Key notes

- Dogecoin price rebounds 3% to $0.20 on Sunday, October 19, after Elon Musk’s X announced a new market for unused usernames.

- Traders speculate on Dogecoin integration into XHandles payments as open interest rises 10.62%.

- Short traders still dominate derivatives markets despite prices rallying over the weekend.

Dogecoin price rebounded 5% to $0.20 on Sunday, October 19, boosted by Elon Musk’s X, launching a new market for unused usernames.

Dogecoin price closed its second consecutive week of loss at $0.18, losing 35% from its local high of $0.27 recorded on October 6. Dogecoin’s sensitivity to market sentiment has reared its head this month, with macroeconomic headwinds and major market selloffs contributing to its disappointing performance over the past two weeks.

Dogecoin Price Rises as Elon Musk’s X Market Sparks Integration Speculation

The launch of the XHandles marketplace has renewed speculation about a Dogecoin integration for payments on the Musk-led platform.

According to X’s official statement, X Handle Marketplace is configured to redistribute handles that are no longer in use. Eligible subscribers will be able to search, request and purchase unused credentials.

The handles are coming…

Join the waiting list at pic.twitter.com/XOa9b2lfkN

– Manage Market (@XHandles) October 19, 2025

XHandles has launched an official website, allowing potential users to sign up for a waitlist ahead of the full rollout.

Elon Musk’s affiliation with Dogecoin has been well documented over the years, reinforced when US President Trump appointed him to head DOGE, the agency of the Department of Government, a financial watchdog, in January 2025.

Having left office in May, Musk remains active in the Dogecoin community.

Dogecoin short traders remain resilient despite recovery bets

Although Dogecoin’s connection to XHandles remains unconfirmed, derivatives traders appear divided on DOGE’s near-term direction.

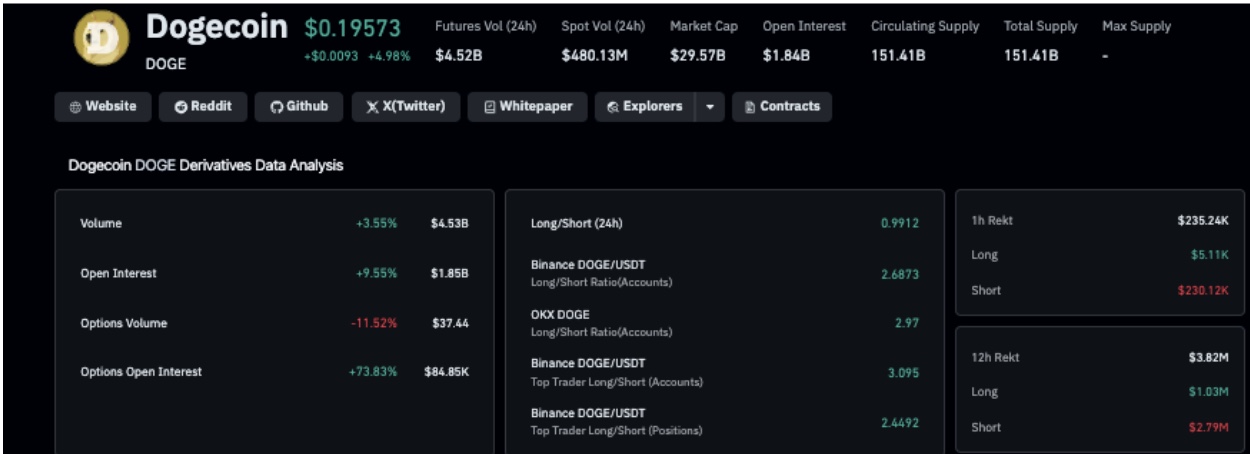

Data from Coinglass shows that Dogecoin open interest increased by 10.62% on the day, reaching $1.9 billion at the time of writing, supported by a 6.19% increase in trading volumes to $4.6 billion.

Dogecoin derivatives market data as of October 19, 2025 | Source: Coinglass

Of the total $4.7 million in liquidations over the past 24 hours, short traders accounted for 70% of intraday losses, or about $3.3 million, compared to $1.4 million for long positions.

Dogecoin’s long/short ratio sits at 0.99, indicating that bearish traders have not yet fully retreated. This suggests that even as bulls embrace the rally, short sellers continue to cover their positions, expecting the rebound to be short-lived.

Speculation about Dogecoin potentially integrating into the XHandles marketplace could fuel more bullish bets, as seen in August 2023, when X obtained payment issuer licenses in several US states.

As the U.S. government shutdown weighs on financial markets, derivatives market data shows traders expect greater Dogecoin price volatility in the coming week.

Dogecoin Price Forecast: Can bulls defend the $0.18 support zone?

After corrections of 34.6% from its monthly peak, Dogecoin rebounded 11.9% over the weekend from Friday’s lows. DOGE is currently trading near the middle Bollinger band ($0.19 to $0.20), reflecting prices returning to neutral territory, recovering from the aftershocks of the $1.2 billion crypto market liquidations on Friday.

The RSI (14) stands at 40.77. At the same time, the average RSI line at 42.19 suggests slight bullish momentum but is still below the neutral mark of 50, implying that Dogecoin remains in recovery mode rather than a confirmed bullish reversal.

Volume stabilized around 154.3 million DOGE, reflecting moderate but steady demand following the capitulation seen in mid-October. A break above the $0.22 level (median resistance) could confirm the bullish continuation towards $0.26-$0.28, aligning with the upper Bollinger band.

Conversely, failure to hold $0.18 support would once again expose DOGE to lower band targets near $0.16.

If momentum builds and Musk’s X Market offers credible integration of Dogecoin payments, it could potentially spark a longer-term rally towards the psychological $1 mark.

following

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article is intended to provide accurate and current information, but should not be considered financial or investment advice. Because market conditions can change quickly, we encourage you to verify the information for yourself and consult a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with experience supporting various Web3 startups and financial organizations. He completed his undergraduate degree in Economics and is currently studying for a Master’s degree in Blockchain and Distributed Ledger technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn