- DOGE’s trading volume has increased with the price.

- Selling pressure on DOGE has increased in recent days.

Dogecoin (DOGE) has become volatile again over the last 24 hours with its promising price pump. Thanks to the latest rise, the world’s largest memecoin managed to break out of an uptrend.

Will this pave the way for DOGE towards $0.66?

Dogecoin becomes bullish again

Dogecoin bulls have once again taken control of the market, as the price of the world’s largest memecoin surged almost 8% in the past 24 hours.

With the last pump, DOGE was estimated at $0.46 at press time, with a market cap of over $68.4 billion.

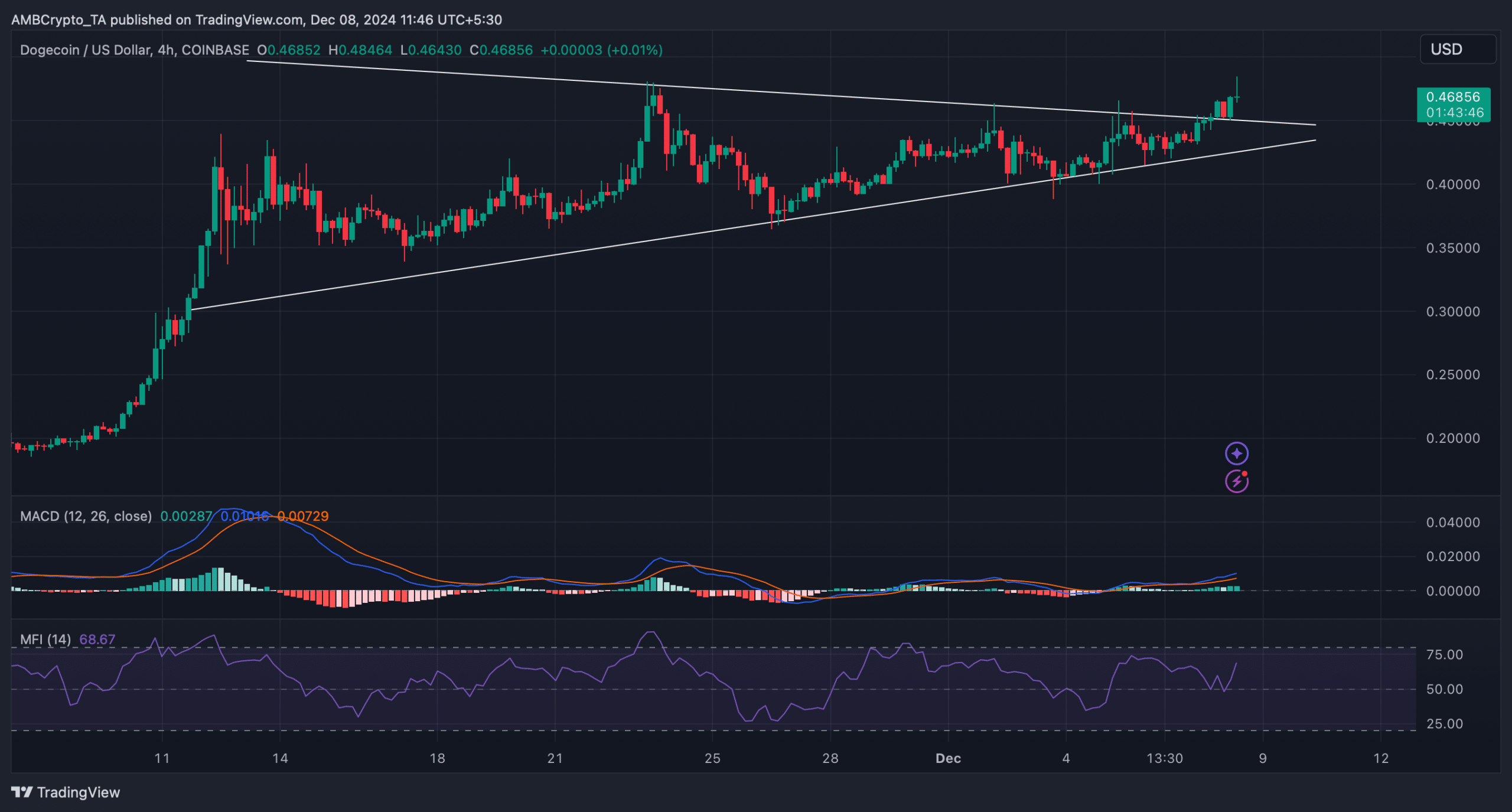

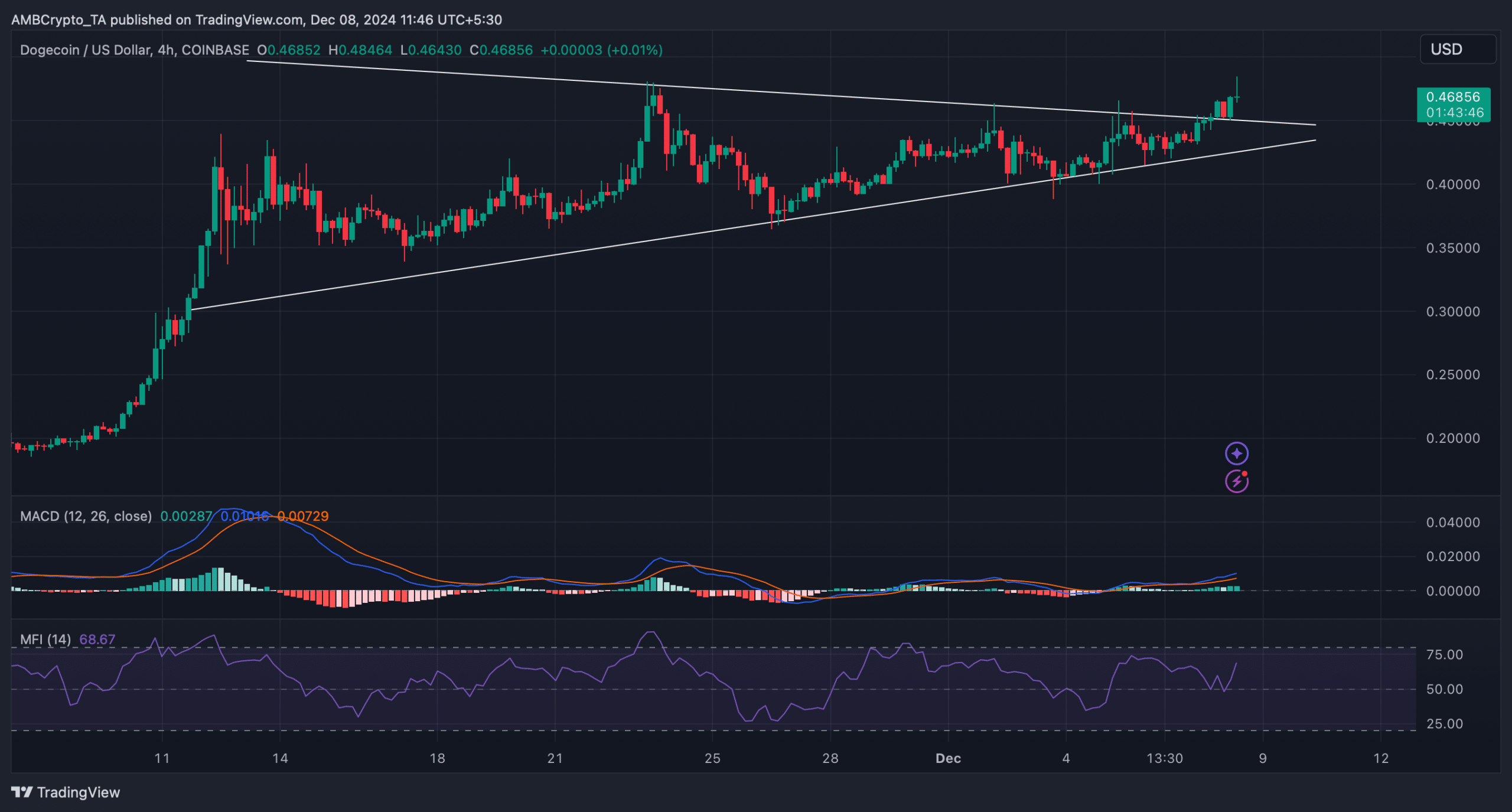

The price rise allowed the coin to break out of a bullish symmetrical triangle pattern. The pattern first appeared in early November and since then, DOGE has been consolidating inside, only to break out on December 7th.

Source: TradingView

Meanwhile, the technical indicator MACD displayed a bullish advantage in the market. DOGE’s Money Flow Index (MFI) also saw an uptick. An increase in the metric indicates that there is strong buying pressure in the market.

This growing buying pressure may push Dogecoin towards its next target: $0.66.

However, such breakouts are often followed by slight corrections, which are usually a retest of support before the start of a bull rally. Therefore, in case DOGE experiences a pullback, investors should not panic.

