According to Fundstrat Research, Ether could climb much higher before the end of 2025, with price targets ranging from $ 10,000 to $ 15,000.

Related reading

Reports show that Ether has jumped approximately 60% in the last 30 days and has reached a four -year summit almost $ 4,770 at the start of negotiations, while other covers put the token at $ 4,694 and noted a overvoltage of 78% on an eight -week section.

These movements pushed the ether near its peak of all time, and fund managers take note.

Targets and justification of funds

According to Fundstratttttrate’s information director Tom Lee, and the Digital Asset Research Head Sean Farrell, institutional forces and new rules are key engines.

They indicate that the work of Stablecoin and token projects are built mainly on Ethereum, and they cite regulatory efforts such as the Genius Act and the so-called Crypto project of the dry as factors that could accelerate the passage of Wall Street on Blockchain Rails.

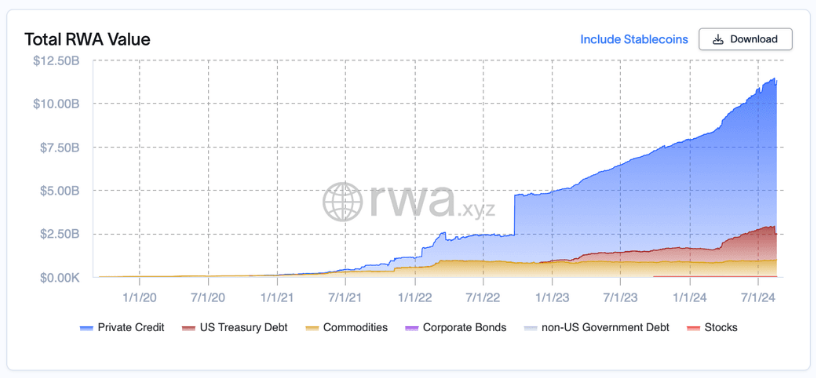

Based on the data, Ethereum has a dominant part of 55% in the tokenization sector of real assets of 25 billion dollars, a statistic that Fundstrat uses to plead for a broader institutional adoption.

Institutional request and big buyers

Reports have revealed a large -scale business accumulation which, according to several analysts, withdraws the market offer.

Bitmin Immersion Technologies would have added about 1.2 million ETH since early July, leaving the company with around $ 5.5 billion in ether in its books. The company’s action (BMNR) was volatile, a certain coverage pointing to a jum of 1,300% over a short period.

Fundstrat and other observers claim that this type of business treasury bill, combined with fresh FNB flows, could create a structural offer for ETH if the purchase is maintained.

Rachael Lucas, cryptographic analyst at BTC Markets, described these positions as strategic and long -term, affirming that they remove the “substantial liquidity” of commercial basins.

Market momentum and price complaints

According to Fustratt, Ether surpasses Bitcoin this year. A set of figures has enabled the ETH year to gain 28% compared to 18% Bitcoin, while other reports showed ETH more recently up 41% YTD and Bitcoin up 30% YTD, the BTC negotiating nearly $ 121,000 in this snapshot.

Based on reports, Fundstrat analysts consider ETH as an important macroelian trade for the next 10 to 15 years if institutional and regulatory trends continue to push higher demand.

Analysts warn that high targets will need supported and important imports to become reality. Monitor the rhythm and consistency of FNB flows, the disclosure of the corporate treasury and any regulatory decision around stablescoins and daycare rules.

Related reading

There is also a practical concern: large concentrated purchases can quickly tighten markets but can also reverse whether changes in feeling or liquidity needs change.

According to the analysis and comments of the public of Fundstrat, the optimistic case for the ether is clear and supported by specific figures: $ 10,000 to $ 15,000, the treasury bills of companies holding millions of ETH and recent recent gains.

Meta star image, tradingview graphic

(Tagstotranslate) Altcoins

Source link