This article is also available in Spanish.

Ethereum started the new year with a strong performance, rising more than 9% in just a few days. This rally brought renewed optimism to the market, particularly among analysts and investors who were concerned about Ethereum’s prolonged underperformance relative to Bitcoin. Over the past few months, ETH has struggled to maintain momentum, leading many to question its near-term potential.

Related reading

However, leading analyst Daan recently shared an insightful chart that changed the narrative. According to Daan, Ethereum has historically shown significant activity during the first quarter of the year, even in periods where it lagged behind Bitcoin. This trend highlights Ethereum’s rebound potential as market dynamics shift in its favor.

As Ethereum price action strengthens, the next few weeks will be crucial. Investors are closely watching whether ETH can maintain this momentum and regain its dominance in the altcoin space. Overall market sentiment suggests that 2025 could be a pivotal year for Ethereum, with the first quarter’s trend potentially setting the tone for impressive progress.

Ethereum’s start to the year sparks optimism

Ethereum began 2025 on an optimistic note, with investors and analysts closely monitoring whether this momentum can be maintained. Although the start of the year has been strong, Ethereum’s performance will need to break from past trends of underperformance relative to Bitcoin to truly thrive in the months to come.

Analyst Daan recently shared a detailed analysis of the ETH/BTC ratio on X, highlighting the historic importance of the first quarter for Ethereum. According to Daan, Ethereum often saw substantial action during this period, even in years when it lagged behind Bitcoin.

During the previous bull cycle in 2020 and 2021, the ETH/BTC ratio saw significant increases that coincided with the start of an alt season. This historical data suggests that Ethereum’s Q1 performance could set the tone for broader market activity.

For Ethereum to build on this promising start, the ~0.04 level of the ETH/BTC ratio constitutes a critical resistance point. A decisive breakout above this level could revive investor confidence and potentially lead to significant gains. However, failure to maintain momentum or surpass key levels could cause Ethereum to continue the broader trend of relative underperformance.

Related reading

The next few weeks will be pivotal. If Ethereum can build on this first quarter strength and surpass critical thresholds, 2025 could mark a banner year for the leading altcoin.

Critical ETH testing zone

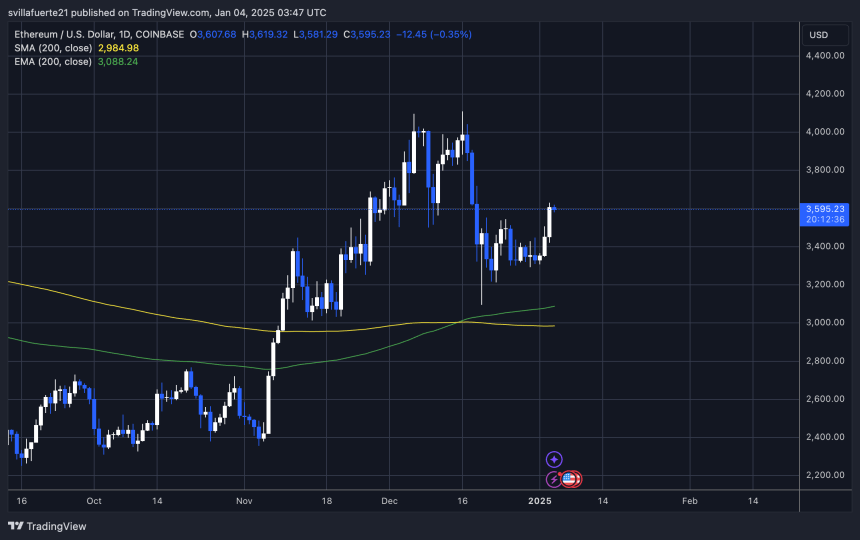

Ethereum is trading at $3,595 after hitting a high of $3,629 yesterday, testing a critical level that could determine its near-term direction. The price has shown resilience, rebounding from the late December decline, but bulls now face the challenge of breaking through this significant resistance to maintain their bullish momentum.

This level represents a crucial turning point for Ethereum. A break above $3,629, followed by a strong close, could signal the start of a bullish rally, potentially paving the way for a move towards higher targets in the coming weeks. However, the market remains in a recovery phase, with trading activity reflecting cautious optimism as investors assess the potential for continued upward movement.

Despite this positive outlook, the path forward may require patience. Consolidation around current levels is possible as the market seeks clarity and momentum builds. Bulls will need to maintain Ethereum’s position above $3,500 to ensure the bullish structure remains intact.

Related reading

As the market begins to wake up from the seasonal correction, Ethereum’s performance at these levels will be critical. A decisive move in either direction could set the tone for the altcoin’s trajectory in the coming months, making it a key moment for investors and traders.

Featured image of Dall-E, chart by TradingView