DOGE (

DOGE

$0.10

24h volatility:

8.5%

Market capitalization:

$17.35 billion

Flight. 24h:

$2.79 billion

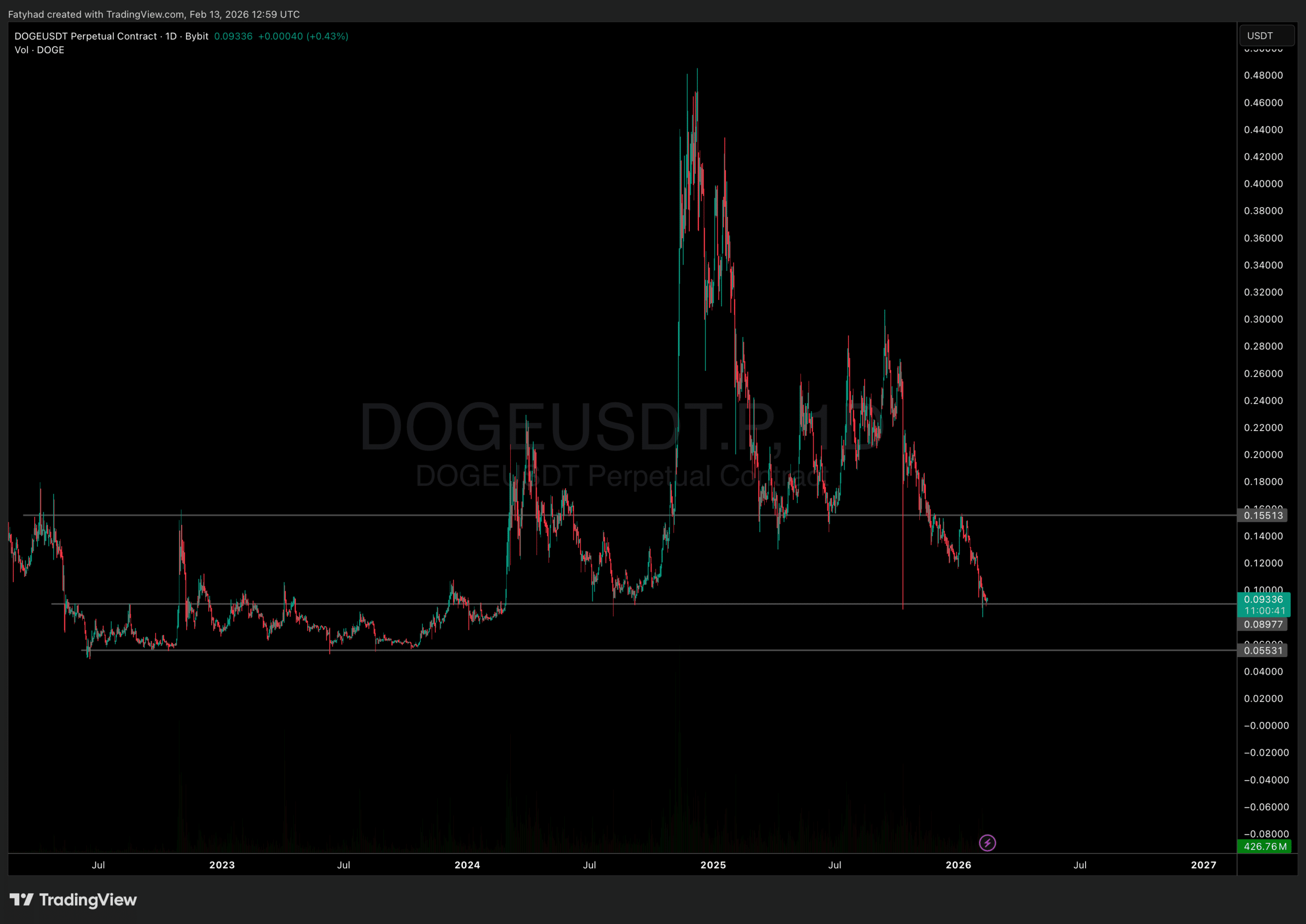

) is currently testing a critical support level near $0.09 as the entire crypto sector is weighed down by extreme fear and weak technical setups.

