Key notes

- More than 85% of transactions in the Ethereum ecosystem now take place on layer 2 networks.

- The base became the dominant L2, representing more than 80% of all L2 transaction costs and operating at a beneficiary margin of 98.3% in May 2025.

- Despite the transactions discrepancy, Ethereum L1 remains the basic settlement layer, hosting 90% of the Stablecoin value and 83% of all active world (RWAS).

A new report highlights a major change in Ethereum

Ethn

$ 3,008

24h volatility:

0.3%

COURTIC CAPESSION:

$ 363.10 B

Flight. 24 hours:

$ 40.12 B

The ecosystem, showing that layer 2 networks now manage more than 85% of all transactions.

However, while the L2 love the base and the arbitrum

ARB

$ 0.41

24h volatility:

2.6%

COURTIC CAPESSION:

$ 2.02 B

Flight. 24 hours:

$ 455.51

have become the main hubs of user activity, the main of Ethereum remains the basic settlement layer, dealing 85% of all the transferred values.

The report, published on July 10, 2025 by Dune Analytics, shows that Base has established itself as the dominant L2.

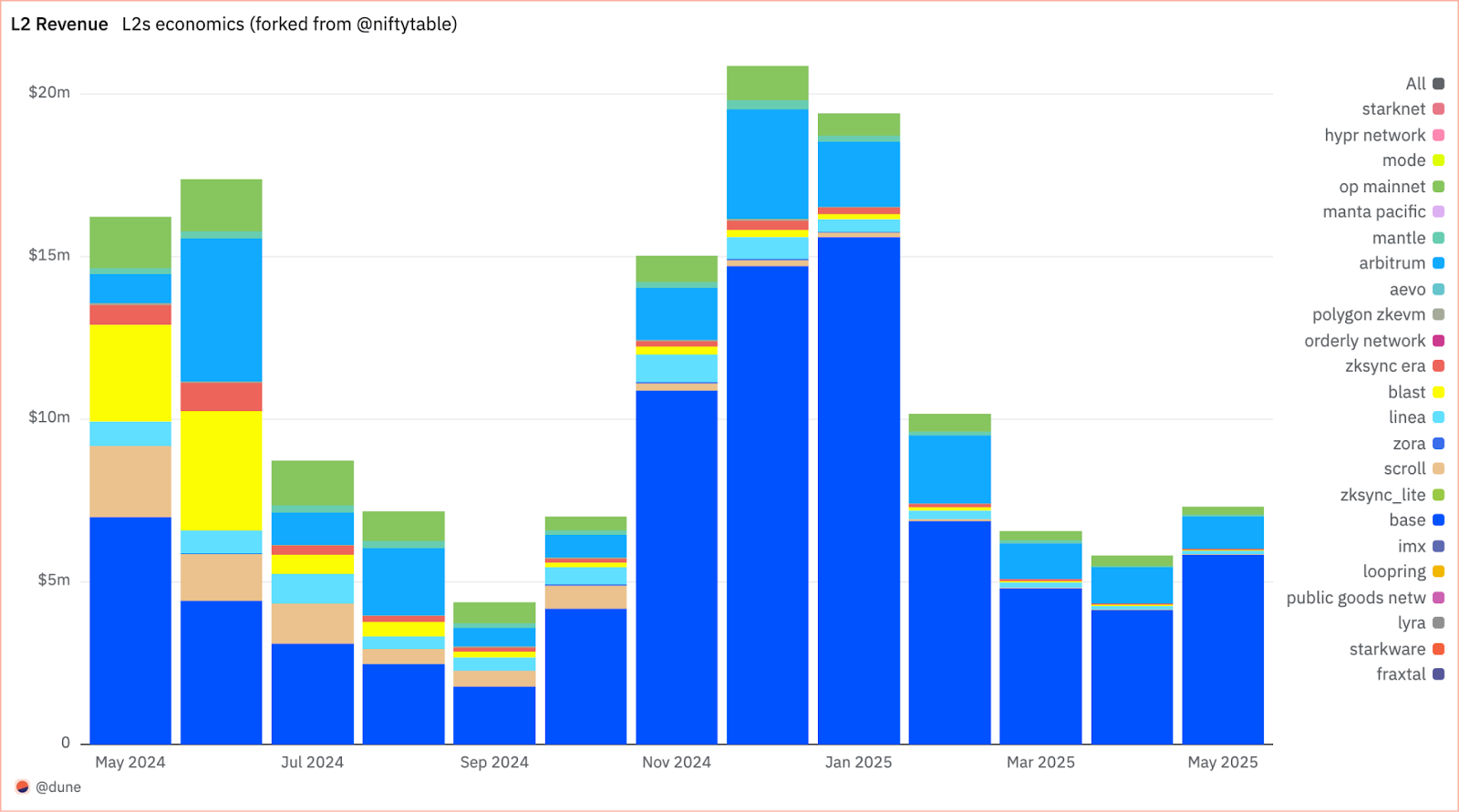

It now represents more than 80% of all transaction costs in L2 and has generated $ 5.8 million in revenues in May 2025 only, which puts it in pace for an annualized execution rate of $ 70 million.

A new L2 economy fueled by Dencun

Ventilation of monthly income through the layout of layer 2 from May 2024 to May 2025. The base (blue) is the dominant L2 in terms of generation of income. | Source: Dune Analytics

Ventilation of monthly income through the layout of layer 2 from May 2024 to May 2025. The base (blue) is the dominant L2 in terms of generation of income. | Source: Dune Analytics

This growth was supercharged by the Dencun d’Ethereum upgrade in March 2024. The introduction of “Blobs” considerably reduced data regulation costs to “almost zero” levels, allowing the basis to operate on a profit margin of 98.3% in May 2025.

The lower costs also made L2 much more attractive to users. On decentralized scholarships, the number of professions has more than doubled from one year to the next to 132 million in May 2025, with a base with more than half of these trades. This same month, the volume of basic DEX trading exceeded that of Ethereum for the first time.

However, the Mainnet continues to be the chain of choice for high -value assets. Ethereum L1 welcomes 90% of the offer of $ 150 billion and 83% of the $ 6 billion in real assets. This fundamental role arouses a broader interest and reflects a tendency to increasing institutional adoption, which includes developments such as new ETF proposals featuring Ethereum.

In the end, the report of a clear image of the modular future of Ethereum. The Mainnet consolidates its role as a cup cup cup and safety screen of the ecosystem, while the L2 have become the main execution layer where the next generation of consumption applications is under construction and scale.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

As a Duckdao web3 and old CMO marketing strategist, Zoran Spirkovski translates complex cryptography concepts into convincing stories that stimulate growth. With training in cryptographic journalism, he excels in the development of marketing strategies for Defi, L2 and Gamefi projects.

Zoran Spirkovski on x