The ETHE of the ETF ETF of the American list just recorded five consecutive days of net outputs, adding pressure on Ethereum funds and signaling the smaller risk appetite of smaller investors.

Wacky data Dollars’ 248.4 million shows left the products on Friday, going to $ 795.8 million weekly dollars. The ether fell by approximately -10% on the same section.

It is the longest withdrawal since the week ending on September 5, when the token exchanged almost $ 4,300.

A big question is suspended on the market: the development. Traders are waiting to see if American regulators will harm inside ether ETF. September 19, reports The said Graycale was preparing to accumulate part of his large eth pile, widely read as a vote of trust that the dry could allow it.

Breaking: gray levels are preparing to play their $ ETh Holdings. $ Ethe $ ETh

They moved more than 40k $ ETh During the last hour they position themselves (1.5 m $ ETh) to mark the awards.

They are the first ETF ETF on the US markets to do so. pic.twitter.com/vsomr0vnhq

– Emmett Gallic (@emmettgallic) September 18, 2025

The timing is not clear. The feeling is not. “It is a sign of capitulation because the sale of panic was so high,” said cryptographic analyst Bitbull said outings.

$ ETh ETF has just recorded its biggest weekly outing of all time.

It is a sign of capitulation because the sale of panic was so high.

Do you think $ 3,750 was the bottom for ETH? pic.twitter.com/drjlssokjc

– bitbull (@Akabull_) September 27, 2025

Bitcoin products also felt cold. ETF BTC Spot recorded $ 897.6 million in net outings during the same five days. Bitcoin fell by -5.28% over the week and changed hands at around $ 109,551 at the time of the press.

Etf James Seyffart analyst said On a podcast Thursday that the FNB bitcoin “have not been perfectly hot in the last two months”, while noting that they remain “the biggest launch of all time”.

Live now – the Rush Crypto ETF has not even started@Jseyff joins us to map the Boom of Crypto ETF: what is real, what is the next step and which really buys.

We excavate how Spot Bitcoin and Ethers Ethereum opened the valves, how the advisers, the hedge funds and even the sovereign heritage funds … pic.twitter.com/jnafgnr7d0

– Bankless (@Banklesshq) September 25, 2025

The flows can depend on the position of the dry. A green light for the development could regularly request ether funds. Until then, price action and ETF data will define the tone.

Could institutional purchase push Ethereum beyond $ 4,000?

