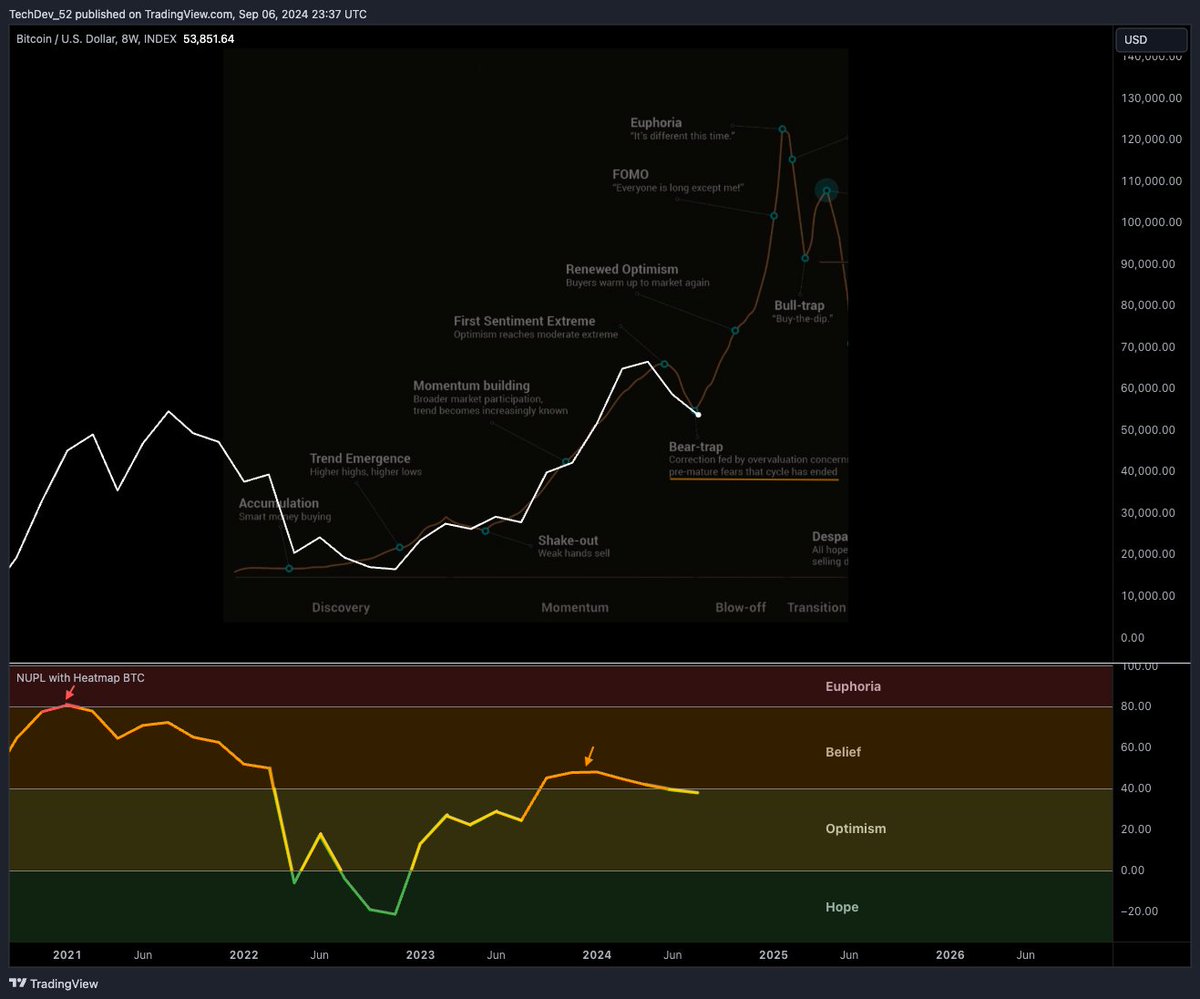

TechDev shares a chart with its 467,000 followers on social media platform X that suggests Bitcoin market cycles play out in a series of stages starting with an “accumulation” and ending with a bull trap.

According to TechDev, BTC is in the “bear trap” phase of the cycle, which precedes the “renewed optimism,” “FOMO,” and “euphoria” phases before peaking and entering the bull trap.

The analyst also believes that USDT’s dominance in the cryptocurrency markets looks bearish, implying that stablecoins will soon be massively traded for other digital assets, thereby boosting prices.

TechDev recently compared the historical price performance of Bitcoin to that of the Nikkei 225, Japan’s largest stock index.

Based on TechDev’s charts, the trader suggested that Bitcoin could reach $760,000 between 2028 and 2029 before witnessing a multi-year bear market, similar to the Nikkei in the 1990s.

Last month, TechDev indicated that it was optimistic about the recent slowdown in the cryptocurrency market.

“It is clear that fear is extreme in the market. The last two weeks have been filled with pessimistic comments from the pessimists – on a retest at $48,000, the level they said they would never reach the last time they announced pessimism at $25,000.

This is exactly what I like to see. The fact that this has happened at a time when global macroeconomic conditions are trending upwards makes this nothing more than two weeks of deafening noise to me. More like the last six months.

This is usually the case in all speculative markets, but the last two years have reflected this phenomenon more than ever before in the cryptocurrency market: the price does not go up until X gets scared. This was the case at $15,000 after the FTX crash, at $20,000 after the regional banks failed, at $38,000 after the ETF crash, and now.

What you will also remember is how abruptly sentiment can change in a matter of weeks. This is expected to happen again. Meanwhile, the global cycle continues to point upwards.

At the time of writing, Bitcoin is worth $54,435, up slightly from the day.

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check price

Follow us on XFacebook and Telegram

Surf the Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: Midjourney