DeFi Technologies has announced plans to launch CoreFi Strategy, a new investment vehicle aimed at providing exposure to Bitcoin and its associated decentralized finance ecosystem.

Scheduled to begin in the first quarter of 2025, the initiative will operate on a Canadian exchange, according to a company press release.

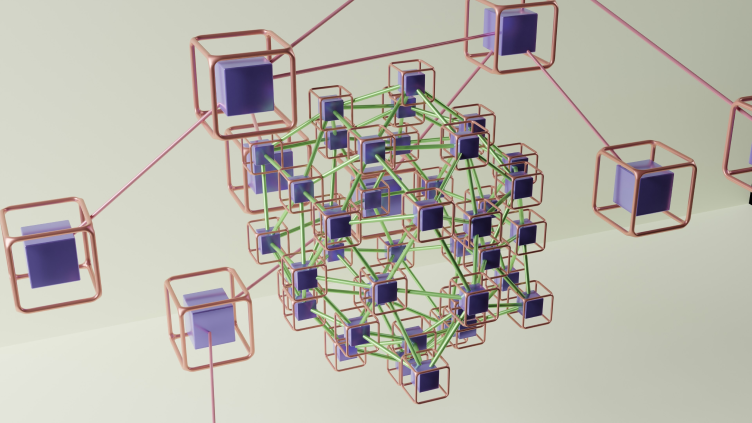

The CoreFi strategy is designed to replicate the investment strategies seen at companies such as MicroStrategy and MetaPlanet. It will focus on the accumulation of Bitcoin (BTC) and CORE, the native asset of the Core blockchain. By leveraging funding strategies, CoreFi aims to build its treasury while providing investors with regulated access to Bitcoin staking and yield generation opportunities.

Olivier Roussy Newton, CEO of DeFi Technologies, highlighted the potential for investors to engage in the booming Bitcoin staking ecosystem through this new strategy.

The company’s approach reflects successful models that have seen significant stock price appreciation, with MicroStrategy shares up more than 500% over the past year and Bitcoin itself rising by approximately 150%.

Core currently holds over 8,200 Bitcoins staked and has a total value locked (TVL) of over $700 million. Its recent Dual Staking integration allows CORE token holders to earn higher staking returns when staking on Bitcoin, improving potential returns for investors.

As of July 31, DeFi Technologies reported CA$837 million ($597.65 million) in assets under management (AUM). Analysts including Benchmark’s Mark Palmer expressed a positive outlook, anticipating continued growth in assets under management due to the launch of new exchange-traded products (ETPs) and rising prices of underlying crypto assets.

DeFi Technologies trades under the symbol CBOE:DEFI in Canada and is also available over-the-counter in the United States.