- The Dogecoin price has had a hard time at $ 0.18, the Whales and the activity of the network can report a break.

- MacD and RSI have shown lower – if Doges does not break by $ 0.29, additional declines are likely.

DOGECOIN (DOGE) recently shown a mixed price action, following a correction that destroyed its earlier earnings.

At the cost of $ 0.1681 At the time of the press, Dogecoin has a negotiation volume 24 hours a day of $ 844 million, reflecting a variation of -0.43% in the last 24 hours, but an increase of 3.24% compared to last week.

Although DADECOIN has recently decreased, there is a cautious optimism that it could return to $ 0.29. This perspective is supported by the main technical levels and market dynamics.

Dogecoin faced several corrections, withdrawing from its recent tops. However, analysts estimate that $ 0.29 can be achievable in the short term.

The prediction depends on the proximity of DOGE to the exponential mobile average of 20 days (EMA), which could act as a level of support for the future price movement.

The merchants closely follow this level for signs of stability, which could indicate a potential rally. However, if Doge fails to disintegrate above the EMA, additional declines could follow.

According to Igor BondarenkoIf Doge is struggling to take momentum at this level, the price can drop as low as $ 0.10, presenting a downward scenario for cryptocurrency.

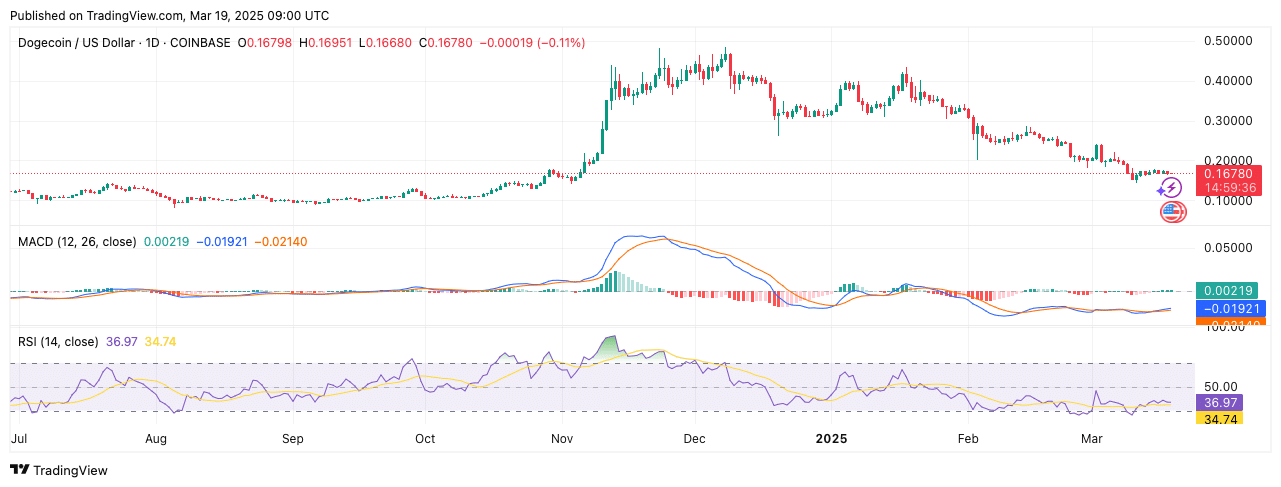

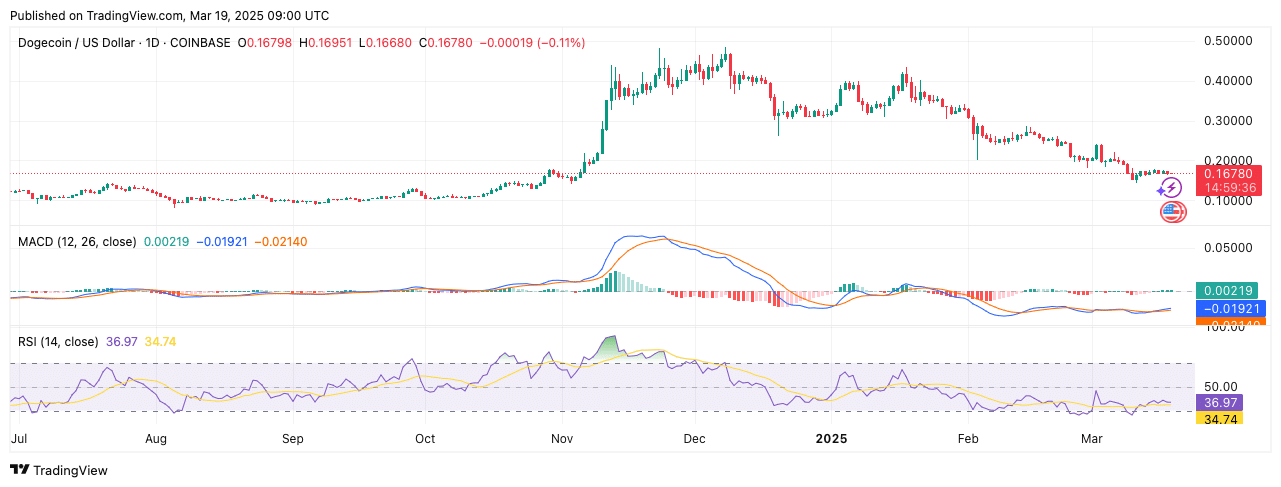

Momentum Lower in MacD and RSI

At the time of writing the editorial staff, the MacD indicator showed a downward trend for Dogecoin. The MacD (blue) line was below the signal line (orange), suggesting a lack of upward dynamics.

In addition, the histogram remains mainly negative, strengthening the dominant weakness on the market.

Source: tradingView

