Bitcoin continues to make the headlines – not only for its role in the reshaping of global finance, but for its amazing prices growth over the years.

Since this month, the price of a bitcoin has been negotiated at $ 78,837. In April 2024, he negotiated at $ 69,336. In 2023, Bitcoin amounted to $ 28,353.

Bitcoin has always been a volatile market, often experiencing strong drops from its peaks.

Don’t miss:

The previous examples include the draw of 86% 2013-2015 of 86%, the 2017-2018 correction during the repression in China and the ICO arrow, the Cash-Flash Covid 2020 with a drop of 72%, the 2021-2022 inflation crisis with a crisis of 77% of 28% of its highs.

Source: TradingView (User source and screenshot – @notetrades)

Trend: if there was a new fund supported by Jeff Bezos offering a 7 to 9% target yield with monthly dividends?

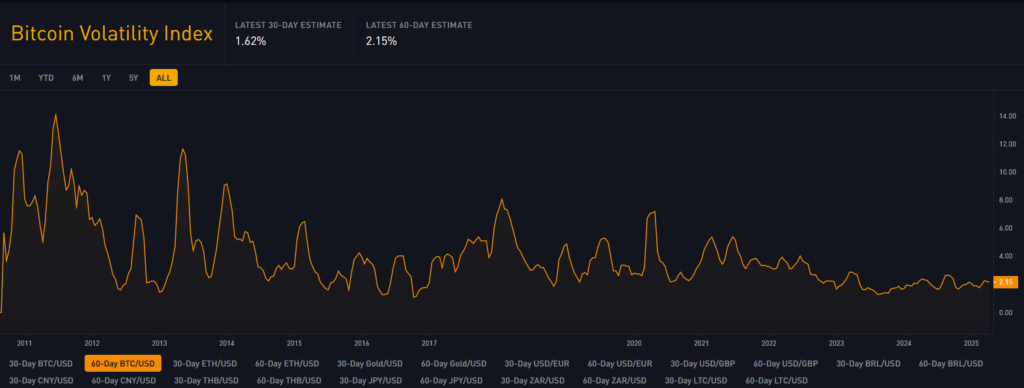

Wild stabilization oscillations: volatility evolving bitcoin

Volatility has played a major role in these prints. At the start of Bitcoin, there was not as much institutional support as today, which led to greater volatility both upward and downward.

In recent years, volatility has decreased considerably because Bitcoin has won more recognition and adoption in countries around the world.

Source: Bitboi.io (Source of screenshot – Nick Thomas)

The average BTC / USD 30 -day volatility has decreased in the past 15 years. In 2010-2011, the average was around 6% to 8%, and it has since fallen at around 2% in the past two years.

As volatility decreases, this implies that future direct debits may not be as extreme, but it also means that percentage gains up to current levels may not be as dramatic as they were in previous years.

This type of behavior is typical of a maturation asset. A useful analogy is that of a young child – in life, emotions can be intense and unpredictable. But as people age, they generally become more stable, measured and less reactive. Likewise, Bitcoin volatility has decreased over time because the asset has matured and has acquired wider acceptance.

See also: Blackrock calls 2025 the year of alternative active ingredients. A New York company has quietly built a group of more than 60,000 investors who have all joined a class of ALT assets previously exclusive to billionaires like Bezos and Gates.

Zoom out: Bitcoin draw in a macro context

What should be understood is that Bitcoin continued to show force and are negotiated over time, even in the face of fundamental challenges within the assets itself.

Recently, we have noticed increased volatility in all markets – not just bitcoin. It is easy to point your fingers and say, “I told you,” But the reality is that it goes beyond the withdrawal of a single market. This is a broader macro level problem.

That said, do not let the short -term noise influence your decision -making. Take a step back and ask: Why is Bitcoin broken down?

Has something fundamentally changed with the assets? Or do we just see the effects of a wider macroeconomic pressure?

In my opinion, this is the latter – which means that I don’t think it’s time to sell and run for hills.

The two fundamentals, which have only reinforced over time, and techniques can guide you.

I recently wrote on Bitcoin key levels, which you can read here.

Read then:

Market news and data brought by benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.