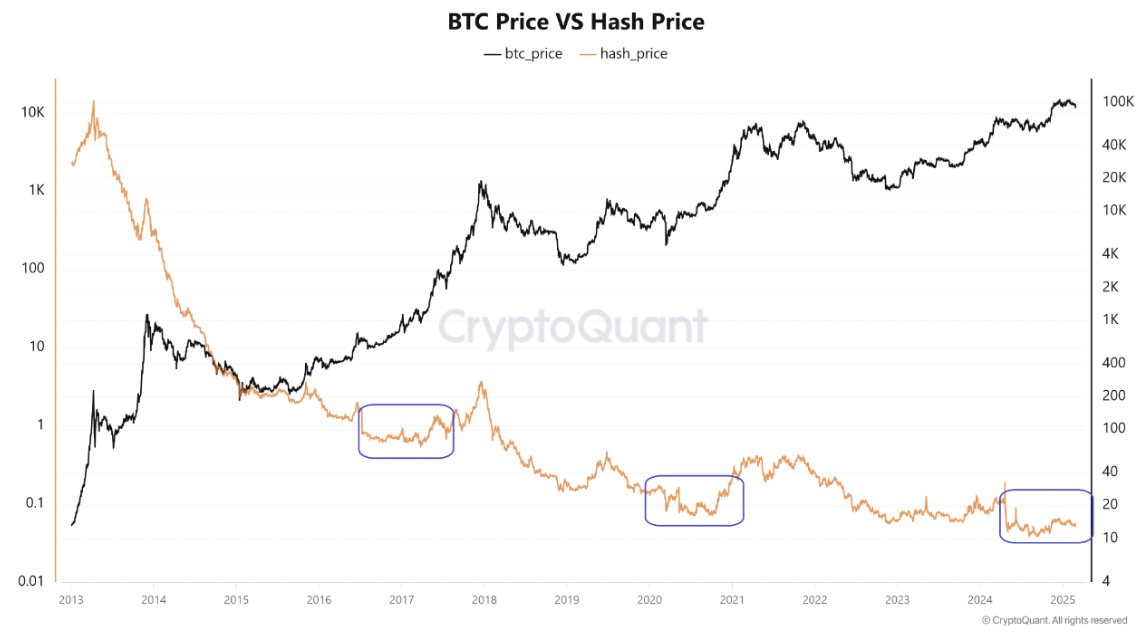

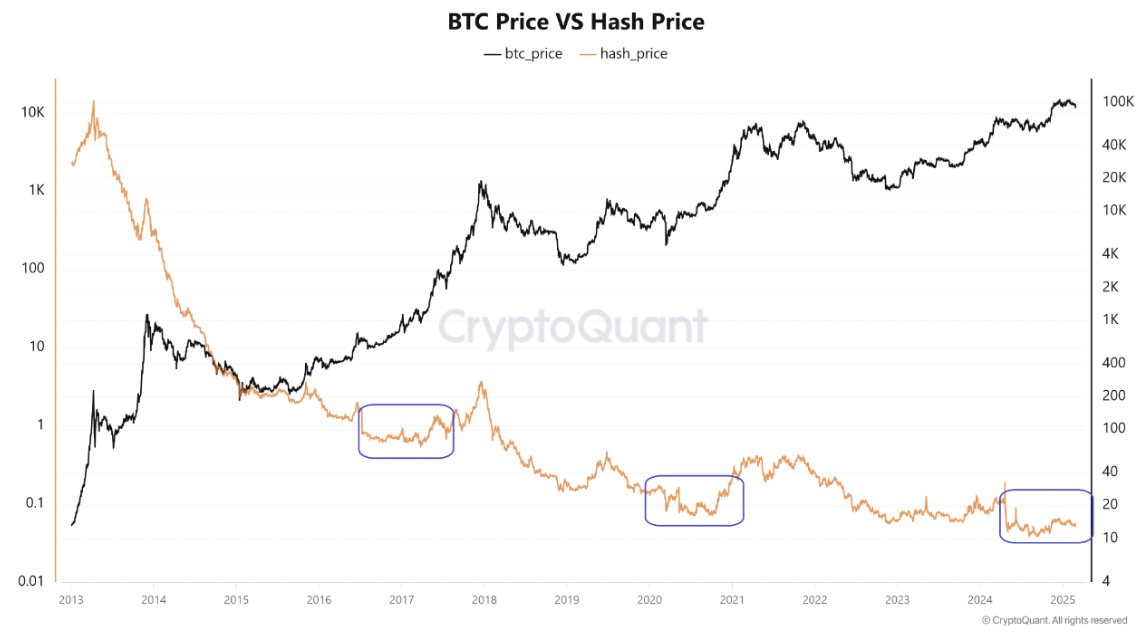

- The lower bitcoin hash price suggested that it could approach a low price, potentially signaling a rebound.