What metrics suggest

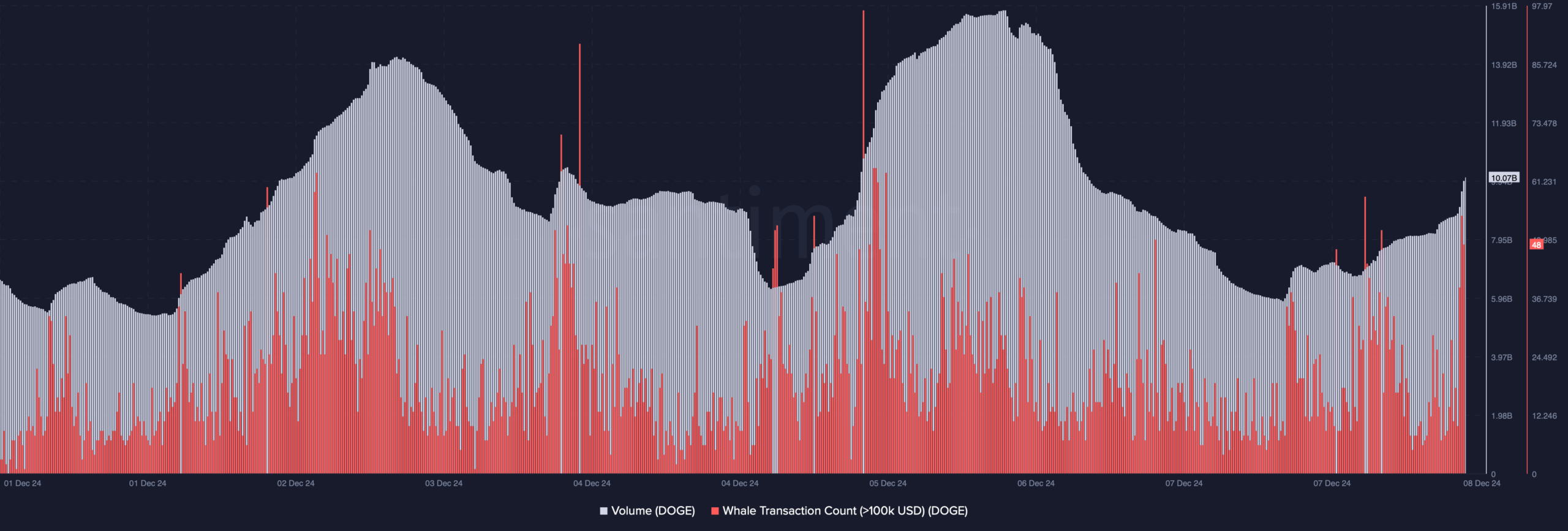

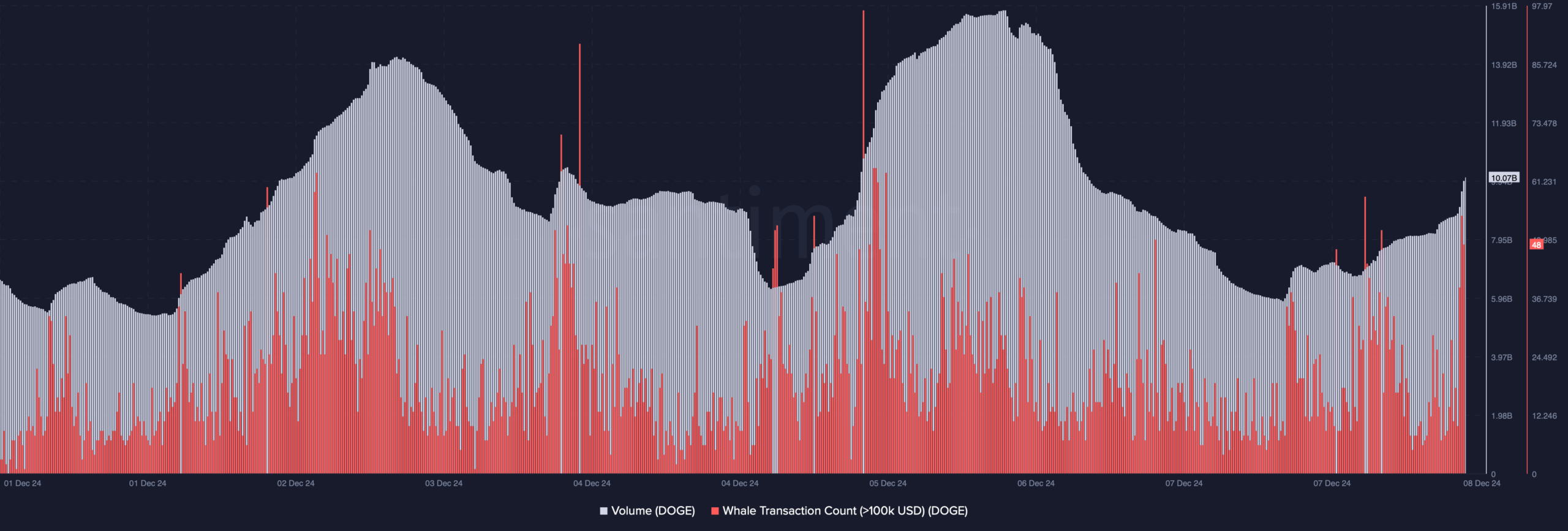

The good news is that even though the price of DOGE increased over the past 24 hours, the trading volume of the memecoin also surged by over 78%, serving as a basis for the bullish rally.

The wealthiest players in the market were also actively trading the coin. This is evident from the increase in the number of Dogecoin whale transactions over the past seven days.

Source: Santiment

Additionally, the memecoin’s Long/Short ratio recorded a slight increase over a 24-hour period.

A rise in the ratio means that there are more long positions in the market than short positions, indicating increasing bullish sentiment in the market.

However, IntoTheBlock data revealed a downward trend. Dogecoin’s net flow ratio has increased in recent days as it reached 4.68% from -2.33%.

This clearly meant that investors were dumping their holdings, causing selling pressure to increase.

Every time the selling pressure increases, it is followed by a price correction, which could cause the price of DOGE to fall and allow it to retest the support of the aforementioned bullish pattern.

