Ethereum is notable withdrawal after an explosive rally which has brought the price from $ 2,500 to $ 3,800 in less than three weeks. Despite this recharge time, the bulls remain in control, the ETH holding a company higher at the level of $ 3,600 – a key support area now acting as the basis of potential consolidation. The market seems to digest recent gains, with signs that Ethereum’s strength could be far from over.

Related reading

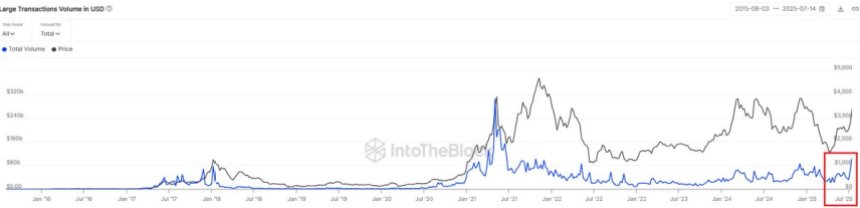

The data on the Sentora chain add to the upward prospects. Last week, Ethereum saw the highest weekly volume of large transactions since 2021. This increase in large -sized activity signals an increase in the interests of institutional actors and significant investors, even in the midst of short -term volatility.

With legal clarity in the improvement of the United States and the fundamental strengthening of basic principles, the current break can prepare the ground for another higher leg. Whether this consolidation lasts for days or weeks, high activity on the chain suggests that the Ethereum ecosystem is heating up, with the positioning of major actors for the next movement.

Institutions run from BTC to Ethereum

Sentora data confirms a major change in progress: Large money Ethereum is back. Last week, transfers on the chain of more than $ 100,000 has totaled more than $ 100 billion – the highest weekly volume since 2021. This increase in high value transfers reflects renewed institutional interest, strengthening the role of Ethereum as the main Altcoin in the middle of the market dynamics.

The moment of this wave is critical. The price of Ethereum has joined $ 2,500 at $ 3,800 in a few weeks, and institutional capital seems to turn from Bitcoin to Eth. While Bitcoin remains in a tight consolidation range just below its top of all time, the upward momentum of Ethereum and the chain force may now suggest the load. This rotation sparked discussions on the start of the “Ethereum season”, a model observed in previous market cycles when ETH surpasses BTC and capital begins to flow into the larger Altcoin market.

Some analysts believe that this could mark the first stages of a long -awaited allusivity season. Historically, Ethereum leads such phases, acting like the bridge so that investors explore high beta active ingredients through the cryptography ecosystem. If ETH maintains the current force and exceeds the level of $ 4,000, this could trigger a wider market expansion.

Related reading

Eth Price holds above the key support after the parabolic rally

Ethereum has made its first significant decline since it started a powerful push in the region of $ 2,500 in early July. After reaching a local summit of $ 3,801, ETH is now negotiated about $ 3,662, down around 2.7% over the day. Despite the minor correction, the overall structure remains optimistic. The current price is above $ 3,600 zone, a level which now acts as a key short-term support.

The volume has decreased slightly during this decline, which suggests that the sales pressure remains relatively controlled. ETH is still negotiating well above its 50-day mobile averages, 100 days and 200 days, strengthening the strength of the upward trend. The next major resistance is between $ 3,800 and $ 3,850, which aligned with the previous peaks observed at the beginning of 2024.

Related reading

Successful consolidation greater than $ 3,600 could provide the basics of a new higher leg towards the $ 4,000 mark. However, non-compliance with this level of support could trigger an area of the $ 3,450 at $ 3,450, followed by a stronger support around $ 3,000 and the $ 2,850 breaking area.

Dall-e star image, tradingview graphic

(Tagstotranslate) ETH

Source link