As DOGE faces immediate bearish pressure, market analysts suggest that the token has entered a rare “maximum opportunity” zone, characterized by technical indicators that have historically preceded significant cyclical lows.

EXPLORE: What is the next crypto to explode in 2026?

Is the crypto market signaling a cyclical reset?

The recent price action has positioned the largest meme coin at an important time. Crypto analyst Cryptollica identified this specific accumulation zone using a long horizon chart of DOGE against the US Dollar Index (DXY).

The Great Reset Cycle – Is History Repeating Itself? 🪦$DOGE

We look at a unique macro perspective: DOGE vs. DXY on the 10-day time frame. This chart filters out intraday noise and reveals the true cyclical nature of the asset.

The perfect S/R reversal (market memory): The… pic.twitter.com/9AOjmp8ZMt

– Cryptollica⚡️ (@Cryptollica) February 11, 2026

His theory is that the current correction has returned price action to a historic “Launchpad”: a level that served as breakout resistance in early 2021 before turning into a fortress of macro support during the bear markets of 2022 and 2023. This retest comes as the broader crypto market navigates complex signals regarding Bitcoin’s next move, which often dictates the beta response for altcoins like DOGE.

The theory posits that prior resistance, once broken, acts as a memory point for institutional positioning. When the market revisits these levels after a full boom-bust loop, they often offer favorable risk/reward ratios for entry.

DISCOVER: Best Solana Meme Coins by Market Cap 2026

DOGE Crypto Technical Analysis: RSI and Key Levels

At the heart of this technical analysis is the 10-day Relative Strength Index (RSI), which is currently hovering around 34. During previous market cycles, particularly in 2015, during the March 2020 crash, and in mid-2022, visits to this “red line” zone marked points of capitulation followed by sustained rallies.

While previous reports examined whether Dogecoin price was preparing for an aggressive rally similar to previous cycles, the current reality demands that DOGE defend the $0.089 floor first.

DOGE Price Analysis Source

Conversely, a weekly close below $0.09 would likely invalidate the “Launchpad” bullish thesis. Such a breakout could trigger a deeper decline towards the $0.080 liquidity cluster, extending the correction started in January.

EXPLORE: 10 new Binance announcements to watch out for in February 2026

Maxi Doge Presale Accelerates as DOGE Crypto Tests Critical Support

As Dogecoin tests the crucial $0.09 support level, the meme coin market is entering a decisive phase. DOGE is currently trading around $0.0935, with analysts warning that a weekly close below $0.09 could open the door to $0.080. For bulls, defending this level is key to confirming the “Launchpad” accumulation thesis.

As DOGE struggles to stabilize, Maxi Doge (MAXI) continues its ongoing presale. The project has already raised over $4.5 million, with the token price currently at $0.0002803.

Maxi Doge leverages pure meme culture but combines it with structured incentives for first-time buyers. Its staking model distributes rewards daily through a pool powered by smart contracts.

The project also organizes community competitions based on ROI and prepares partner events related to future platform integrations and gamified tournaments.

If DOGE manages to regain momentum in this support zone, a rotation of capital into smaller meme assets could follow. Maxi Doge is positioning itself early in this cycle, providing pre-sale exposure while the broader meme industry searches for direction.

Visit Maxi Doge here

following

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article is intended to provide accurate and current information, but should not be considered financial or investment advice. Because market conditions can change quickly, we encourage you to verify the information for yourself and consult a professional before making any decisions based on this content.

Neil is a professional cryptocurrency content writer with years of experience. He has written for various cryptocurrency websites to report on the latest news and has been hired by all kinds of cryptocurrency projects, to create content that would increase their visibility and attract more potential investors.

Neil Mathew on LinkedIn