Read Dogecoin (DOGE) Price Prediction 2024-2025

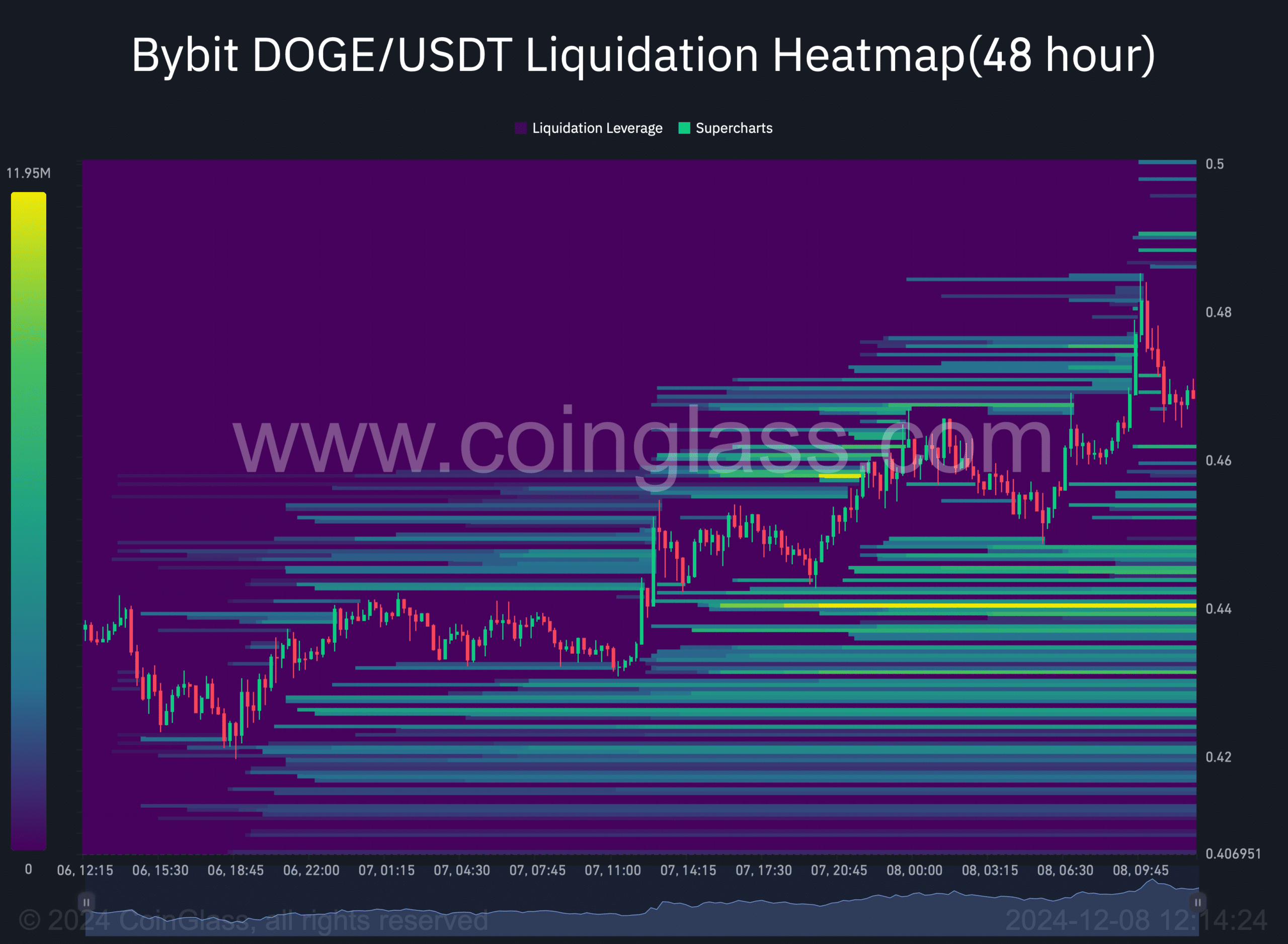

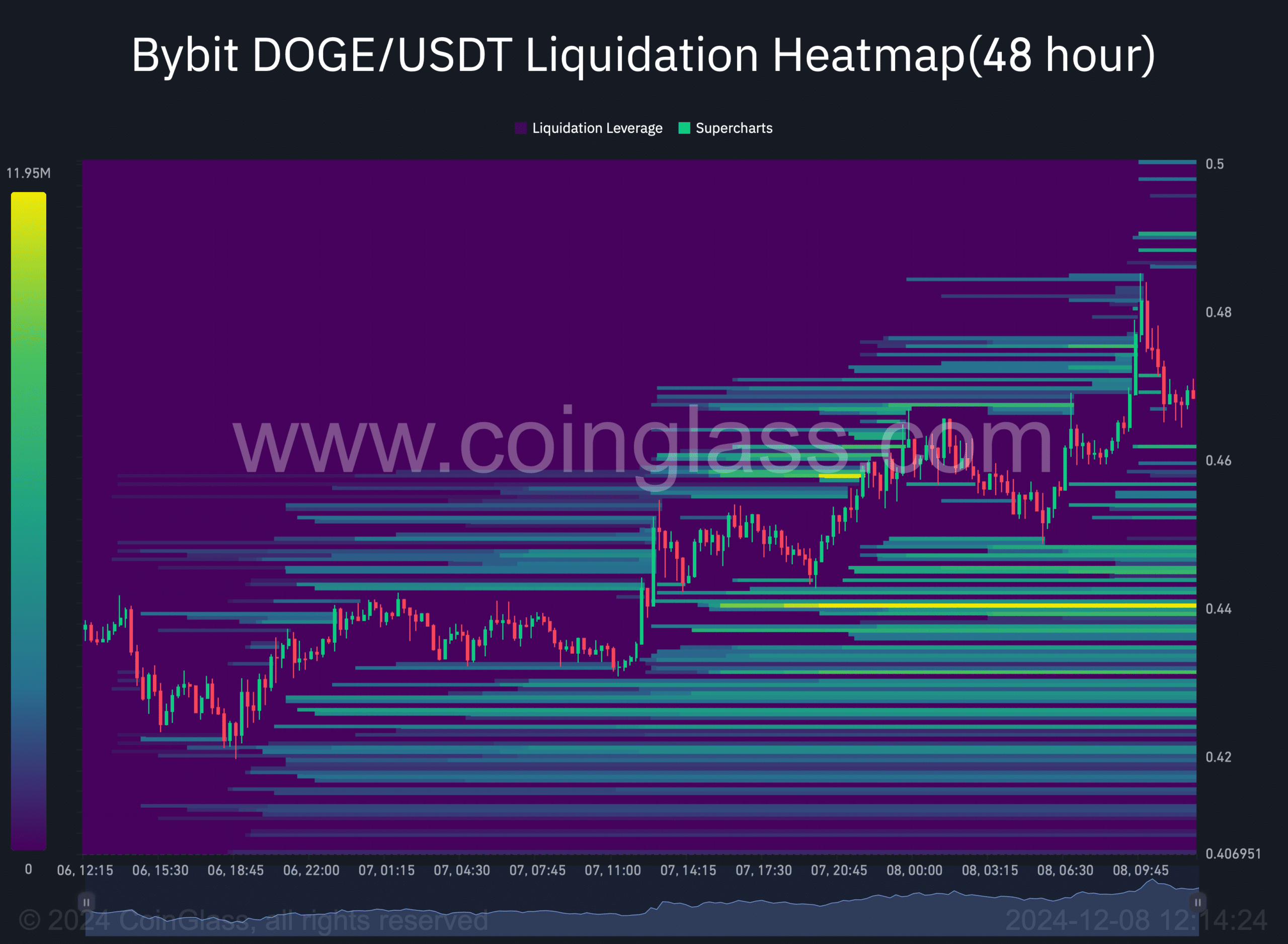

Nonetheless, if the selling pressure does not affect DOGE’s uptrend, then DOGE could first advance towards $0.49 before targeting $0.66 as a slight liquidation barrier lies at this level. .

Source: Coinglass