The RSI was 36.97, just below the neutral brand 50. This level suggests that Doge is in the occurrence region, which could indicate an additional sale pressure if it continues to drop below 30.

If the RSI remains less than 40 years, the market could undergo continuous weakness, potentially leading to new corrections.

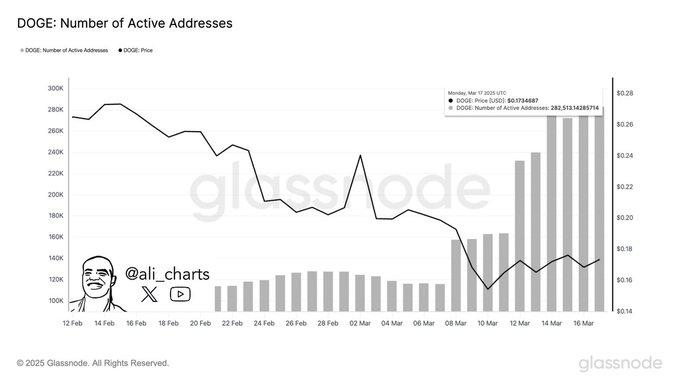

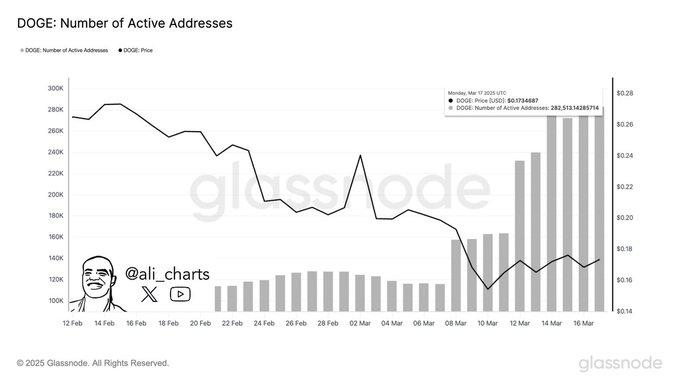

Whale activity and network participation

Despite the lower signals, the Dogecoin network has shown increased activity. According to the Crypto analyst Ali MartinezThere was a significant increase in active addresses, from 150,000 on March 12 to more than 280,000 in March.

Source: X

The peak of activity coincided with an increase in prices from $ 0.16 to $ 0.26, which suggests that a higher participation in the network has resulted in demand.

However, the price was then recovered, indicating that the initial enthusiasm decreased.

In addition, large transactions have increased while whales bought more than 110 million Doge in one week. This influx of major players supported a short -term upward trend, but also suggested that some purchase pressure was temporary.

The recovery of subsequent prices suggests that taking profits or market corrections may have influenced the slowdown.

Source: X

Resistance and support levels

While Dogecoin moves through this phase of uncertainty, the levels of resistance of the keys and support are crucial. The price reached $ 0.202 on March 6, which remains a high level of resistance.

A break above this level could point out a continuation of the tendencyBut not to do so can cause consolidation or additional drop.

Upon down, $ 0.18 has become a critical level of support for Dogecoin. If the price breaks below this level, it could suggest a lower lower market change and cause new downward pressure.

Finally, while the market remains volatile, the next few days will be crucial to determining the next major Dogecoin movement.