Join our Telegram channel to stay up to date with the latest news

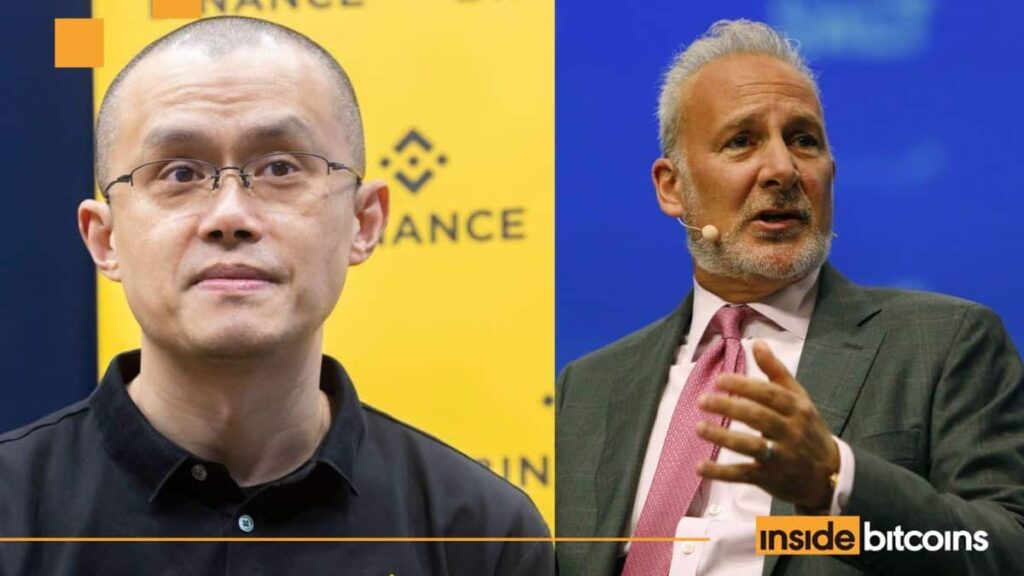

Binance co-founder Changpeng Zhao, aka CZ, clashed with Bitcoin critic Peter Schiff over his claims about tokenized gold.

The confrontation arose from comments made by Schiff in a live broadcast with Threadguy that he is considering a blockchain-based platform to launch a tokenized gold product that would have an advantage over Bitcoin.

“Because gold will retain its purchasing power, ideally the only thing that makes sense to put on a blockchain is gold,” he said.

Schiff added that his tokenized gold product “will do everything Bitcoin promises but can never do” and that traders could buy tokenized gold through a platform called SchiffGold.

“And then you can transfer the amount of gold instantly at a very low cost,” he said. “Much cheaper and much faster than transferring Bitcoin. You can pay or be paid in gold. And you can exchange it for physical gold or possibly a token.

CZ Declares Tokenized Gold Tokens Are a “Trust Me Bro” Product

CZ took issue with Schiff’s comments about X.

“Most people ‘in crypto’ know this, most people ‘not in crypto’ may not understand yet,” he said. “Gold tokenization is NOT ‘on-chain’ gold.”

He explained that gold tokenization involves trusting a third party to give you gold at a later date, “even after a change in leadership, maybe decades later, during a war, etc.”

“It’s a ‘trust me, bro’ token,” he said.suggesting that the level of trust required around tokenized gold is why no “gold coins” have really taken off.

State the obvious. Most people “in crypto” know this, most people “not in crypto” may not understand it yet.

Gold tokenization is NOT “on-chain” gold.

This means that you trust a third party who will give you gold at a later date, even after a change in management, perhaps…

– CZ 🔶BNB (@cz_binance) October 23, 2025

Gold experiences worst correction in years

After recording several all-time highs this year, gold experienced its biggest correction in years this week.

This pullback saw the price of gold fall from a high of $4,381 to a weekly low of $4,1115, triggering a loss of $2 trillion in market capitalization.

But Schiff continues to argue that the metal is a better choice than BTC.

“If gold can fall 6.5% in one day following panic selling, imagine what can happen to Bitcoin,” he said on X. “Such a crash may not be imaginary for long.”

Schiff said the fall in the price of gold would not result in a capital rotation into Bitcoin, as many analysts predict, and instead predicted that the drop “could trigger a mass exodus out of Bitcoin.”

Instead of gold’s sharp correction triggering a widely publicized rotation into Bitcoin, it could trigger a mass exodus out of Bitcoin. Watch below!

-Peter Schiff (@PeterSchiff) October 22, 2025

Bitcoin, meanwhile, has climbed more than 1% in the past 24 hours to reach trade at $109,563.88 as of 6:03 a.m. EST.

CZ Predicts Bitcoin Will Overtake Gold in Market Cap

Earlier this week, the founder of Binance predicted that Bitcoin could eventually surpass the market capitalization of gold.

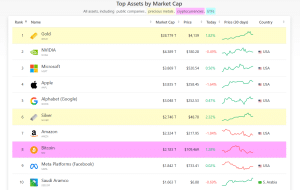

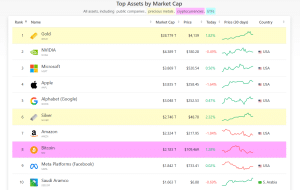

Main assets by market capitalization (Source: CompaniesCap.Market)

According to CompaniesMarketCap, the capitalization of gold stands at over $28.77 trillion, making it the most valuable asset in the world. Bitcoin’s capitalization is around $2.18 trillion, ranking it first. the eighth largest asset in the world and larger than Meta and Saudi Aramco, parent company of Facebook.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news