DEFI technologies (CBOE: DEFI) (OTC: deftf), a Canadian company, should have a significant impact on the investment scene of digital assets in 2025. With government policies favorable in Canada and the United States, the company is in a privileged position to direct decentralized global finance ( DEFI) sector.

Discover the best actions and maximize your wallet:

Bride traditional finances and blockchain

Founded in 2020, DEFI Technologies aims to connect traditional finance with the rapidly growing world of decentralized finance. They offer investors a way to draw from digital assets like Bitcoin, Ethereum and Solana thanks to familiar investment channels. This means that you do not have to navigate directly in the complexities of possession of cryptocurrencies.

Their main tool on this subject is the products exchanged (FTE), provided through their subsidiary, Valor Inc. CES ETP are available on the main European scholarships, such as the Frankfurt Stock Exchange and the SPOTLIGHT stock market. This configuration allows investors to expose themselves to the main cryptocurrencies and unique assets, such as UNISWAP (UNI) ETP – the first of its kind on a global scale. Essentially, DEFI Technologies allows traditional investors to more easily access the digital asset market without diving into the end of possession of cryptography.

Beyond ETPs, DEFI Technologies is actively involved in decentralized blockchain networks. They participate in activities that support network security, governance and transactions validation. This practical approach not only strengthens their operations, but also places them at the forefront of blockchain innovation.

Defi is on a strong financial trajectory

Financially, the company is on a strong ascending trajectory. As of January 31, 2025, Valor declared $ 1.4 billion Canadian dollars (1.009 billion US dollars) of assets under management (AUM), reflecting an increase of 23% compared to the previous month. This growth was motivated by the rise in prices of digital assets and the continuous net tickets of $ 48 million Canadian ($ 33.5 million) in January, powered by high ETP demand such as XRP (XRP-USD), Sui (Sui-USD), and DOGE (USD).

In addition, Valor finished January with a cash balance and USDT of approximately 27.2 million dollars (18.9 million US dollars), reflecting an increase of 24.9% compared to the previous month.

This financial success is reflected in their performance in stock. Trading under the Ticker “DEFI” on the CBOE Canada, the action reached a summit of $ 5.24 CA on December 6, 2024, a significant leap compared to its lower 52 weeks of $ 0.37 CA. This wave reflects the growing importance of the cryptocurrency sector and the confidence of investors in the direction of the company.

The CEO is CEO Olivier Roussy Newton, which is dedicated to expanding investors’ access to decentralized technologies. The company’s mission is to identify innovative opportunities in the DEFI space and to invest in technologies that offer diversified exhibition at the decentralized ecosystem. This avant-garde approach guarantees that DEFI technologies remain a key player in the merger of traditional financial markets with decentralized platforms.

Government initiatives Adoption of fuel blockchain

Canada has been proactive to adopt blockchain technology. Canadian securities administrators (CSA) have developed a regulatory framework that incorporates digital assets into the financial system. This led to the approval of the Stock Exchange (ETF) funds based on crypto, positioning Canada as a leader in blockchain innovation.

In addition, Canada’s national cybersecurity strategy in 2025 highlights the importance of securing digital infrastructure, including blockchain technologies. This strategy demonstrates the government’s commitment to promote innovation while guaranteeing the safety of digital assets.

In the United States, President Donald Trump’s administration has also shown support for digital assets and blockchain technology. In January 2025, President Trump signed the executive decree 14178, entitled “strengthening American leadership in digital financial technology”. This order emphasizes the commitment of the administration to support the growth of digital assets through the economy. It revokes the previous guidelines which hampered the innovation of blockchain and prohibited the creation of a digital currency from the Central Bank, signaling a clear approval of decentralized financial systems.

Global trends propel the growth of challenge

In Asia, Hong Kong has made progress by potentially accepting cryptocurrencies as proof of wealth for immigration purposes, according to Reuters. This reflects a broader acceptance of digital assets in the financial and government sectors.

In addition, DEFI Technologies extends to key markets such as Asia, the Middle East and Africa by recently signing a memorandum of understanding (MOU) with Asianext, a stock exchange based in Singapore of a leading. and a memorandum of understanding with the Nairobi Stock Exchange.

DEFI Technologies sets the Crypto ETP trend

In 2024, the crypto world experienced a massive increase in products negotiated on the stock market (FTEs), and DEFI Technologies was right there, on the trend. When the US Greenlot Spot Bitcoin ETPS in January 2024, it was like opening the valves – the investors flocked, wishing to obtain a piece of the action. The FNB Ishares Bitcoin Trust of Blackrock (IBIT), for example, drawn $ 50 billion in assets that year. This has set a new record, according to Ishares.

Europe has not been left behind. Deutsche Börse reported that their assets ETF and ETP reached a top of 1.83 Billion of euros in 2024, with negotiation volumes of 28%, reaching 230.8 billion euros.

DEFI Technologies, through its subsidiary Valor Inc., jumped on this trend by unfolding a variety of ETP Crypto. In fact, Valor plans to have a total of 100 FTEs at the end of 2025.

Are DFI technologies a purchase?

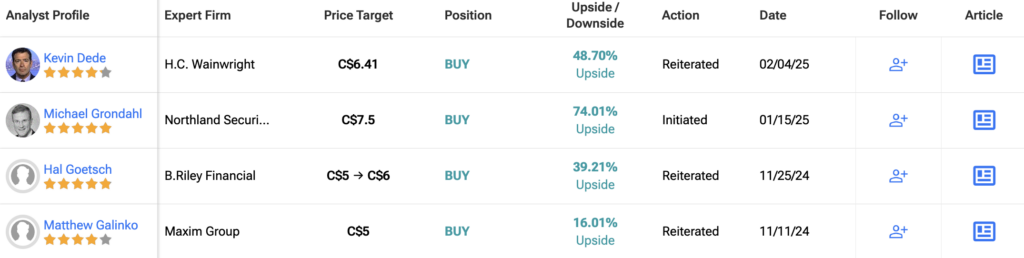

Analysts remain optimistic about Defi Technologies Stock, with a strong purchase consensus side based on 3 purchases. In the past year, DEFI has increased by more than 410% and the average DEFI price target of $ 6.64 implies an increase of increase of 54.06% compared to current levels.