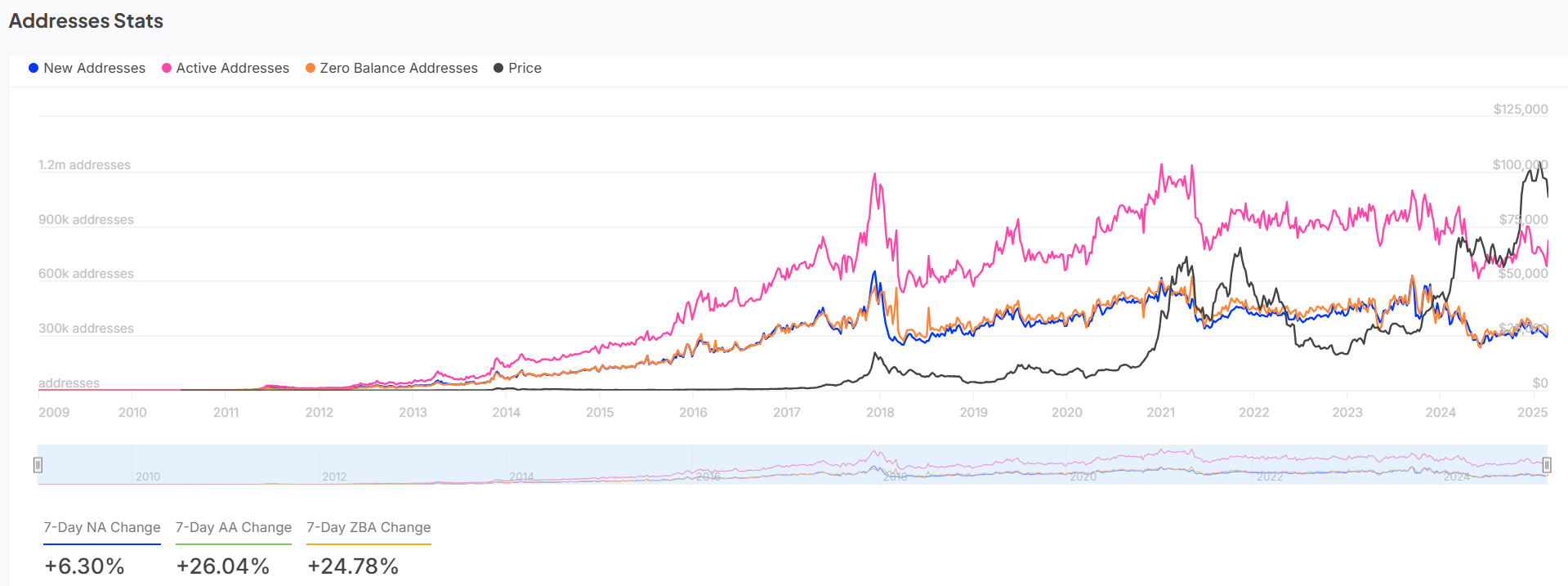

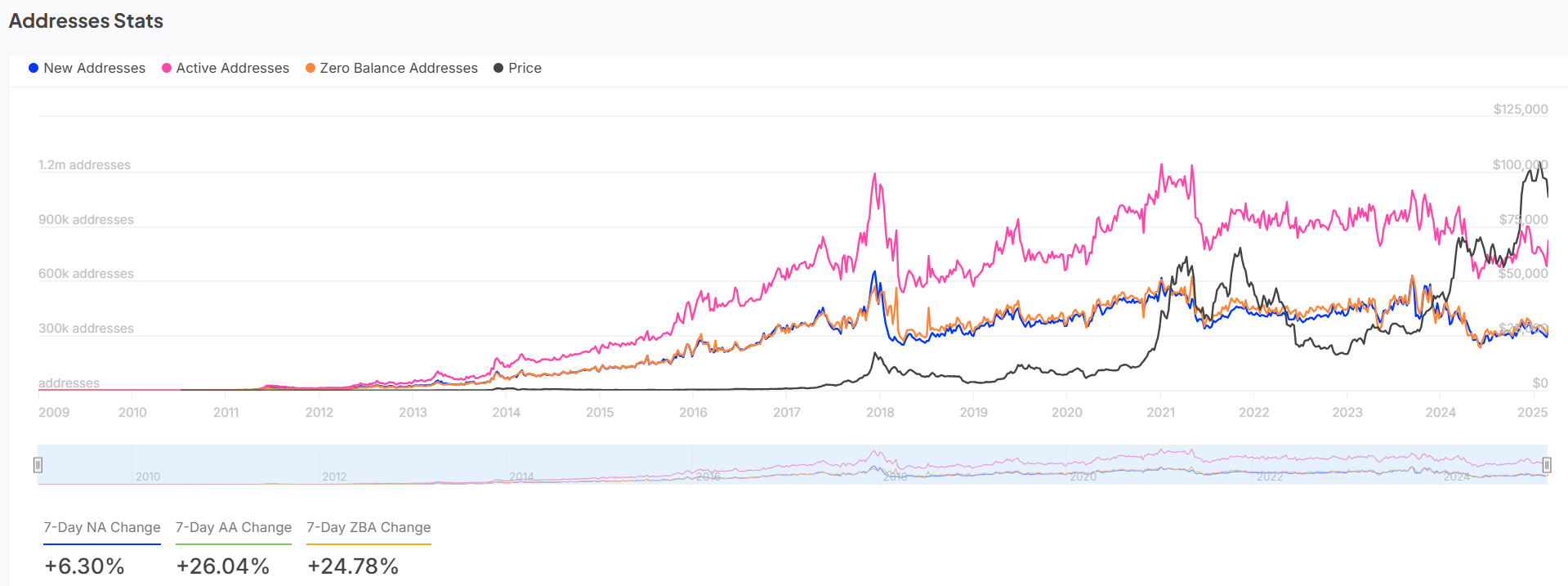

- The increase in active addresses and the increase in the stock / flow ratio highlighted the increasing confidence and scarcity of the market.

Bitcoin (BTC) Recent movements in the hash price are aligned with past models, suggesting that cryptocurrency could approach a background. At the time of the press, Bitcoin was negotiated at $ 801.35, down 7.67% in the last 24 hours.

Historically, the lower award price periods have brand The price of Bitcoin is boss, noting that a potential rebound could be on the horizon.

While BTC tests these key levels, it raises the question – could it be an ideal accumulation phase before the next bull race?

Source: cryptocurrency

Bitcoin in / Out of the Money Chart reveals interesting information on the current feeling of the market. A large part of the BTC, around 75.30% (14.95 million BTC), remains “in money”, showing that most investors are still in profit.

However, 23.23% (4.61 million BTC) of Bitcoin addresses are “out of money”. This shows that if most bitcoin holders remain profitable, the market is not without challenges.

BTC: The growing activity on the blockchain suggests …

Bitcoin address statistics provide additional information on market management. Active addresses have increased by 6.30% in the last 7 days, reflecting growing participation in the Bitcoin network.

The pink line, representing active addresses, shows a regular increase, closely reflecting Bitcoin price movements. Meanwhile, the number of zero balance addresses increased by 24.78%, reporting that many new users actively hold or exchange bitcoin rather than abandoning their portfolios.

This increase in activity, in particular with the increase in new addresses (26.04% in last week), suggests that market confidence increases. This could lead to a price rebound if BTC continues to take momentum.

