In the world of finance, where traditional investments like stocks and bonds have long been the norm, MicroStrategy’s bold move into Bitcoin has sparked significant debate. At the heart of this debate are figures like Peter Schiff, known for his skepticism of cryptocurrencies, and Michael Saylor, CEO of MicroStrategy, who has chosen Bitcoin as the future of money.

Actions of #MicroStrategy just hit a new 52-week low, down 90% from February 2021’s record. Shareholders will pay dearly for @saylorIt is #Bitcoin obsession. Don’t make the mistake of thinking that 90% off is a good buy. This isn’t just a sale, it’s a going out of business sale.

-Peter Schiff (@PeterSchiff) December 29, 2022

MicroStrategy’s Bitcoin strategy: a financial chess game or a Ponzi scheme?

Peter Schiff, a vocal critic of Bitcoin, recently took to X to express his concerns about MicroStrategy’s plans. Schiff pointed out that on the day the price of Bitcoin increased, shares of MicroStrategy ($MSTR) actually fell by 5.5%.

According to Schiff, this could indicate that Michael Saylor was offloading MSTR shares to buy more Bitcoin, thus supporting its price. Schiff framed this as a “shell game,” wondering how long this financial juggling act could continue without collapsing like most Ponzi schemes.

Schiff’s critique is rooted in his belief in traditional assets like gold, which he believes have intrinsic value due to its utility in various industries. In contrast, according to Schiff, Bitcoin has no such utility, making its value purely speculative. This narrative presents MicroStrategy’s substantial investments in Bitcoin as a speculative bubble rather than a sound financial strategy.

EXPLORE: Detroit will accept crypto for taxes and fees to attract blockchain companies

On the other hand, Michael Saylor considers Bitcoin the supreme property of the human race, a digital gold with immense capital preservation potential. MicroStrategy’s strategy under Saylor has been to take advantage of Bitcoin’s limited supply against the backdrop of an ever-expanding monetary base from central banks around the world. According to Saylor, this approach is not speculative but constitutes a forward-thinking move aimed at guarding against inflation and the devaluation of fiat currencies. Bitcoin .cwp-coin-chart path svg { stroke: ; line width: ; }

Price

Trading volume in 24 hours

Last price movement over 7 days

itself is valued at approximately $107,000 a piece.

The United States should buy #Bitcoin and sell gold.pic.twitter.com/HD69iy1EAO

-Michael Saylor

(@saylor) December 7, 2024

Elliot Wave Theory: Predicting the Future of MicroStrategy MSTR Stocks?

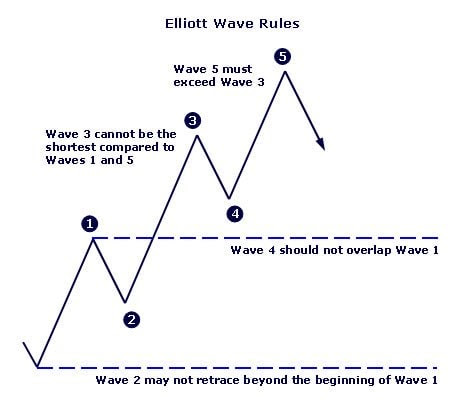

In the midst of this financial tug of war, another perspective is emerging in the field of technical analysis, particularly through the prism of Elliott Wave Theory. This theory, named after Ralph Nelson Elliott, posits that market prices move in repetitive patterns or waves, influenced by investor psychology.

(Source)

A tweet from @Freedom_By_40 suggested applying Elliott Wave Theory to analyze MicroStrategy stock movements. This theory could help determine whether the stock’s recent performance is part of a larger wave pattern suggesting future growth or decline. If MicroStrategy’s stock price decline is part of a corrective wave, it could rebound more strongly, reflecting bullish market sentiment toward Bitcoin and, by extension, MicroStrategy’s strategy.

$MSTR detailed countdown for the rest of the cycle.

For those new here, please don’t pay as much attention to time as price (time is just a better projection as EW is not based on time but price) . pic.twitter.com/SUNCckzpVR

– Freedom at 40 (@Freedom_By_40) December 18, 2024

However, if this drop signals the start of a bearish wave, it could indicate that the market is losing confidence in Bitcoin’s long-term value proposition or in MicroStrategy’s strategy to secure its financial stability with Bitcoin. Such analysis could be crucial for investors trying to predict the sustainability of MicroStrategy’s approach to navigating the volatile cryptocurrency market.

The debate over MicroStrategy’s Bitcoin investment strategy encompasses broader questions about the future of money and investing. Peter Schiff’s critique highlights the risks of speculative bubbles, while Michael Saylor’s advocacy for Bitcoin highlights a vision of digital assets transforming traditional finance. At the same time, tools such as Elliott Wave Theory provide a way to predict potential outcomes based on historical market behavior.

EXPLORE: 11 Best AI Crypto Coins to Invest in 2024

Join the 99Bitcoins News Discord here for the latest market updates

The article Decoding MicroStrategy’s Bitcoin Strategy: Ponzi Scheme or Brilliant Investment? appeared first on 99Bitcoins.

(@saylor)

(@saylor)