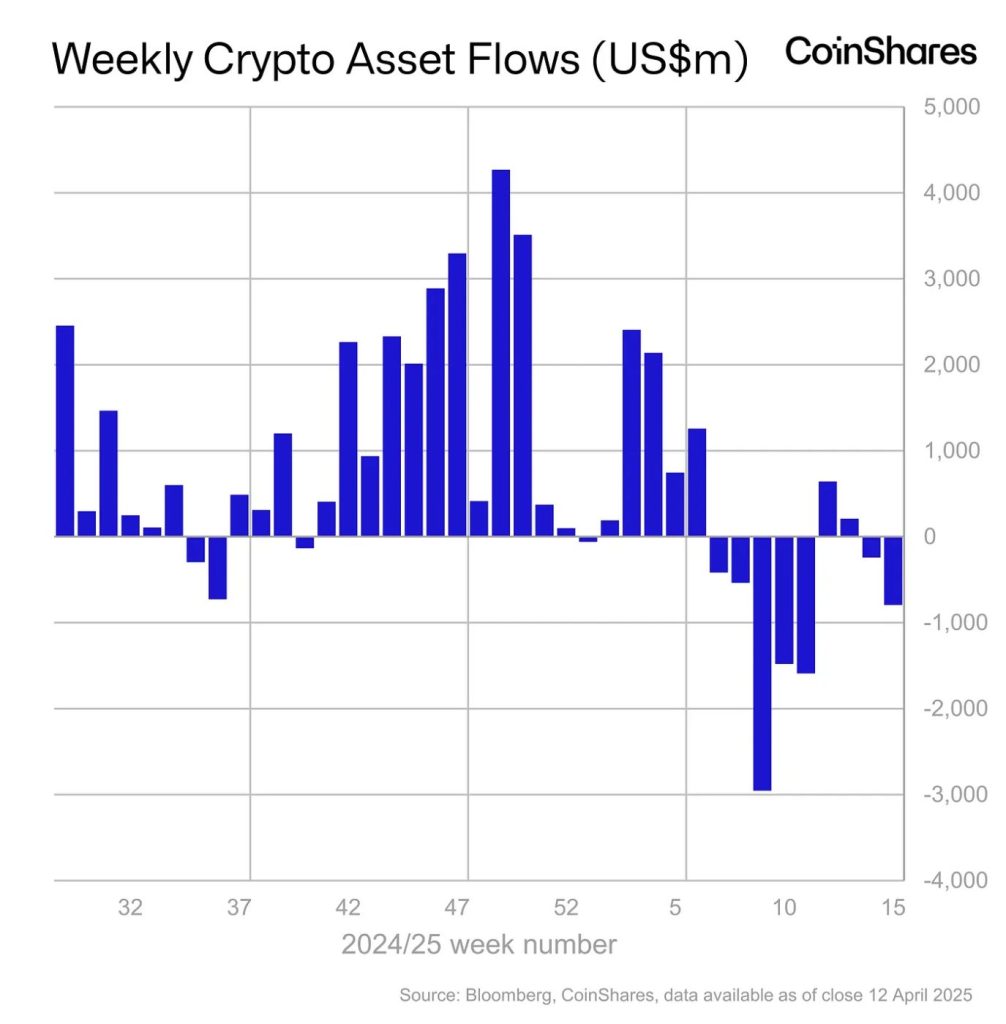

Digital Asset Investment Products had another difficult week, registering $ 795 million on outings, the third consecutive week of decline.

The growing pressure of recent developments linked to prices continues to slow down investor confidence in the cryptography sector, according to a Monday of Coinshares report.

Since early February, outings have totaled $ 7.2 billion, destroying almost all 2024 -year -old gains. Net entries for the year are now at only $ 165 million.

Cryptographic markets rebound after Trump softens the prices

In particular, a recovery at the end of the week of cryptographic prices contributed to increase the total assets under management (AUM) to $ 130 billion – an 8% rebound compared to the lowest of April 8, after the partial decline of President Trump controversial prices.

Bitcoin brought the weight of last week withdrawals, with $ 751 million in outings.

Despite this, the main cryptocurrency still shows $ 545 million at YTD entrances.

Ethereum followed with $ 37.6 million in outings, while Solana, Aave et Suit also displayed smaller losses.

Interestingly, even short-coated products have experienced $ 4.6 million, suggesting a global risk of risk rather than directional bets.

Some altcoins have challenged the trend: XRP led entries with $ 3.5 million, while Lando, Algorand and Avalanche each attracted interest in modest investors.

The outputs indicate continuous prudence among digital asset investors in the midst of macroeconomic and geopolitical uncertainty.

Meanwhile, BlackRock Crypto ETF entries fell 83% in T1 2025, after a strong end in 2024.

While the company has always attracted $ 3 billion to Bitcoin and Ether, investors’ enthusiasm has decreased sharply in the midst of stagnant cryptography and the increase in market volatility, according to the company’s first quarter gain report.

The entries represented only 2.8% of the total of the Ishares for the quarter, which indicates a broader evolution of investors towards prudence under the current economic conditions.

The slowdown in the crypto reflected a wider weakness in the activities of the BlackRock ETF, the total ISHARES entries lowering more than 70% to 84 billion dollars, compared to $ 281 billion in the previous quarter.

Despite the detention of $ 50.3 billion in AUM digital assets, Crypto contributed less than 1% to the long -term income from BlackRock.

The volatility of the market and the feeling of change within the framework of the Trump administration were cited as key reasons for the retirement of investors.

Andrew Kang of Mechanism Capital takes a position of $ 200 million on Bitcoin

Despite the low performance of the ETF market, crypto traders are still optimistic about Bitcoin.

On the one hand, Andrew Kang, founder of Crypto Venture Firm Méchanism Capital, doubled his bull bet on Bitcoin, taking a position of $ 200 million.

As indicated, a portfolio linked to Kang made a second 100 million dollars on Bitcoin on Monday, bringing its total position to $ 200 million.

The recent trade leads to a potential gain or loss estimated at around $ 6.8 million, reflecting Kang’s confidence in a short -term bitcoin rally.

Last week, the director of chief investments of Bitwise, Matt Hougan, reiterated his December prediction that Bitcoin could reach $ 200,000 before the end of 2025.

Hougan argued that recent developments in American trade policy, in particular within the framework of the push of the renewed price of former President Donald Trump, could act as tail winds for Bitcoin.

Post digital asset funds see $ 795 million in outings, $ 7.2 billion since February appeared first in Cryptonews.

The tariff titles have shaken the world! Volatility occupies the front of this week’s market update, making a dramatic return to the markets.

The tariff titles have shaken the world! Volatility occupies the front of this week’s market update, making a dramatic return to the markets.