The price of bitcoin would have always evolved in a cyclic model – defined by distinct periods of movements up, laterally and down – since its creation. However, this cycle theory seems to be threatened, the first cryptocurrency apparently moving against the trend.

The founder of the cryptocurrency Ki Young Ju, who had proclaimed that the BTC bull cycle was completed in March 2025, reviewed his analysis and launched the idea that the price of bitcoin could come out of the usual cyclical trends. Another chain expert on the X platform weighed with an interesting socket on BTC cyclical behaviors.

Investors could see the unique first cycle in the history of Bitcoin

The pseudonym analyst on the Darkfost chain has taken the share of X to share their point of view on the current cycle and the price of Bitcoin which potentially breaking the dynamics of the fractal cycle. According to the online pendulum, the current market cycle could be different from the typical cycles observed in the past, but perhaps not as much as investors think.

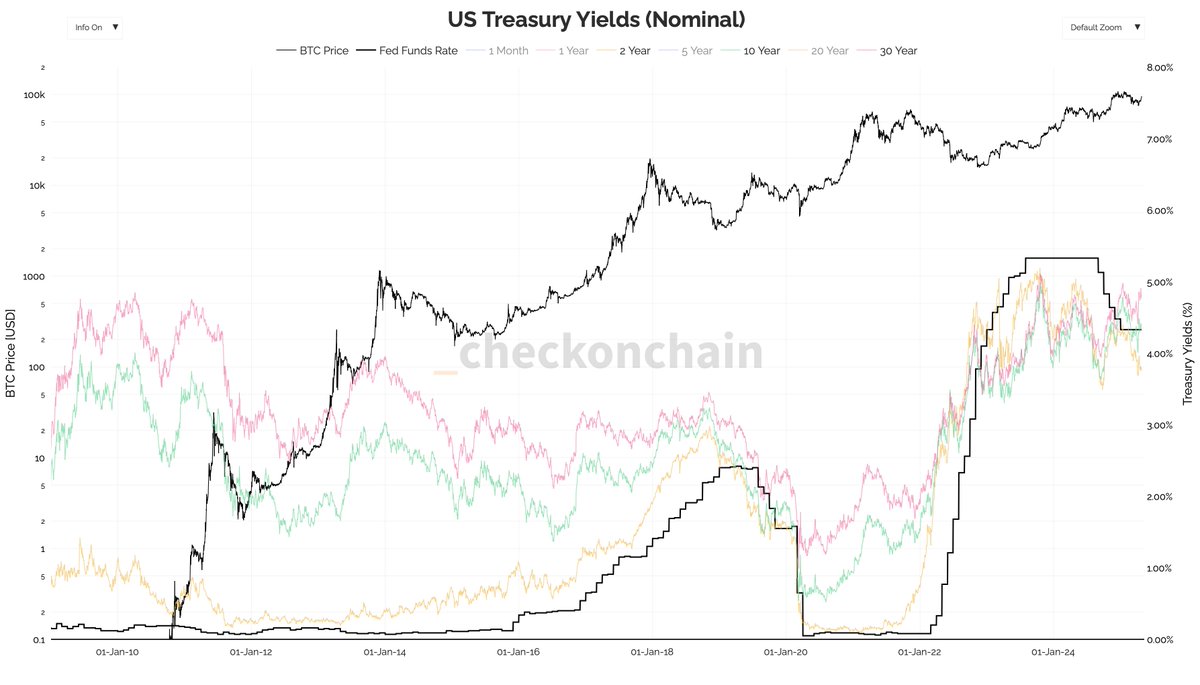

Darkfost has based their analysis on the high graphic, which brings together key macroeconomic data and compares it to bitcoin price movements. First, the chain analyst believes that the flagship cryptocurrency never had to evolve in market conditions this hostile for risk assets.

Source: @Darkfost_Coc

Darkfost alluded to high interest rates by the American federal reserve, saying that potential juicy yields on safer investment instruments have not prevented the price of Bitcoin from reaching two new summits of all time in the current cycle. More specifically, the Crypto analyst highlighted the situation with the yields of the Treasury.

Darkfost said:

Why would money, in particular institutions, be willing to take risks when they could earn a sure return of 5% without any real risk? What is even more striking is that the US2Y has been higher than long -term yields, an unusual and historically significant configuration.

Darkfost went further to say that the current cycle could indeed be different, because liquidity has not been completely directed to risk assets. However, this did not prevent the first cryptocurrency from occurring impressively in the past year.

In the end, Darkfost mentioned that the re -election of American president Donald Trump brings a certain level of uncertainty on the market. The chain analyst concluded that if Bitcoin remains in a typical cycle for the moment, investors could see the first cycle really unique if the macro-conditions are improving this year and lasts until 2026.

BTC price at a glance

When writing these lines, Bitcoin is estimated at around $ 94,752, reflecting a drop in prices of approximately 0.5% in the last 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Star image created by Dall-E, tradingView graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.