Source: intotheblock

Breakout to come? Technical indicators show …

Bitcoin technical analysis shows crucial support and resistance levels.

At the time of writing this document, BTC tested the support of around $ 80,216, a level that experienced previous price reactions. However, the downward trend line and the distribution of key support levels suggest that BTC is under pressure.

In addition, RSI Stochastic reading of 2.23 reports a condition of occurrence, which often precedes a price reversal. Bollinger strips also point to a tightening scheme, indicating that volatility could soon increase.

These technical indicators suggest that the BTC could bounce back from this level of support or decompose more, depending on future market developments.

Source: tradingView

Stock ratio / BTC flow: fuel of growing rarity …

The Bitcoin Stock / Flow ratio jumped 100% in the last 24 hours, reaching 2,1152 m. This indicates an increase in the rarity of Bitcoin, as the rate of new supplies continues to decrease.

The increase in the stock / flow ratio suggests that, although BTC is faced with the volatility of short -term prices, its long -term value proposal remains intact.

As fewer BTC parts are introduced into traffic over time, rarity will increase demand, which could increase higher prices.

Source: cryptocurrency

Does Bitcoin are preparing for a rebound?

Based on the current analysis, Bitcoin approaches a potential background. The lower axing price, combined with the increase in active addresses, points out a potential price reversal.

Although technical indicators such as stochastic RSI point to a condition of occurrence, bitcoin is likely to experience an increased purchasing activity. Rarity continues to drive value.