- dogwifhat could make serious gains if it breaks through a nearby resistance zone.

- The high volume of purchases was an encouraging sign.

dogwifhat (WIF) is up 37% since Monday, September 23, at the time of writing. The meme coin also saw a breakout beyond the formation of the seven-week range that peaked at $1.98.

Since this is the first WIF cycle, a long-term uptrend and Dogecoin (DOGE)-like run in 2021 cannot be ruled out. Here’s what investors and swing traders should keep in mind.

Fibonacci retracement levels could push back bulls

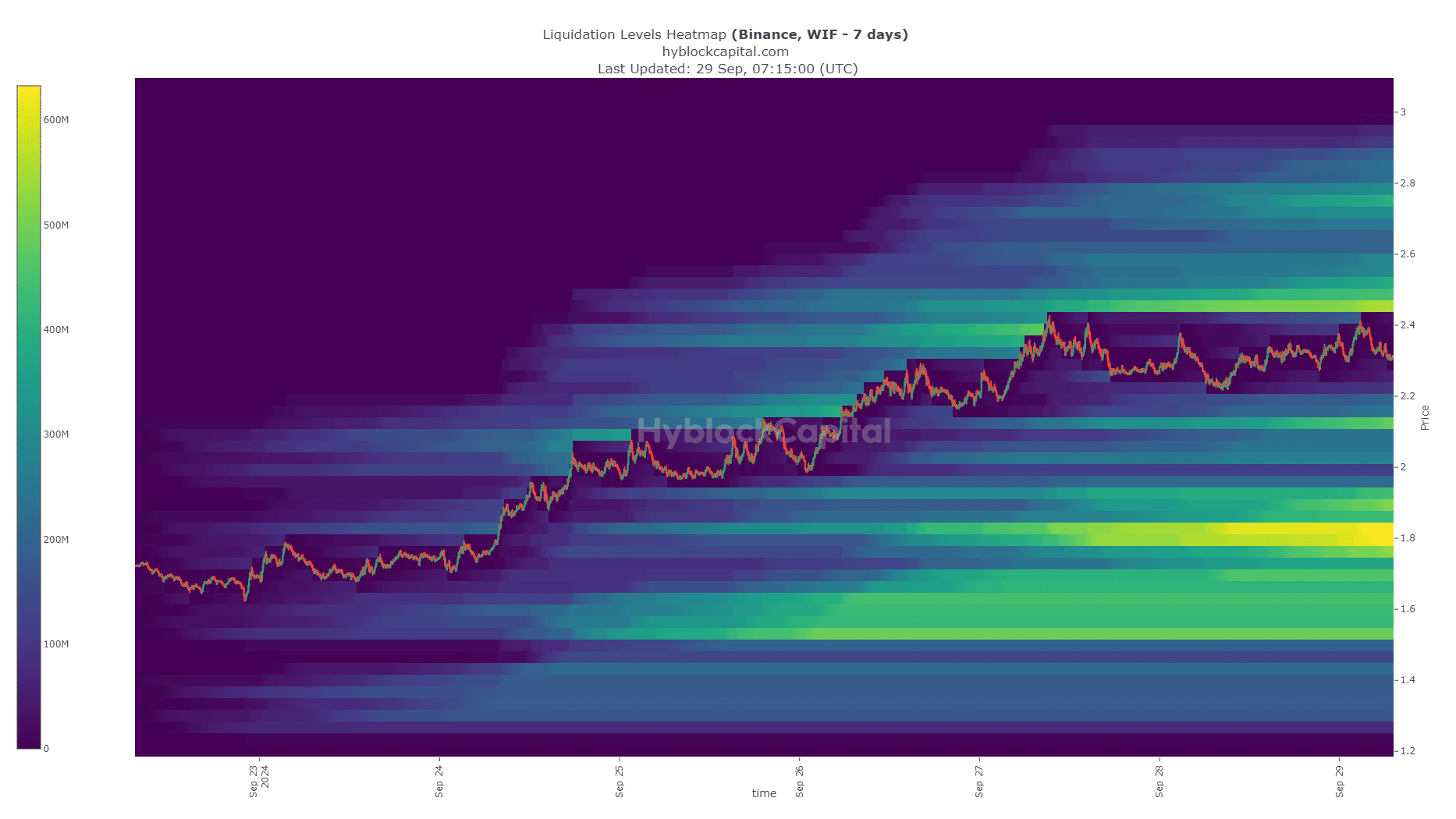

Source: WIF/USDT on TradingView

The daily market structure was firmly bullish and the OBV showed that buying pressure was intense. The movement of the volume indicator above the August and July highs was a sign that this breakout could exceed the $2.9 level.

A set of Fibonacci retracement levels have been plotted based on the downward impulse movement from the second half of July. The 78.6% retracement level was at $2.5, a level that served as support and became resistance in July.

