According to a report from Elliptic, crypto exchanges with operational or financial ties to Russia continue to contribute to the evasion of international sanctions.

Summary

- Elliptic claims some exchanges are helping Russia circumvent sanctions via crypto.

- Wallet turnover and P2P ruble exchanges obscure sanctioned flows.

- Shared custody connects the global Exmo and Russian platforms.

The platforms provide transaction routes for Russian entities to make cross-border payments free from traditional banking oversight through ruble-to-crypto conversions.

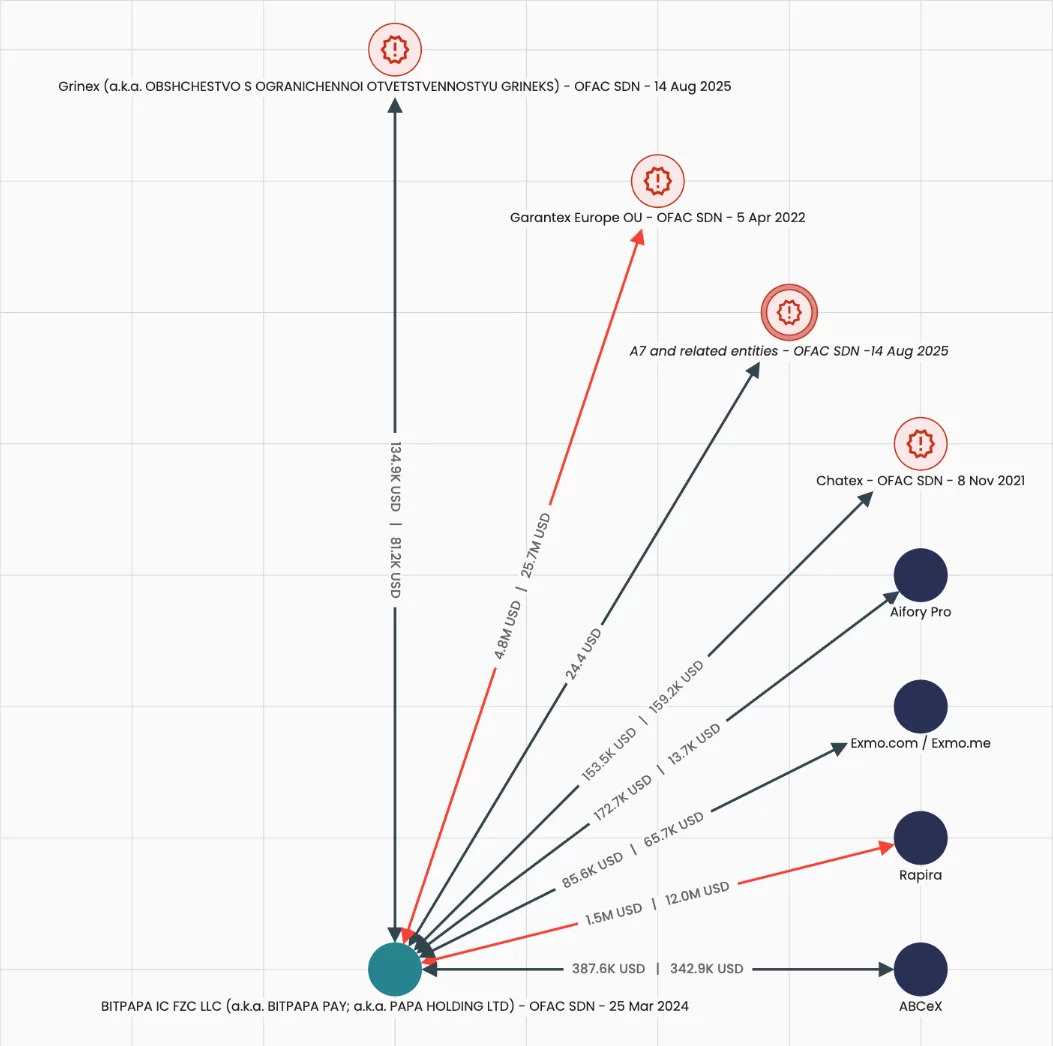

Bitpapa, sanctioned by the U.S. Office of Foreign Assets Control in March 2024, sends approximately 9.7% of outgoing crypto funds to OFAC-sanctioned targets, including 5% to the sanctioned exchange Garantex.

ABCeX processed at least $11 billion in crypto from its office in Moscow’s Federation Tower, previously occupied by Garantex.

Exmo claims to have exited the Russian market but continues to share custodial wallet infrastructure between its Western- and Russia-facing platforms. They conduct over $19.5 million in direct transactions with sanctioned entities.

Bitpapa and ABCeX use crypto wallet rotation to evade tracking

Bitpapa, a peer-to-peer exchange with companies registered in the United Arab Emirates, primarily targets Russian users, allowing rubles to be exchanged for cryptocurrencies.

Blockchain analysis shows that the platform manages wallets to evade sanctions by constantly rotating addresses.

This prevents transaction monitoring systems from identifying Bitpapa as a counterparty and hiding the origin of Russian funds.

ABCeX manages both order book and P2P ruble-to-crypto trading from the Federation Tower in Moscow.

The exchange uses wallet hiding strategies to prevent crypto transactions from being linked to the service. ABCeX sent sums to Garantex and Aifory Pro, which specializes in cash-to-crypto services.

Fiat currencies, including rubles, are converted to crypto through these services before being transferred across borders without going through intermediaries.

The assets can then be converted into local currency through foreign crypto brokers or exchanges. Many exchanges maintain nominal registrations outside of Russia while contributing to high trading volumes linked to sanctioned entities.

Exmo shares wallet infrastructure between separate platforms

Exmo claimed to exit the Russian market after the invasion of Ukraine in 2022 by selling its regional operations to Exmo.me.

Blockchain analysis contradicts this geographic operational separation, showing that Exmo.com and Exmo.me continue to share identical custodial wallet infrastructure.

Cryptocurrencies deposited to either platform are grouped into the same hot wallet addresses, while withdrawals for both platforms are issued from matching addresses.

The shared infrastructure shows no real operational separation and allows funds from the Russia-facing platform to mix with those from the Western-facing entity. Exmo has carried out transactions with Garantex, Grinex and Chatex.

Rapira, an exchange incorporated in Georgia with an office in Moscow, participates in ruble trading and has engaged in direct crypto transactions with Grinex totaling over $72 million.

Moscow authorities reportedly raided Rapira’s offices as part of an investigation into capital flight to Dubai.

Aifory Pro operates in Moscow, Dubai and Turkey, serving as a “payment agent for foreign economic activities” for international trade between Russia and China.