CEA Industries Inc. (NASDAQ: BNC), the company that only months ago was touted as the largest publicly traded BNB government bond in the United States, is now at the center of an escalating governance battle after Changpeng “CZ” Zhao’s YZi Labs filed a broad consent solicitation with the U.S. Securities and Exchange Commission.

The filing marks a direct attempt to reshuffle the company’s board, reverse recent bylaw changes and install new management at a company that has seen its stock price collapse despite holding one of the largest institutional BNB positions on record.

YZi Labs decides to replace BNC directors after months of governance conflicts

The preliminary Schedule 14A, submitted Monday, asks BNC shareholders to approve the expansion of the board of directors, the repeal of all changes made after July and the election of a new slate of directors nominated by YZi Labs.

The file includes a white consent card allowing shareholders to formally support or reject the proposals.

If the majority of outstanding shares consent, YZi Labs would have the option to restructure the board of directors by written authorization without the need to call a shareholder meeting.

YZi Labs, which owns about 5% of BNC’s outstanding shares, argued in its filing that the current board has failed to provide timely information, execute corporate actions or maintain basic communications with investors.

The company said BNC shareholders “deserve a well-functioning board” and warned that failure to act would lead to “further destruction of shareholder value.”

The consent solicitation follows months of tension between the two parties, documented by repeated requests for information and governance issues raised by YZi Labs.

The dispute intensified after CEA Industries’ $500 million PIPE funding in August, which financed the company’s transformation into a BNB-focused digital asset treasury.

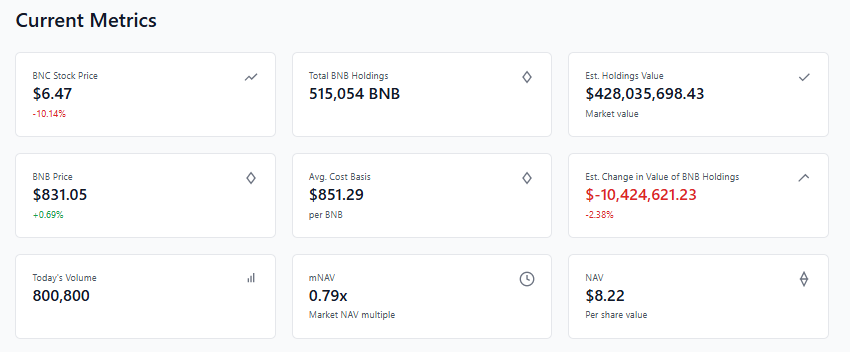

Shares soared more than 600% in July when the cash strategy was announced, but the company’s shares have since fallen more than 92%, recently closing at around $6.47, even as BNB itself hit an all-time high above $1,300 in October before falling back into the $820 range.

BNC’s reported net asset value stands at $8.09 per share, lowering the stock’s mNAV multiple to approximately 0.8x.

File accuses CEA Industries of operational failures and leadership conflicts

YZi Labs’ filing lists a series of operational failures, including delays in filing registration documents for a market offering, a lack of investor updates, and an unfinished investor relations website months after the PIPE.

It also states that the company has not provided any regular reporting on net asset value, BNB yield, or accumulation rates.

The group raised further concerns over branding confusion, with the company changing from “CEA Industries” to “BNB Network Company” without clear instructions to investors.

The filing also cites potential conflicts of interest within the leadership structure. CEO David Namdar, director Hans Thomas and former 10X Capital executive Russell Read all have ties to 10X Capital, the company responsible for managing the treasury of BNC’s digital assets.

According to YZi Labs, Namdar and Thomas participated in discussions promoting other crypto treasury businesses while leading BNC, raising questions about their focus and independence.

The company said it had repeatedly requested clarification on executive employment terms and management fees, but received no response.

The battle comes as CEA Industries holds one of the largest disclosed BNB treasuries in the world, with approximately 480,000 to 515,000 BNB accumulated at an average cost close to $851 per token.

At recent prices, the holdings are valued at approximately $412 million, along with $77.5 million in cash.

The company previously stated that its goal is to accumulate 1% of the total BNB supply by the end of 2025.

The names of the candidates for the position of director proposed by YZi Labs remain redacted in the preliminary file. CEA Industries has not yet released a public response to the consent solicitation.

The article CZ’s YZi Labs in Boardroom Coup Bid for World’s Largest BNB Treasury appeared first on Cryptonews.

BNB Hits Second ATH This Month, Breaks $1,300 Barrier

BNB Hits Second ATH This Month, Breaks $1,300 Barrier