Dogecoin could prepare for his next escape. After having held a business nearly $ 0.17 on the weekly graph, Doge recently rebounded on Fibonacci keys and the support of the trend line, referring to a renewed bullish potential.

With its 200-week mobile average offering a constant support and price comfortably above the ascending canal, the techniques suggest that the configuration aligns. If the recent dive towards the 200 MA on the M15 graph is a low risk entry, this could prepare the ground for a resistance retest of $ 0.16490, and perhaps more.

Rejection to resistance, but techniques always favor the bulls

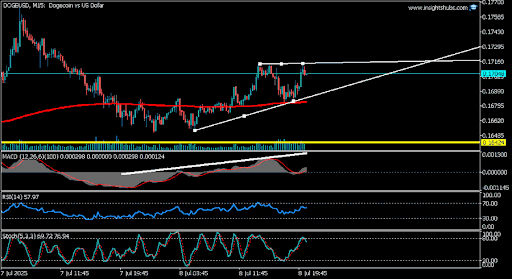

In a recent analysis shared on X, Thomas Anderson presented a detailed ventilation of the action of DOGE / USD prices within the M15 and M30 deadlines. According to the expert, Dogecoin is currently negotiated at $ 0.17043, and the price is faced with the rejection to the yellow horizontal resistance line around $ 0.16490. Prices’ action shows consolidation just below this key level, signaling indecision among traders.

Anderson stressed that the 200 mA (red line) acts as a dynamic support from below, helping to anchor the price during the current consolidation phase. This average mobile support offers bulls the bottom of the bottom to regain control if the momentum moves in their favor.

On the M30 graph, Anderson noted that the wider bullish structure remains intact, with Doge Price holding above the ascending trend line. This technical model suggests continuous optimism for ascending movements, provided that the price does not break below key support areas. Thomas Anderson concluded that any decline in the 200 MA on the M15 deadline could offer an opportunity to purchase, in particular for traders who are considering a resistance retest of $ 0.16490.

Dogecoin’s weekly graphic echoes the optimistic plan of Elliott Theory Theory Theory

By taking a closer look at the weekly Dogecoin graphic, the crypto analyst Andrew observed a notable long -term wave structure. He explained that in the past three years, Dogi has completed an increase in five waves, followed by a typical ABC correction, in accordance with Elliott’s wave theory.

Andrew also noted that the price had found a strong reaction at the level of 0.786 Fibonacci, marked by a light blue line, which traces the retrace of the whole ascending movement. This reaction suggests that DOGE may have reached a critical support zone, where buyers could start to intervene.

In this spirit, Andrew thinks that the current structure seems to form a larger 1-2 configuration, which could lead to a powerful advance of waves 3. If this model takes place, it can point out the beginning of a new upper phase with the potential of breaking beyond the previous summits.