- Recent price action for Algorand has revealed a strong bearish trend.

- Binance derivatives data has revived some hopes for short-term buyers.

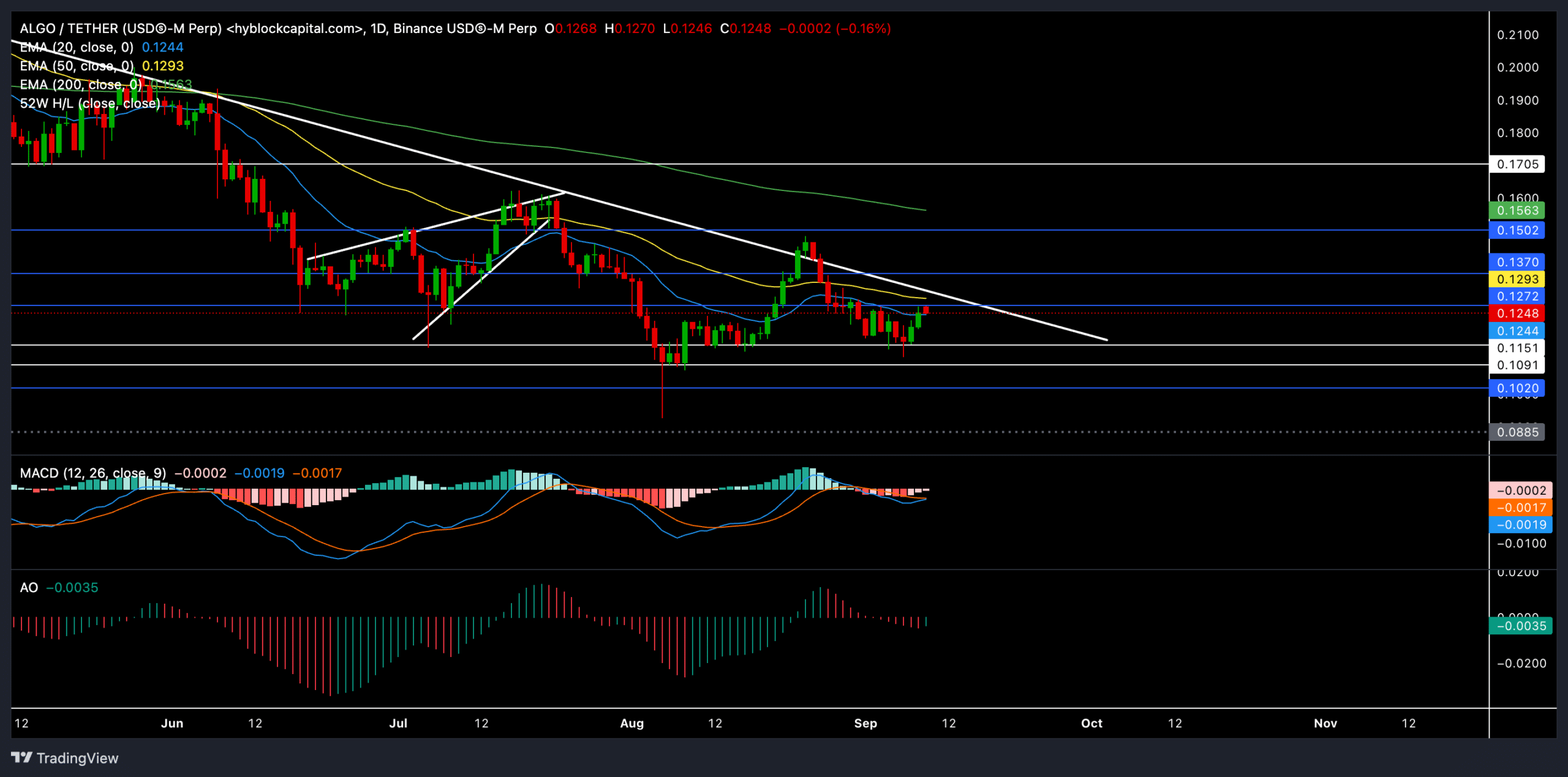

Algorand (ALGO) has been trading in an uncertain market recently. At the time of writing, its price was struggling to stay above the 50 EMA and 200 EMA levels, showing that the bears are firmly in control.

Despite a recent bounce from the $0.1 support level, ALGO failed to reclaim key resistance areas.

As the Cryptocurrency Fear and Greed Index has moved into the “Fear” zone, the altcoin’s near-term recovery prospects appear questionable. At press time, ALGO was trading at $0.12, showing signs of short-term consolidation.

ALGO Bears Prevent Break Above Trendline Resistance

Source: TradingView, ALGO/USDT

ALGO price recently formed a descending triangle pattern on its daily chart, with lower highs indicating persistent selling pressure. Over the past month, the $0.1 support area has been critical for ALGO’s defense.

If this support is broken, we could see a sharp decline towards $0.0885, the next major support level.

On the upside, the 50 EMA ($0.12) could act as a significant barrier, coinciding with the long-term descending trendline. A break above this confluence of resistances could trigger a bullish reversal towards the $0.13 and $0.15 levels.

However, bulls will need huge volumes to achieve this.

The MACD indicator showed rather flat momentum, with the signal line slightly above the MACD line. This suggests a slight advantage for the bears in the short term.

If the MACD crosses into positive territory, it could indicate the beginning of a bullish phase. Buyers should wait for a close above the zero bar to confirm this bullish recovery.

The Awesome Oscillator (AO) is hovering around the zero line, reflecting weak momentum and a lack of strong directional bias. A decisive move up or down from the equilibrium could quickly indicate the likely price trend.

Here’s what the derivatives data reveals

Source: Coinglass

Derivatives data also reaffirmed a cautious sentiment around ALGO. Open interest fell 2.59% to $23.93 million, suggesting traders are reducing their exposure in anticipation of further decline.

However, the long/short ratio on Binance was skewed towards long positions, with a ratio of over 2.4 for top traders per account.

Volume decreased by 3.37%, with a total of $25.44 million traded, further reinforcing the fact that traders are waiting for a clear directional move before committing to new positions.

Traders should remain cautious and watch for a breakout of key levels before making directional bets. Additionally, ALGO’s price is closely correlated to Bitcoin’s movements and any sudden market-wide changes could have a significant impact on its trajectory.