- Investors often traded tokens and shares in private Telegram chats.

- Today, startups are making millions launching custom products to do the same thing.

- Making these agreements public will not, however, make everyone happy.

Secondary markets for cryptocurrencies, where investors privately buy and sell their stakes in companies as well as locked tokens, are booming.

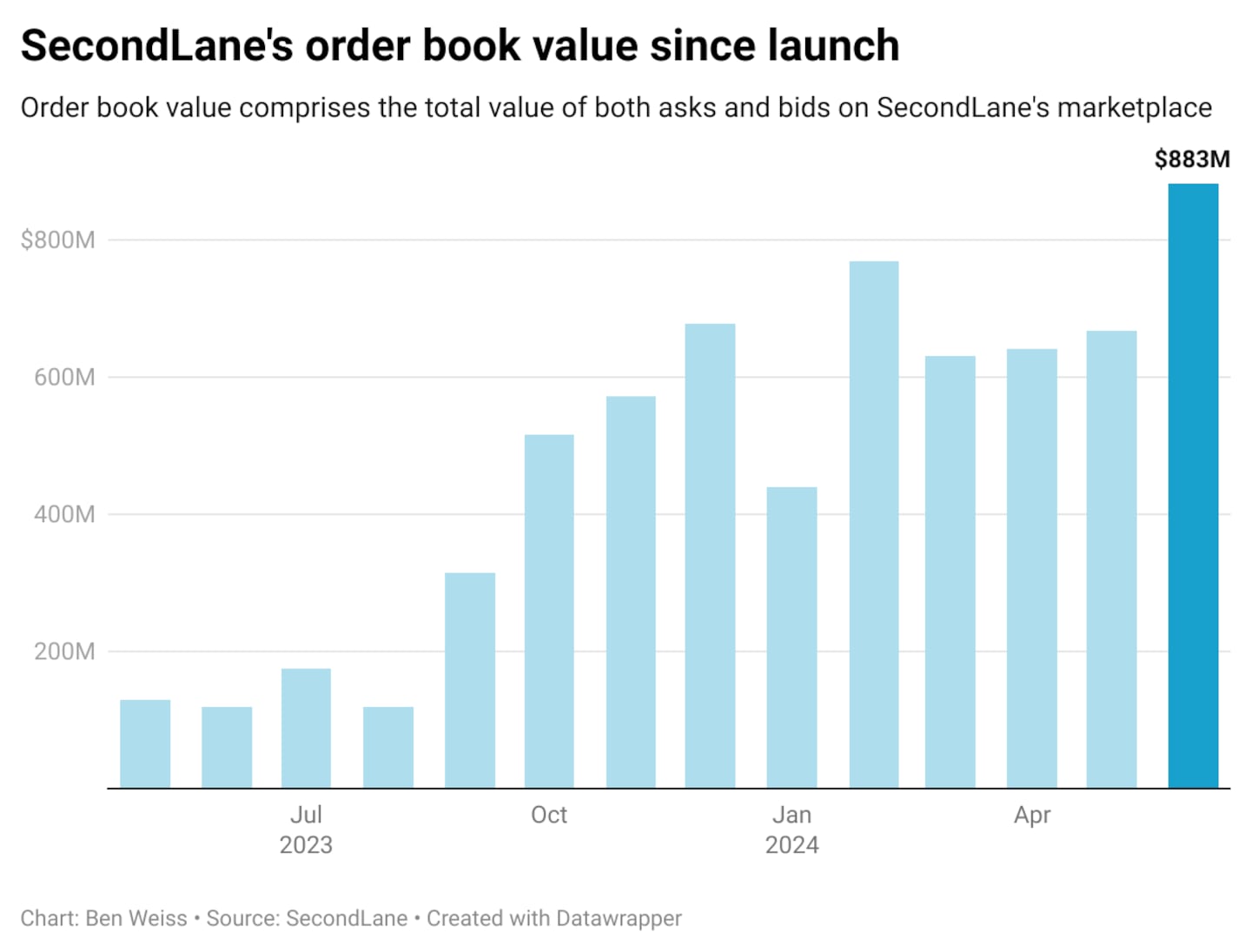

Since May 2023, activity on SecondLane, one of the largest secondary marketplaces, has seen a 631% increase in activity.

The monthly value of its order book, or a record of requests and offers for the company’s assets, reached nearly $900 million in July.

So what is driving so much activity in such an illiquid and opaque market?

Insiders say a recent influx of venture capital, general growth in private markets and the emergence of new assets that investors can’t sell through traditional financial institutions.

“You invest a lot of private capital into a new market, you wait a few years, and undoubtedly some of those investments will want to try to get early liquidity,” said David Mirzadeh, who founded secondary market data provider Bulletin in June 2023. DL News.

