Ethereum pushes above the level of $ 3,800, showing a level of force not seen since the beginning of 2024. The second largest cryptocurrency by market capitalization has now won more than 50% since the end of June without a single significant retire, indicating that the bulls control firmly. The current rally was supported by an increasing dynamic, an increase in institutional demand and increasing clarity on the regulatory front – contributing to a renewed confidence of investors.

This last decision puts Ethereum at a striking distance from the psychological resistance of $ 4,000, many analysts providing for that a break could occur in the coming days. The metrics and the structure of the market on the chain continue to show signs of strength, because ETH keeps comfortably above key mobile averages and previous levels of resistance now overturned in support.

If the upward trend continues, a push above $ 4,000 could open the door to new heights of several months and potentially trigger the next major step. All eyes are now on ETH’s ability to support the momentum and challenge resistance levels as the bullish feeling spreads.

ETF Flows Fuel Ethereum Rally, but caution is lingering

The best Ted Oilers analysts shared key data revealing that Ethereum’s Etf entries jumped by $ 2,182,400,000 last week – a strong sign that institutional appetite for ETH is accelerating. The pillows suggest that Ethereum Fomo is just beginning, because traditional investors now consider assets as an investable vehicle thanks to the recent regulatory clarity in the United States. Legal frameworks becoming more defined, Ethereum benefits from its position as the main intelligent contract platform in a maturation cryptography ecosystem.

The entries reflect renewed confidence in the long -term value of Ethereum, especially since its fundamentals remain strong and that institutional demand continues to develop. This capital of capital has helped Eth recover the level of $ 3,800 and maintain a powerful upward trend that started at the end of June. However, some analysts remain cautious. Although the trend clearly promotes bulls, the market has not yet seen a healthy rescue correction to reset the momentum and establish a firmer base for more increase.

While Ethereum addresses the critical resistance of $ 4,000 for the first time since December, the price action in the coming weeks will be decisive. The bulls are now focusing on the break above this level to confirm the continuation, but the short-term consolidation potential remains on the table. The momentum is strong, but a short recharging time could strengthen the bases of the next movement.

The weekly graph ETH shows a massive force

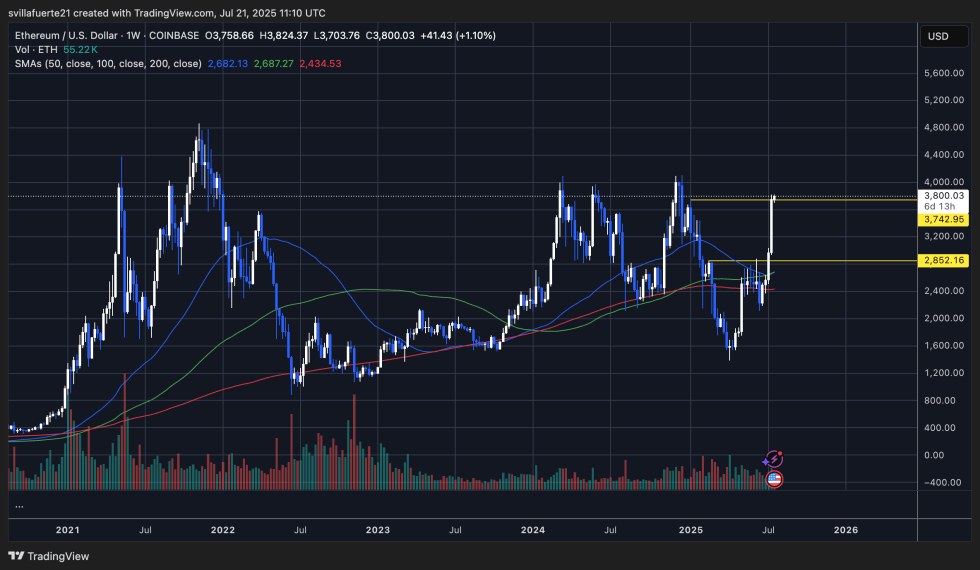

The weekly graphic of Ethereum confirms a powerful break, ETH is currently trading about $ 3,800 – a level that has not been seen since the start of 2024. The wave occurs after a clean recovery of support of $ 2852 and a rapid push above the resistance zone of $ 3742 for a long time. This decision, supported by an increase in volume and a strong inclined in price action, reflects a strong bullish dynamic. More importantly, Ethereum is now negotiated well above the moving averages of 50, 100 and 200 weeks, which gather nearly $ 2,400 to $ 2,700. This long -term MAS alignment under price offers a solid base for more increase.

The structure now reflects the first phases of the previous bull cycles of Ethereum. If the bulls can maintain control and push decisively above $ 4,000 in the coming days, ETH can enter a price discovery phase, potentially targeting new heights of all time later this year. However, this level has proven to be a major resistance in the past, as shown by the beginning of 2022 and the end of 2023, so the rejection is still on the table.

That said, the net rally without a major retirement since June increases the probability of a short -term consolidation or correction. However, the global trend is optimistic and the momentum remains clearly in favor of Ethereum.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.