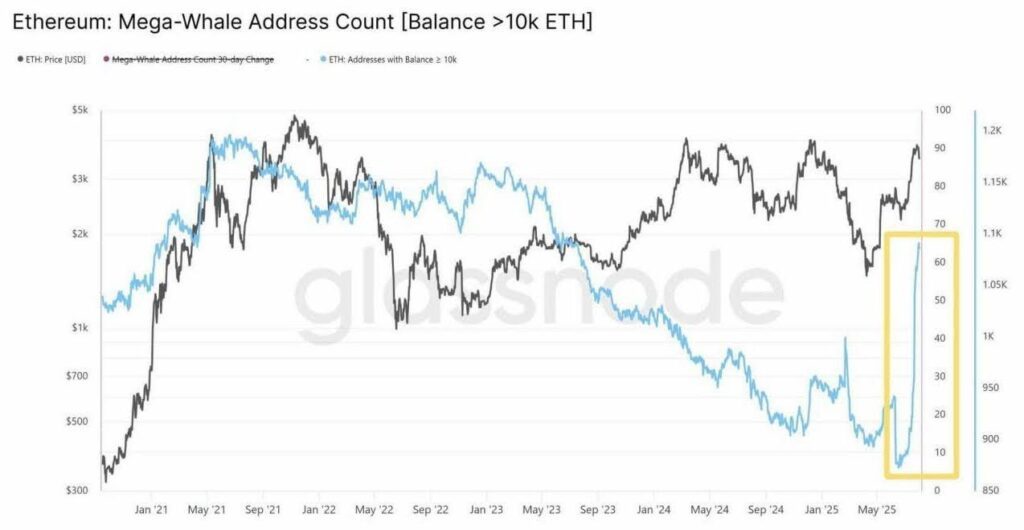

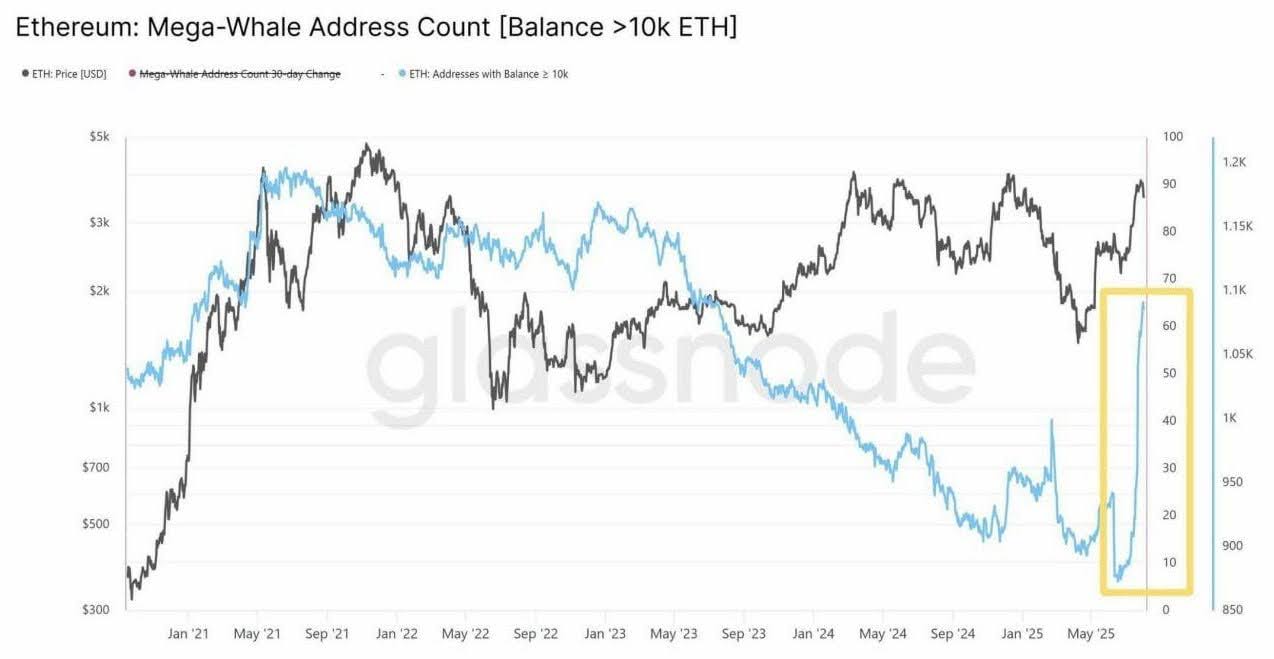

According to Glass noseThe biggest holders of Ethereum are back in purchasing mode. Portfolios with 10,000 ETH or more, often called mega whales, have grown up at one of the fastest clips for years.

(Source: Glassnode))

More than 60 of these addresses have appeared in recent weeks, a pace given for the last time at the beginning of 2021.

The quarter of work occurred after ETH recovered the $ 4,000 mark. It indicates a renewed confidence of long -term institutions and holders who tend to buy when they see the value.

In past cycles, an increasing part of parts in large wallets have aligned with accumulation phases that have preceded major movements. These entities often include funds, guards and high net investors.

The derivatives add to the image. The positioning of future ethers inflated parallel to the purchase of points, suggesting that the great players build an exhibition on the markets.

This can attract retail later, but also make the swings sharper if the positions return.

Yes, whales have a history of profits near the summits. However, the speed and size of recent additions are more like a long -term positioning than in short -term trading.

For the moment, the data suggest that deep pocket buyers always see ETH as a basic before known catalysts such as wider ignition use and any progress on ETF levels.