Token Transactions Behind the Scenes

Secondary markets are traditionally illiquid, with brokers manually finding buyers and sellers of startup shares and other assets between different investment rounds.

Nevertheless, it is a growing niche in global financial markets.

Join the community to receive our latest stories and updates

According to a recent report from BlackRock, the volume of completed secondary deals more than quadrupled between 2013 and 2023, reaching $115 billion. And while the amount of global private equity raised declined year-over-year in 2023, it has doubled over the past decade to reach nearly $1.05 trillion in 2023, according to McKinsey & Company.

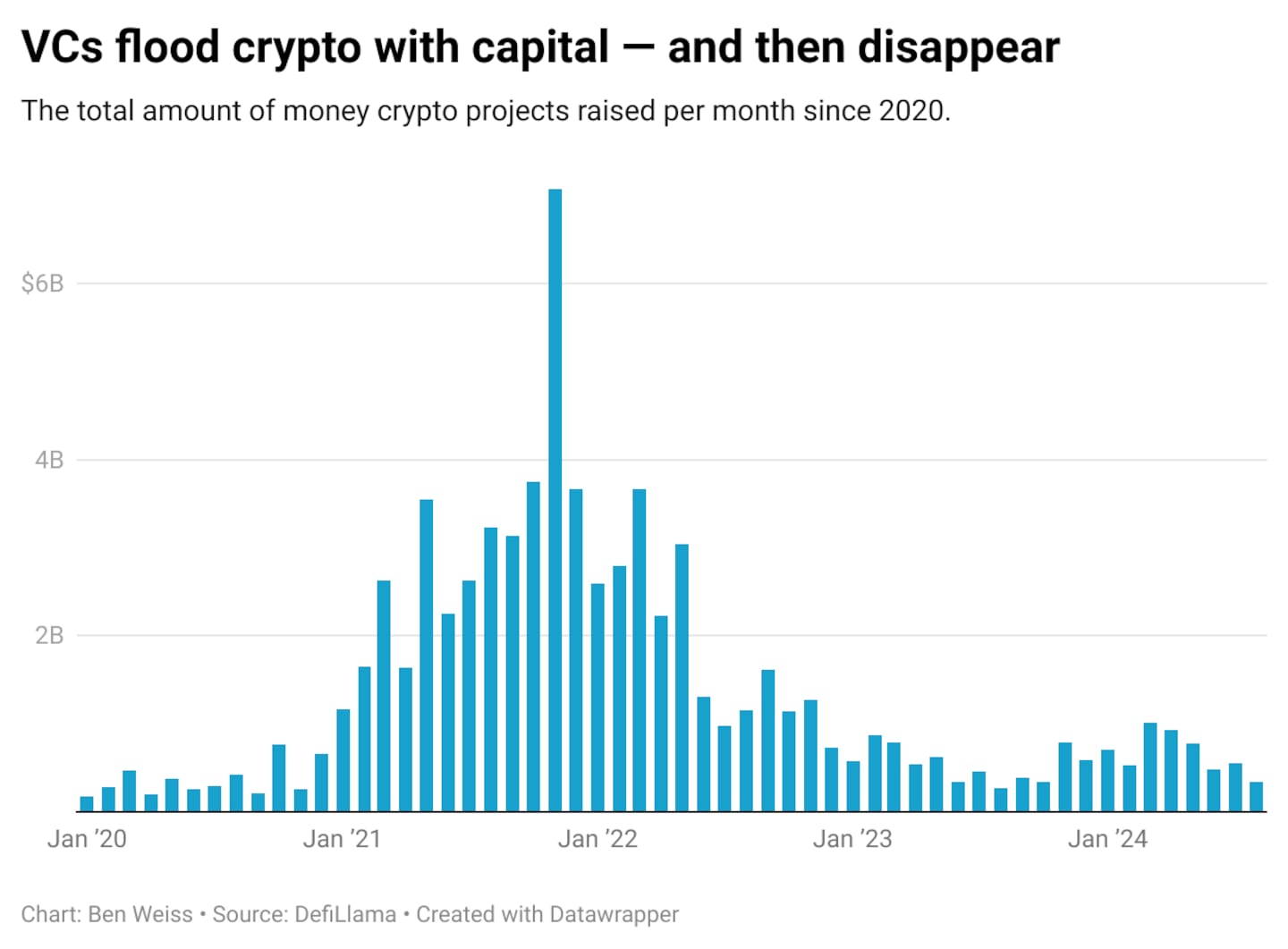

Trading activity is now picking up in the cryptocurrency sector thanks to the influx of capital investment in recent years.

