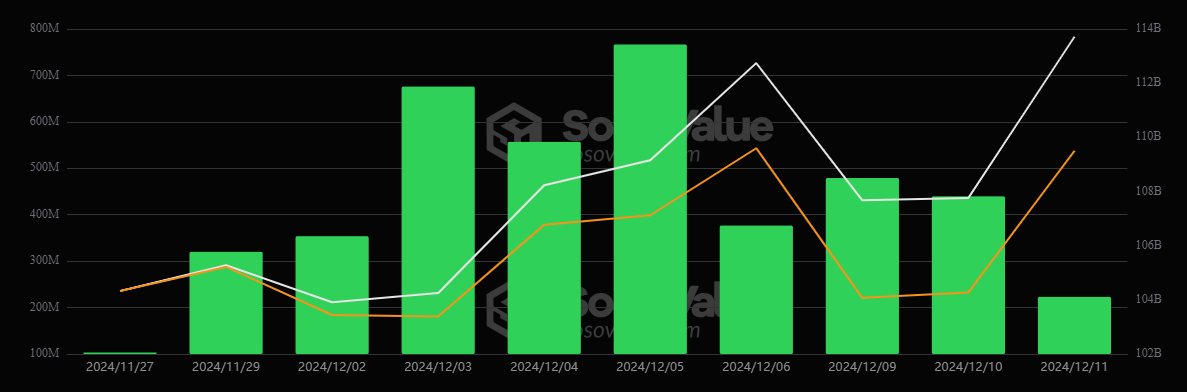

Ethereum and Bitcoin ETFs are stealing the show, with weeks of massive inflows signaling a clear increase in investor appetite. Institutional players are getting involved and individual investors are diversifying their bets, putting this segment at the forefront.

Leading the way, Bitcoin spot ETFs racked up a 10-day streak of inflows, bringing in $223 million on December 11 alone. Fidelity’s Bitcoin ETF (FBTC) carried much of the load, throwing $122 million at Bitcoin .cwp-coin-chart svg path { Stroke: ; line width: ; }

Price

Trading volume in 24 hours

Last price movement over 7 days

in a single day.

Bitcoin ETFs lead with consistent momentum

iShares Bitcoin Trust (IBIT) has become the dominant player, managing $51.1 billion in assets. Fidelity’s FBTC follows closely, with $20 billion under management. Both ETFs have posted a solid 138% growth since February, far outpacing the broader market index.

“We believe many advisors and investors are using Bitcoin ETFs for a small portion of their portfolios, leveraging them with risk capacity,” said Todd Rosenbluth, head of research at TMX VettaFi.

EXPLORE: Buy and use Bitcoin anonymously / without ID

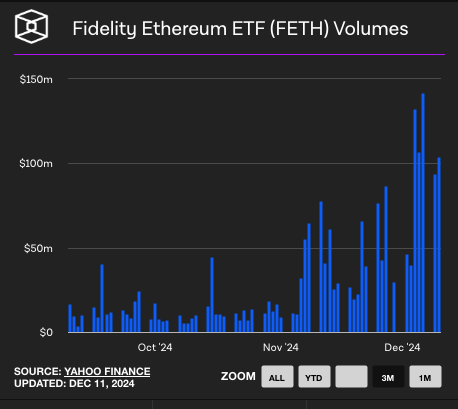

Ethereum ETFs join the rally

Not to be outdone, Ethereum-focused ETFs have seen their own inflow streaks, with 13 consecutive days of positive net flows. During this period, $1.95 billion was invested in Ethereum ETFs, bringing their net assets to $13.18 billion.

Blackrock’s Ethereum ETF (ETHA) dominated on December 11, bringing in $74.1 million. Such consistent flows demonstrate the growing institutional acceptance of Ethereum as a core asset class alongside Bitcoin. Ethereum ETFs now represent 2.86% of the global cryptocurrency market capitalization, reinforcing their growing relevance in the market.

The differences between spot and futures ETFs remain key to this market shift. Spot ETFs, favored for their direct tracking of cryptocurrency prices, have generated higher returns, with top performers like FBTC and IBIT up 138% since February.

Futures ETFs like ProShares’ BITO, meanwhile, boast an eye-catching 52.3% return thanks to tax tricks, but there’s a slight problem with its two-year performance stagnating at a 28% return on investment, leaving spot ETFs looking like the smarter choice for the long haul. carry.

“Futures-based ETFs were initially the preferred option, but investor preference has shifted to spot ETFs, which better track actual market performance,” Rosenbluth added.

Market Implications and Growing Adoption of Bitcoin ETFs

Bitcoin and Ethereum ETFs have gained more than $6 billion in recent weeks, changing gears in the crypto market and capturing institutional attention. These funds no longer aim only to diversify: they become engines of income. Take WisdomTree’s BTCW ETF, which generated 95% of the company’s revenue, cementing ETFs as the go-to solution for asset managers looking to thrive.

The continued growth of ETF flows for Bitcoin and Ethereum highlights their maturing role in global financial systems. Investors are watching to see if these trends will translate into sustainable price increases and broader adoption in traditional financial portfolios.

All eyes are on whether these flows will drive further innovation in this fast-growing investment category.

EXPLORE: 17 Best Cryptos to Buy Now in 2024

Join the 99Bitcoins News Discord here for the latest market updates

The article Ethereum and Bitcoin ETFs See Record Inflows appeared first on 99Bitcoins.