Amid a general crypto market price decline over the past week, Ethereum (ETH) saw a price correction of over 19.5%, finding support at a local low of $3,100 . Since then, the leading altcoin has shown only slight resilience, rising more than 5% over the past two days. However, recent wallet activity data provides plenty of reasons to be optimistic about Ethereum’s long-term future.

Ethereum HODL Addresses Increase Supply Dominance to 16%

In a recent QuickTake article, CryptoQuant analyst MAC_D shared positive insights about the Ethereum market.

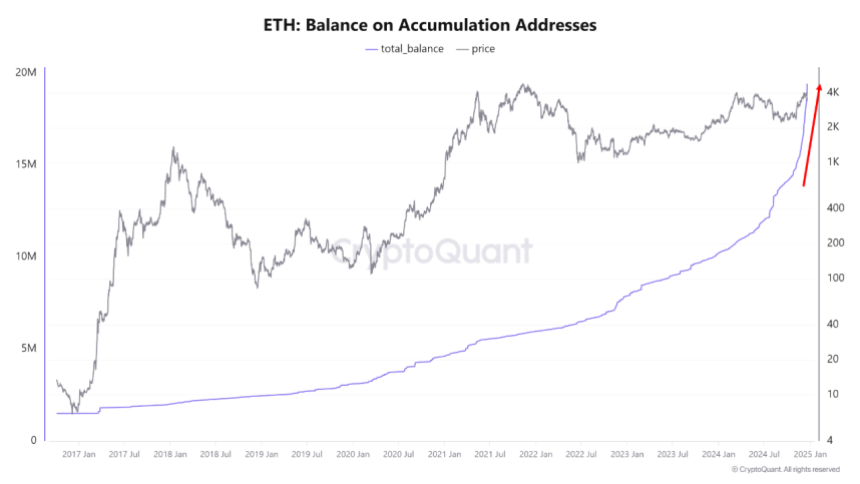

The crypto market expert reports that the balance of Ethereum accumulation addresses increased by 60% between August and December. Meanwhile, these HODL wallets increased their ETH supply share from 10% to 16%, or 19.4 million ETH out of 120 million ETH.

To explain, accumulation addresses are wallets that hold Ethereum but rarely move or sell their holdings. They are considered a long-term investment and confidence measure.

According to MAC_D, the rapid increase in holdings of these Ethereum HODL wallets is a new development absent from previous bull cycles. The analyst attributed this massive accumulation rate to investors’ bullish expectations for the new Donald Trump administration in the United States.

These expectations include more favorable regulation for the DeFi industry which represents a major sector of the Ethereum ecosystem. Therefore, regardless of Ethereum’s current price action, these long-holding wallets will likely continue to increase their holdings in anticipation of future price growth.

Additionally, MAC_D highlights the importance of these accumulation addresses as the price of Ethereum has never fallen below its realized price. Therefore, continued purchase by these wallets offers high potential for long-term price gain.

What’s next for ETH?

Regarding Ethereum’s immediate move, MAC_D warns that macroeconomic factors are likely to exert a stronger influence on the ETH price in the near term, as illustrated by the recent reduction-induced price crash potential interest rates in 2025.

At the time of writing, the altcoin is trading at $3,352 after a 3.07% decline over the past 24 hours. Meanwhile, ETH’s daily trading volume is down 53.25% and valued at $31.15 billion.

Following recent price declines, Ethereum is also showing negative performance on broader charts with losses of 14.74% and 1.05% over the last seven and thirty days, respectively. On a positive note, the asset’s price remains well above its initial price ($2,397) at the start of the post-US election price rally, indicating that long-term sentiment remains positive.

With a market capitalization of $401 billion, Ethereum continues to rank as the second largest cryptocurrency and largest altcoin in the digital asset market.