President-elect Donald Trump’s crypto project World Liberty Financial (WLFI) is loading up on decentralized finance (DeFi) altcoins, according to on-chain data.

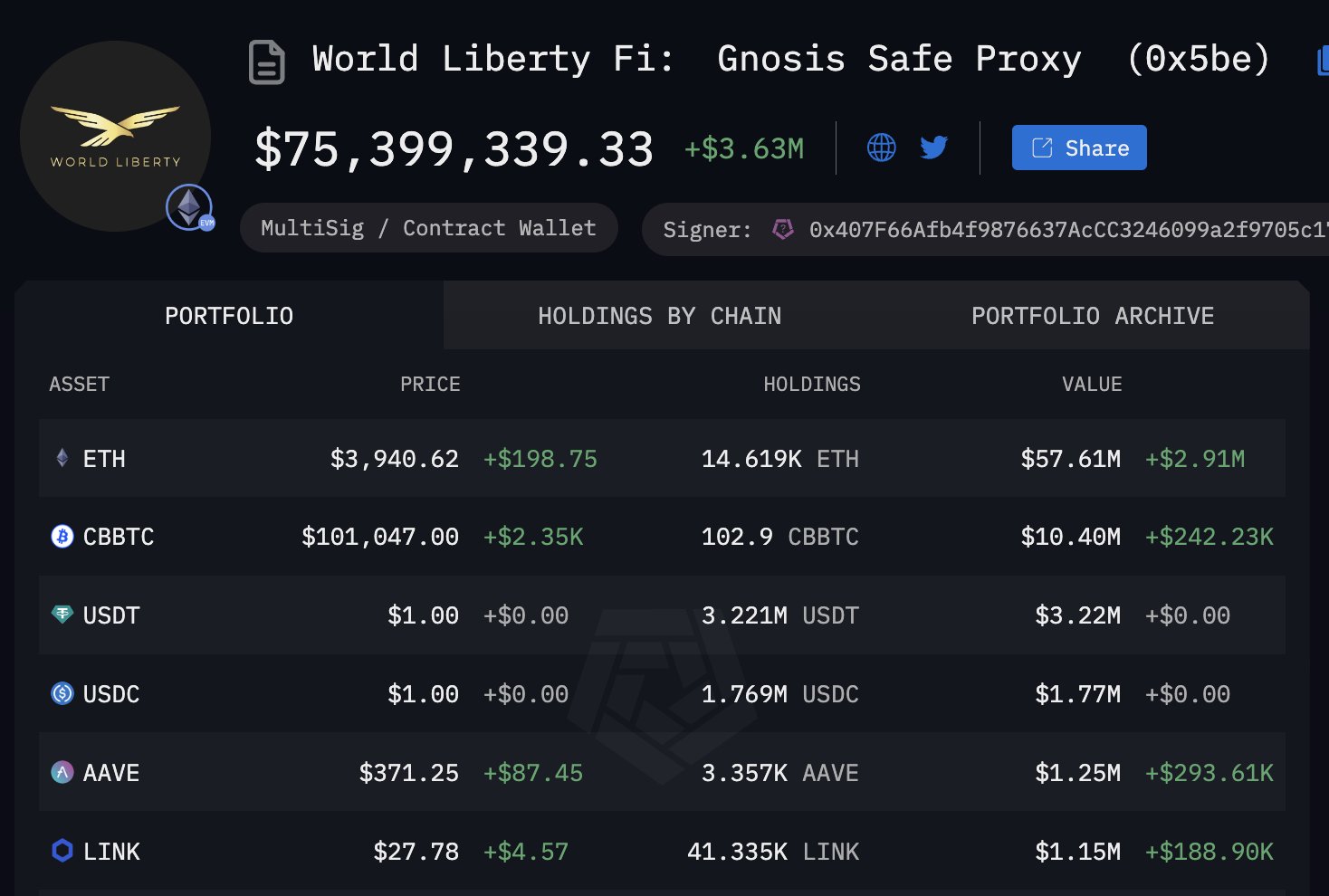

Blockchain intelligence platform Arkham reports that WLFI Treasury has acquired $50 million worth of different DeFi coins in preparation for its launch.

“UPDATE: DONALD TRUMP’S WORLD LIBERTY FI ACQUIRED $50 MILLION IN CHALLENGE COINS

The Treasury of World Liberty Finance has just acquired:

$35 million worth of ETH/WETH

$10 million worth of cbBTC

$1 million worth of LINK

$1 million from AAVE

Is Trump long DeFi?

WLFI launched its token sale in October.

The plan originally anticipated that 63% of all WLFIs would be sold to the public, but according to its current white paper – or “goldbook” – World Liberty Financial appears to have lowered that figure to 35%.

While World Liberty Financial has not yet launched publicly, it is still not 100% clear what services the platform will provide.

World Liberty Financial claims it is “the only DeFi platform inspired by Donald J. Trump” and aims to lead a “financial revolution by dismantling the hold of traditional financial institutions and putting power back where it belongs: in your hands.”

Data from Ethereum blockchain explorer Etherscan shows that the TRON DAO received 2 billion tokens through its investment in WLFI, making Tron (TRX) founder Justin Sun and the DAO the largest holders.

With this purchase, Sun also became an advisor to the project.

Don’t miss a thing – Subscribe to receive email alerts straight to your inbox

Check Price Action

Follow us on XFacebook and Telegram

Surf the daily Hodl mix

& nbsp

Disclaimer: Opinions expressed on The Daily Hodl do not constitute investment advice. Investors should conduct due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and transactions are at your own risk and any losses you may incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: halfway