Tether’s flagship stablecoin, USDT, is facing renewed scrutiny in the European Union as the landmark Markets in Crypto-Asset (MiCA) regulation prepares to enter its implementation phase completes on December 30, 2024.

While Coinbase has already delisted USDT in anticipation of MiCA, other leading exchanges such as Binance and Crypto.com continue to trade the stablecoin while awaiting clarification from regulators. Amid growing speculation on social media about Tether’s future in Europe, questions remain about USDT’s compliance with stricter EU rules and its potential impact on crypto liquidity.

Proactive delisting from Coinbase

The first major sign of trouble for USDT in Europe came earlier this month when Coinbase, a leading US-based exchange, delisted Tether for its EU customers. The company cited compliance concerns in light of upcoming MiCA requirements. Coinbase’s decision sparked intense debate within the crypto community, with some market participants applauding the precautionary approach, while others argued that Tether’s fate should depend on explicit guidance from European regulators.

Despite Coinbase’s decision, no official EU body has officially deemed USDT non-compliant. MiCA imposes rigorous standards on stablecoin issuers, requiring electronic money licenses, independent reserves with recognized banks and detailed disclosure obligations. However, the European Securities and Markets Authority (ESMA) has not yet confirmed whether or not Tether meets these criteria.

Exchanges in “wait and see” mode

While Coinbase took immediate action, other major exchanges took a more cautious approach. Binance and Crypto.com continue to list USDT for EU customers, and many appear to be waiting for explicit guidance from European regulators before deciding whether or not to follow Coinbase’s lead. Some analysts suggest that these platforms could opt for a gradual delisting – if necessary – to minimize market disruption.

MiCA Crypto Alliance technical committee member Juan Ignacio Ibañez notes that “no regulator has explicitly stated that USDT is non-compliant, but that does not mean it is.” It also says that differing responses from exchanges – some quickly delisting, others waiting for definitive statements – could create confusion in the short term. Bloomberg reported that many European exchanges will likely delist Tether by December 30. However, no official timetable has been confirmed by ESMA or any other EU supervisory authority.

Implications for Market Liquidity and Stability

Tether (USDT) is the largest stablecoin by market capitalization, having long served as a liquidity base on digital asset exchanges. Its removal from major European trading venues could significantly affect cross-border transactions, arbitrage opportunities and overall market depth. Many crypto traders rely on USDT pairs to make convenient and quick moves between cryptocurrencies and fiat-like assets, especially during times of high volatility.

Market watchers warn that if USDT disappears from EU exchanges, European traders could turn to alternatives such as Circle’s USDC, which already has an e-money license in the EU, or stable coins backed by the euro. However, this transition could introduce new frictions, such as additional trading fees, fewer trading pairs, or less liquidity. Pascal St-Jean, CEO of crypto asset manager 3iQ Corp., highlighted Tether’s centrality by noting that “a large portion of crypto assets trade in pairs against Tether’s USDT.”

Regulatory obstacles and transition phases

Under MiCA, stablecoin issuers are required to obtain licenses and maintain transparent reserves. The implementation phase of the regulation officially ends on December 30, 2024, but the legislation also provides for an 18-month “grandfathering” period that may extend compliance deadlines to mid-2026 for certain entities. During this transition period, providers already operating under the national laws of EU member states can continue their services while working to obtain full authorization.

ESMA has published a list of how different EU jurisdictions plan to apply these transitional measures, with some allowing up to 18 months of “grandfathering” and others allowing shorter periods of six to 12 months. This patchwork of transition periods could lead to inconsistent approaches among member states, further complicating the stablecoin landscape.

Social media speculation and corporate response

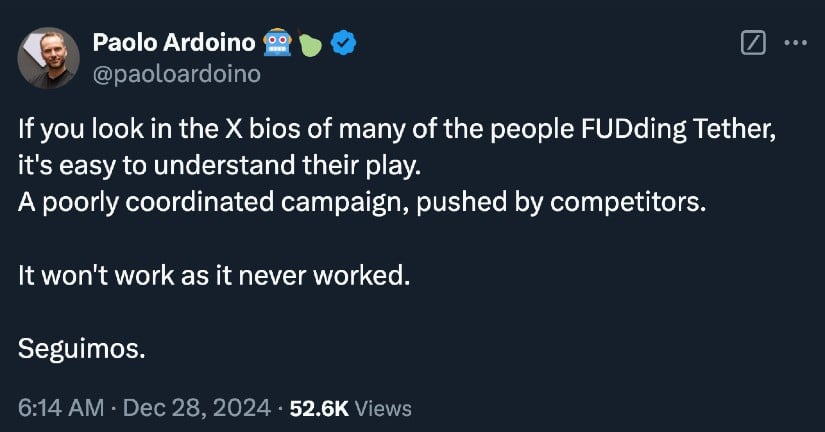

Amid regulatory uncertainty, rumors have been circulating on crypto forums and social media regarding Tether’s immediate removal from EU platforms. A tweet from an influencer, “@RippleXrpie,” claimed that “$USDT will be delisted from EU exchanges” on December 30, predicting that another stablecoin would fill the void. Although such comments have fueled fear, uncertainty and doubt (FUD), no formal pan-European delisting mandate has been announced.

Paolo Ardoino, CEO of Tether, has repeatedly dismissed the speculation as a “poorly coordinated effort” by competitors and critics. The company emphasizes its belief that Tether’s reserves are secure and that it is making great strides toward regulatory compliance worldwide. However, Tether has not yet obtained the official license required by MiCA for stablecoin issuers, unlike its rival Circle, which has been MiCA compliant since mid-2024.

Source: X

Looking back and debating “too big to fail”

Tether has long been a lightning rod for criticism regarding the transparency of its reserves, with some questioning the rigor of its attestations. In previous years, the company faced lawsuits and fines from various authorities, but nevertheless continued to expand globally. With a market value once estimated at over $138 billion, some market analysts say Tether has reached “too big to fail” status in the broader crypto ecosystem.

Critics counter that no stablecoin is safe from future restrictions if it fails to meet emerging regulatory standards, pointing to the EU’s strong legal framework as evidence that tighter oversight is inevitable. Others believe that Tether’s historic resilience could help it overcome its current obstacles, including investing in European companies, such as Quantoz and StablR, to strengthen its presence on the continent.