A daily session closed above this level would be the decisive event for the bulls in this uptrend. A rejection does not seem likely, but a Bitcoin (BTC) retracement could also force WIF to pull back.

The $2.5 zone is crucial in the short term

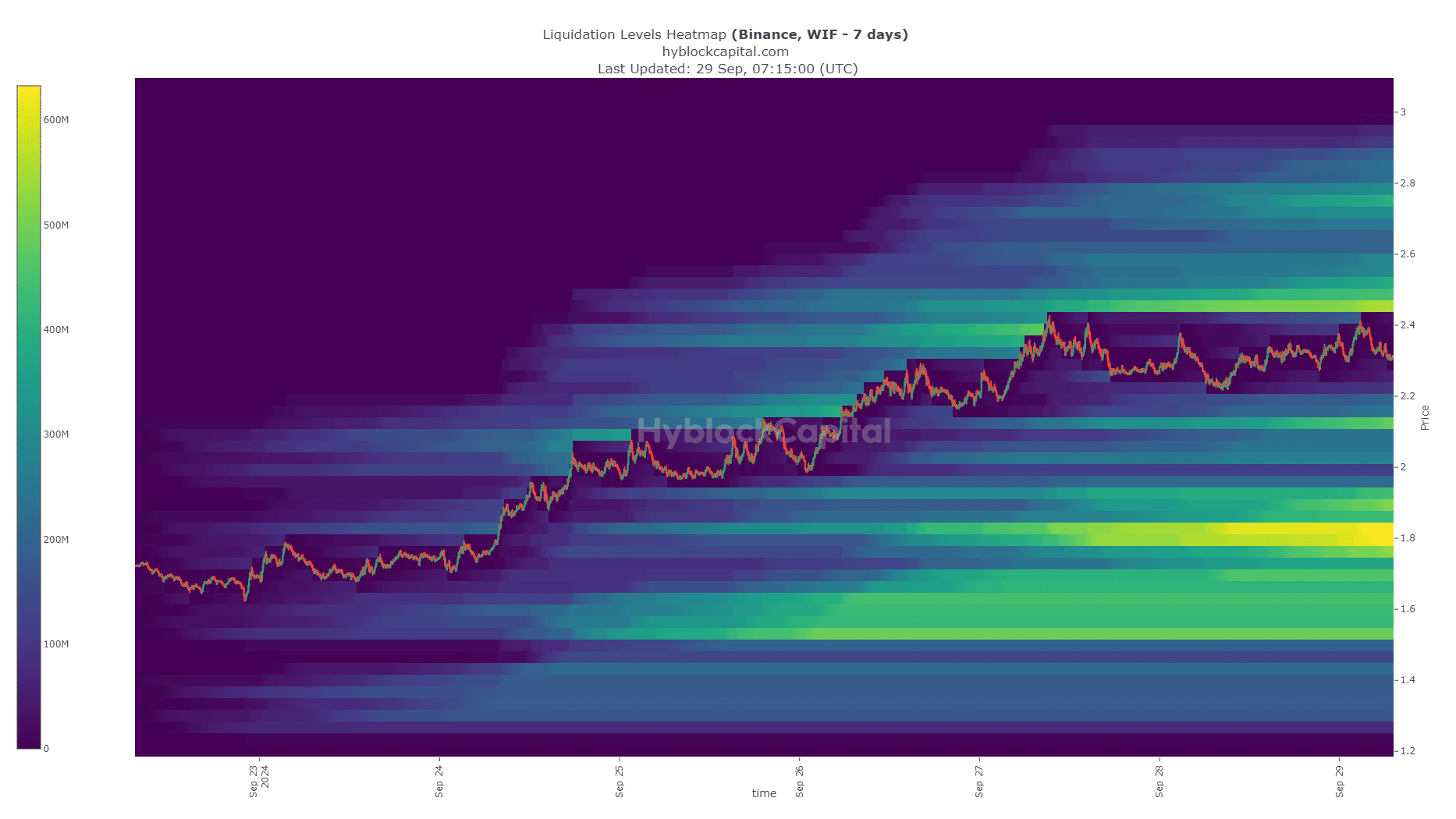

Source: Hyblock

Last week’s liquidation heatmap data outlined the $2.45-$2.5 and $1.8-$1.9 regions as the most near-term resistance and support areas. important. Liquidity at $2.12 was also notable.

Realistic or not, here is the market capitalization of WIF in terms of BTC

These magnetic zones could be visited before the price starts moving in the opposite direction. The Fibonacci levels and liquidity pocket around $2.5 have made this the main resistance zone for dogwifhat bulls to overcome.

Disclaimer: The information presented does not constitute financial, investment, business or other advice and represents the opinion of the author only.