At their peak, crypto projects raised a record $7.1 billion in November 2021, according to data from DefiLlama, from some of the biggest names in venture capital, including Andreessen Horowitz and Tiger Global.

When the bear market hit hard after the collapse of cryptocurrency exchange FTX, venture capitalists hoping for an exit — selling their equity in a private startup or waiting for a token launch to do the same — found themselves facing months without returns on their investments as projects delayed launching new cryptocurrencies, Mirzadeh said.

Funds needed to sell tokens; locked tokens or reserves of cryptocurrency released to holders on set dates; and “simple agreements for future tokens,” or SAFTs, a stock-like agreement that promises a holder tokens once a cryptocurrency goes live.

While cryptocurrencies have attracted big-name venture capitalists, financial institutions like Forge Global and Goldman Sachs, which have traditionally acted as secondary dealers for traditional markets, have not entered the fray.

These institutions do not deal in these assets, said Jan Strandberg, co-founder and CEO of Acquire.fi. DL News.

“Forge doesn’t deal in tokens at all,” he said, referring to heavyweight secondary broker Forge Global. “They only deal in stocks.”

Meeting new requirements

Now, crypto-native platforms like SecondLane, Acquire.fi, Bulletin, and offx have emerged to meet the demand.

And business is booming.

Strandberg, who launched Acquire.fi in 2022, said that up to 80% of his platform’s volume is tied to tokens.

Jonas Thiele, co-founder and CEO of offx, said his company has seen a total order book value of about $1 billion since its launch in December 2023. It will open the invitation-only marketplace to more people later this year.

There is a waiting list for his platform, but he plans to open it to the general public later this year, Thiele said. DL News.

These companies don’t just serve a new market; they also connect buyers and sellers in ways that traditional brokers don’t.

Secondary 2.0

Mirzadeh, whose full-time job is as chief of staff for the NEAR Foundation, worked at Goldman Sachs helping broker secondary market transactions.

“You quickly realize how manual and archaic this whole process is,” he said, referring to executing secondary sales for Goldman’s clients. “There’s not really a lot of automation. It’s all very manual.”

Originally, private over-the-counter transactions between cryptocurrency investors were not much different.

They were usually exchanged by word of mouth or via Telegram, the cryptocurrency’s preferred messaging app.

“It was like trying to make a deal in a crowded room, where everyone had a slightly different version of the facts.”

— Jonas Thiele, Co-Founder and CEO of Offx

Thiele says that has been problematic.

“There have been cases where four to five brokers were involved in a single transaction, resulting in fees of up to 25% of the total volume,” he said. DL Newsreferring to an anonymous deal worth $2 million.

Thiele said this structure also meant that information between brokers and investors could be misunderstood or not shared.

“It was like trying to make a deal in a crowded room, where everyone had a slightly different version of the facts,” he said.

Telegram conversations still dominate the secondary market, but some are now automated. SecondLane, offx, and Acquire.fi have channels that post daily offers and asks.

Lifting the market veil

These platforms are lifting the veil on a historically very opaque market. Nick Cote, co-founder and CEO of SecondLane, a marketplace for secondary cryptocurrencies launched in May 2023, believes greater transparency is inevitable.

“The era of privacy and data siloing is unfortunately behind us,” he said. DL Newsadding later: “Good luck keeping all that stuff private.”

SecondLane and Acquire.fi publicly post offers online and act as intermediaries to connect buyers and sellers.

Others, like Bulletin, aggregate data from secondary trading platforms, cryptocurrency brokers, and user insights.

“What we’re trying to do is take a lot of what already exists in the traditional space — in terms of private market solutions, private credit — and bring it to the digital asset space,” Cote said.

“Growing pains”

Anyone can join SecondLane and Acquire.fi’s deal tally, perhaps to the chagrin of some founders or investors who don’t want it publicly known that their companies are trading at a fraction of their most recent valuation.

SecondLane’s rating understands that this is a bitter pill to swallow.

“If you have portfolios that haven’t been valued in years and they’re pricing at prices that aren’t even close to reality, there’s going to be growing pains,” he said.

However, he believes that projects like SecondLane are ultimately a boon to the crypto industry.

It is better to inform investors realistically about the value of their portfolio now rather than postponing the situation until later when its value could be even lower.

“This is a new paradigm shift that will take time to get used to,” he said.

Editor’s Note: This article has been updated to reflect that Offx has seen $1 billion in bids and asks.

Ben Weiss is a Dubai correspondent for DL News. Liam Kelly is a DeFi correspondent for DL NewsDo you have any information to share with us? Email them at bweiss@dlnews.com and liam@dlnews.com.