Este Artículo También is respondable in Español.

Ethereum has experienced a massive drop, reaching its lowest level since the end of November 2023. The entire market was affected by extreme volatility, uncertainty and aggressive price oscillations, and the ETH losing more than 20% of its value in just a few hours. Investors fear that this correction can extend more while Ethereum has trouble recovering key demand levels.

Related reading

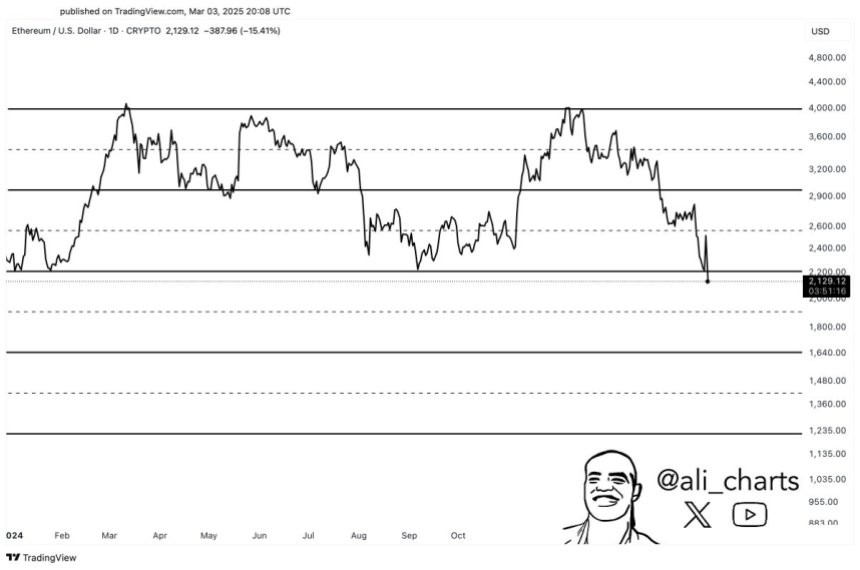

Analysts closely follow the action of Ethereum prices, because the next few days could determine the short-term perspectives of the second largest cryptocurrency. The upper analyst Ali Martinez shared a technical analysis on X, suggesting that Ethereum is about to get out of a canal parallel to the decline. If this push below the $ 2,000 brand occurs, ETH could be set for a deeper correction before any recovery attempt.

Ethereum’s weakness raises concerns about the wider market of cryptography, as altcoins were also hardly affected during this last sale. The feeling remains lower and the merchants expect confirmation of knowing whether the ETH will resume strength or will continue to fall towards lower demand areas. The next trading sessions will be crucial to determine if Ethereum can maintain above critical support or if a new drop is inevitable.

Ethereum faces more lower risk

The action of Ethereum prices has been disappointing while the wider market of the cryptography market has trouble finding stability. Despite brief rallies and net reductions, the ETH failed to establish a clear trend, leaving the uncertain investors of its future orientation. The asset was stuck in a prolonged downward trend, constantly fixing new stockings and strengthening the lowering feeling on the market.

Currently, Ethereum is traded at bearing market prices with little or no signs of sustainable recovery. As the market structure is weakening, many investors expect ETH even more. Analyst Martinez highlighted a worrying development, noting that Ethereum seems to be breaking down from a parallel channel that contained the price for months. The ETH could be on the right track for a net movement around $ 1,250, a level that would signal a deeper market collapse.

A drop to $ 1,250 would not only strengthen Ethereum’s lower prospects, but would also serve as a key signal for wider ventilation on the market. This scenario could lead to the sale of panic at all levels, resulting in other major assets lower and confirming an extended lower market. Despite occasional price oscillations, Ethereum remains critical at a time, the bulls that find it difficult to recover the main levels of support. Unless ETH can recover the lost terrain and establish a solid support base, the risk of additional decline remains high.

Related reading

Ethereum not showing force in the midst of market volatility, investors remain cautious, anticipating lower price levels before any significant recovery may take place. The next few days will be crucial to determine if the ETH can stabilize or if the $ 1,250 target of Martinez will become a reality, confirming the lower perspectives of the entire cryptography market.

ETH test the level of critical demand

Ethereum is negotiated at $ 2,090 after a period of low price action, marking a 30% drop since February 24. This significant drop has left investors wondering if ETH can maintain its long -term bullish structure or if a deeper correction is imminent.

Currently, Ethereum is at a level of critical support which must hold to maintain any hope of Haussier continuation. A ventilation lower than this level would probably confirm a scenario of the bear market, pushing the ETH to lower price levels as the sales pressure is intensifying. The uncertainty surrounding the action of Ethereum prices has left the merchants cautious, because any other weakness could accelerate the decline.

However, recovery is still possible if ETH can recover the resistance level of $ 2,500. Such a decision would point out a renewed purchasing momentum and could trigger a strong recovery, potentially reversing the recent downward trend. If Ethereum manages to return $ 2,500 in support, this would indicate renewed confidence in the asset and prepare the way for higher price targets.

Related reading

For the moment, all eyes are on Ethereum’s ability to defend $ 2,090. The next few days will be crucial to determine if the ETH can stabilize or if the market is moving towards a more extended bearish phase.

Dall-e star image, tradingview graphic