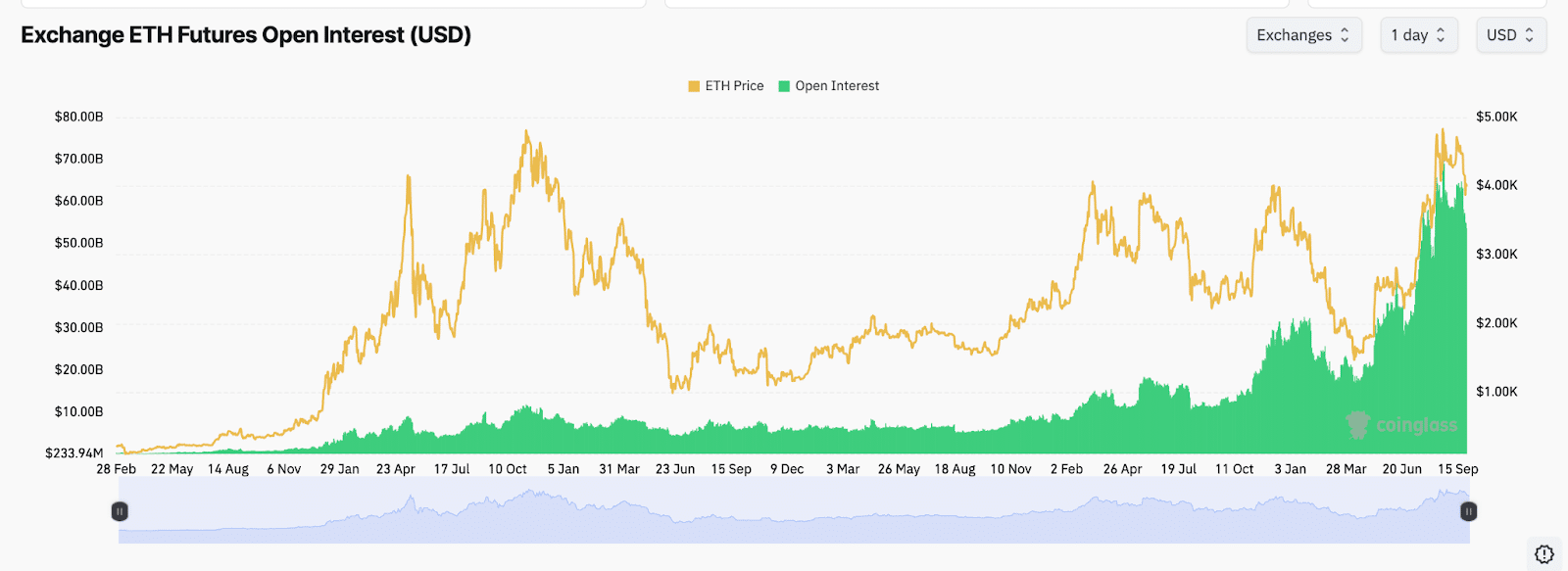

Rinsing data shows that Ethereum Futures open interests nearly $ 70 billion, near readings near the peak of 2021.

(Source: Coringlass))

The jump followed ETH’s thrust above $ 4,000 and reports fresh money on the market through derivatives.

The increase in open interests tells us that more traders have active contracts. This does not say who will be right, only that a greater decision can follow.

When positioning is crowded, financing and liquidations are important. If long dominates, a clear drop can make snowball. If the shorts are too strong, pressure can work quickly.

Discover: 20+ Next Crypto to explode in 2025

Price prediction Ethereum: can Ethereum close above the resistance from $ 4,300 to $ 4,400?

Trader Merlijn said ETH is pressure against a long -standing ceiling nearly $ 4,300 to $ 4,400. Its graph has shown repeated failures in this group since 2021.

$ ETh Go against resistance.

A clean decision and a price discovery will follow.

Targets: $ 10K + and beyond.The rally will not be tall.

It will be legendary.Only catch? You need steel balls to survive the Fud. pic.twitter.com/rbvjmvsn85

– Merlijn the trader (@merlijntrader) September 27, 2025

He maintains that a clean daily newspaper above him would push the ETH in the discovery of prices, opening a path at much higher levels.

