The Ethereum rally this month was clear, but merchants are warned to look close in September.

Related reading

Ether has climbed approximately 20% since the beginning of August, trading at $ 4,745 at the time of publication. Prices even pierced $ 4,80 after remarks with the president of the American federal reserve Jerome Powell at the Jackson Hole symposium, a decision that many crypto consider as a possible spark for more gains.

September historical pollbacks

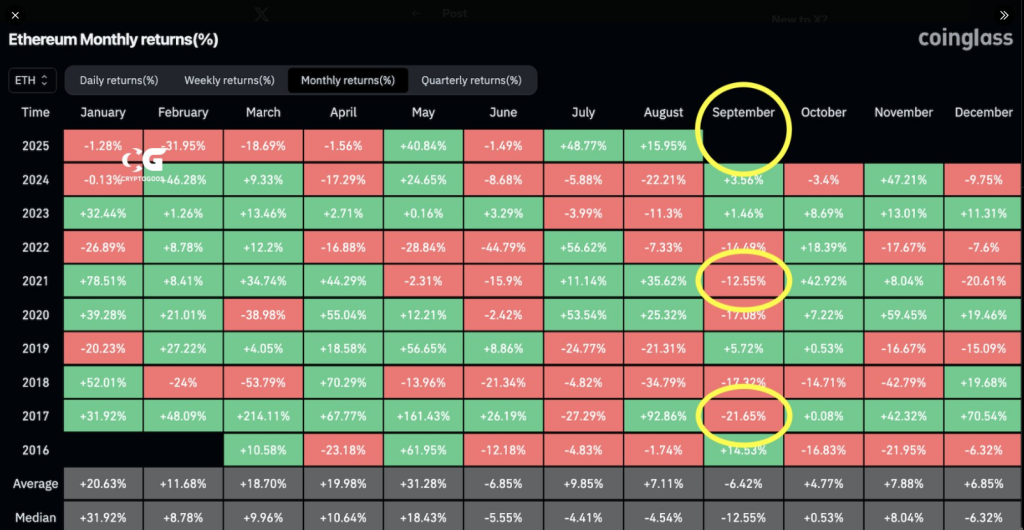

According to CorciLass, the story offers a warning note: there have been only three cases since 2016 where Ether increased in August, then slipped in September.

In 2017, Ether jumped 92% in August, then dropped by 20% the following month. In 2020, August 25% gains were followed by a decline of 17% in September.

And in 2021, a climb of 35% in August gave way to a 12% slip in September. Cryptogoos, a merchant on X, summed it up frankly: seasonality in September during the years after research tends to be negative.

$ ETh The seasonality in September during the years after milk is generally negative.

Will this time be different? pic.twitter.com/h9hj40v3np

– Cryptogoos (@crypto_goos) August 22, 2025

This model does not mean that a repetition is guaranteed. The reports have revealed that the market structure and investor profiles are now different from those in previous years.

In 2016 and 2020, short -term losses in September were followed by recovery of several months, with the ether on the rise in the last three months of these years. Thus, although history counts, it does not decide on results alone.

New money, new dynamic

The flows in the ETHE of the Spot ether this month were large enough to attract attention. Based on the Farside reports, the ETHE ETFs experienced net entries of around 2.70 billion dollars in August, while the Bitcoin ETF experienced around $ 1.2 billion in net outputs during the same period.

At the same time, companies holding crypto on their balance sheets now control an important part of ether. The reports show that the total ether held by cash companies exceeded $ 13 billion in value on August 11.

Arkham reported that Bitmine Tom Lee president bought $ 45 million in additional ether, raising Bitmin pile at $ 7 billion.

These figures change mathematics. Large institutional batteries and demand from ETFs can make movements clear and in the short term more persistent than in previous cycles.

Capital seems rotary; The domination of Bitcoin has dropped 5% in the last 30 days to 55%, which market players mainly attribute to funds through assets beyond Bitcoin.

Related reading

What traders could then do

Merchants and portfolio managers will probably have an eye on macro signals and flow data. Powell’s softer interest rate perspective is a bullish factor for risk assets, but seasonality and previous declines after August are reasons to remain cautious.

Felash star image, tradingView graphic

(Tagstotranslate) Altcoins

Source link