Ethereum price today: $ 1,510

- Short -term Ethereum holders led the recent sales activity, carrying out more than $ 500 million on Monday.

- The increase in DEFI liquidations could accelerate the decline of the ETH and potentially trigger more liquidations.

- ETH could decrease to $ 1,000 if it strikes the lower limit of a downhill channel.

Ethereum (ETH) has undergone an accident of more than 27% in the last 48 hours, briefly switching to a two -year $ 1,410 before recovering the level of $ 1,500 on Monday. The decline, according to Correglass data, sparked $ 257.87 million in liquidations on the ETH derivative market during the period.

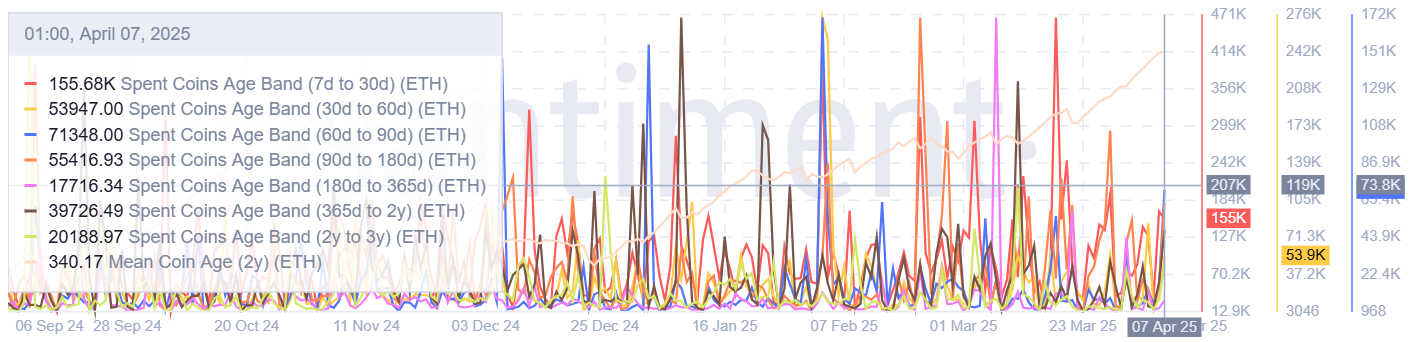

Channel data also shows that most investors are capitulating, sending losses made beyond $ 500 million, according to Santiment. The most recent sales activity stems from the parts purchased in the last month, highlighting the high reaction of short -term holders to downward price movements.

In addition, the coins aged 1 to 2 years join the sale but at a modest pace. An increase in the sale pressure of this cohort could trigger an prolonged drop in the ETH, because most of the DIP purchase activities have largely sank into the addresses linked to these.

ETH has passed pieces of age. Source: Santiment

ETH risks downward pressure if the defecting liquidations continue

The increase in liquidations between the protocols DEFI has partially accelerated the decline of the ETH.

Sky, formerly manufacturer, liquidated the warranty of a whale of 53,074 ETH worth $ 74 million at the time, according to Lookonchain data.

Sky allows users to create and borrow Dai Stablecoin using ETH as a guarantee. The liquid protocol automatically the borrower positions when the value of their warranty decreases below a certain threshold.

Another whale with a warranty of 220,000 ETH added 10K ETH and 3.52 m DAI to reduce its liquidation price to $ 1,119. The whale may lose all its guarantees if the ETH dives below $ 1,119.

Similar liquidations are visible in the AAVE loan platform, where the protocol recorded more than $ 162 million in liquidated guarantees on Monday, according to the dashboard @Kartod Dunes.

Price forecasts Ethereum: Eth Eyes $ 1,000 in the middle of an increased lower pressure

Ethereum is struggling with the level of support close to $ 1,522 after seeing a quick rebound on the lower limit of a downhill channel which extends until December. The upper Altcoin could undergo a new drop in support close to $ 1,000 if it strikes the lower border of the canal.

Daily ETH / USDT table

Uplining, ETH could see a rejection near the resistance of $ 1,800, which is reinforced by a key tendency line.

The histogram bars of the Mobile Average Convergence Divergence (MacD) are lower than their neutral level, while the relative resistance index (RSI) is in the occurrence region. This indicates a dominant downward momentum but with a reversal potential.

FAQ Ethereum

Ethereum is an open source blockchain decentralized with smart contract features. Its native currency ether (ETH) is the second largest cryptocurrency and the number one in market capitalization. The Ethereum network is adapted to the construction of cryptographic solutions such as decentralized finance (DEFI), game, non -buttons (NFT), decentralized autonomous organizations (DAO), etc.

Ethereum is a public technology of decentralized blockchain, where developers can create and deploy applications that work without the need for central authority. To facilitate this, the network uses the Solidity programming language and the Ethereum virtual machine which helps developers create and launch applications with intelligent contract functionalities.

Intelligent contracts are publicly verifiable codes which automate agreements between two or more parties. Basically, these self-executed codes of coded actions when predetermined conditions are met.

The implementation is a process of yielding your inactive cryptographic assets by locking them in a cryptographic protocol for a specified period as a means of contributing to its safety. Ethereum went from a proof consensus mechanism (POW) to a consensus mechanism for proof of appearance on September 15, 2022, in an event called “Fusion”. Fusion was a key element in the Ethereum roadmap to achieve scalability, decentralization and high -level security while remaining durable. Unlike POW, which requires the use of expensive equipment, the POS reduces the entrance barrier for validators by taking advantage of the use of cryptographic tokens as a fundamental basis of its consensual process.

Gas is the unit of measurement of the transaction costs that users pay for the realization of transactions on Ethereum. During the network congestion periods, gas can be extremely high, which means that validators prioritize transactions according to their costs.