(Source: X))

He even calls the “legendary” potential movement, forming it as a structural break rather than a slow version.

Risk is noise around rupture: the feeling can turn around quickly and the wicks above the resistance failed. The configuration is simple, hold it below and in the beach; Close with strength and momentum could extend quickly.

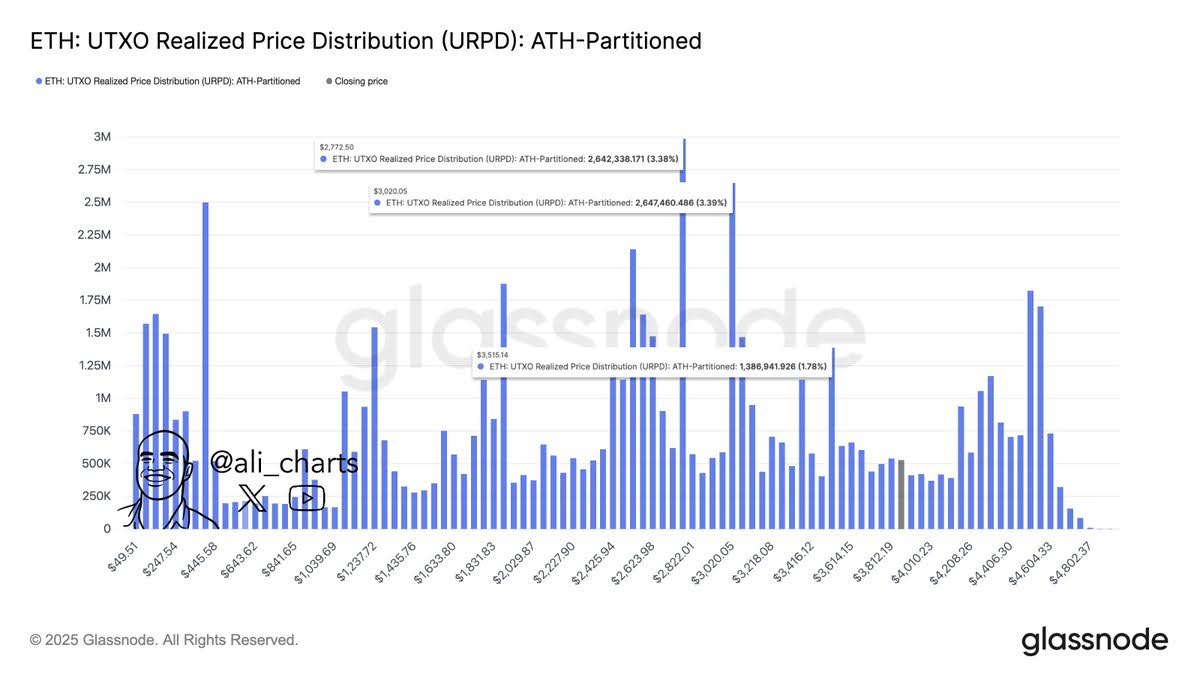

Analyst Ali Martinez Strike three areas to monitor Going down: $ 3,515, $ 3,020 and $ 2,772.

Three levels of support to monitor for Ethereum $ ETh: $ 3,515, $ 3,020 and $ 2,772. pic.twitter.com/m6uitugvjz

– Ali (@ali_charts) September 27, 2025

Its point of view is based on the distribution of the prices produced, which cartography where many addresses bought ETH for the last time.

These clusters often act as retarders for sales. The $ 3,020 area stands out, given heavy purchases.

(Source: X))

Holding this shelf would keep the constructive trend and limit the decline after net movements. Lose it and the market could retain deeper support layers as late long relaxes are relaxing.

In short: respect $ 3,515 on the declines, treat $ 3,020 like the pivot and see $ 2,772 as the defect in a stress event.

DISCOVER: 16+ Binance Nouvelles and to come in 2025

Join the 99Bitcoins News Discord here for the latest market updates

The position is Ethereum towards the south? The week of dark paint outings image for ETH USD appeared first on 99Bitcoins.