This article is also available in Spanish.

Ethereum (ETH) surged above $2,500, now testing a critical supply level that could spark a massive rally for ETH and altcoins.

After several days of anxiety and uncertainty, yesterday’s market rally has reignited optimism in the crypto space. Investors and traders are closely monitoring Ethereum price action, as a breakout above this crucial zone could signal the start of a significant uptrend, potentially paving the way for an Altseason.

Related reading

Leading analysts and investors are awaiting confirmation that ETH is poised to rally soon. Carl Runefelt, a well-known analyst and investor, has shared his technical analysis on Ethereum, suggesting that the long-awaited rally could be upon us.

According to Runefelt, ETH’s exit from the current supply zone could lead to a substantial price rise, attracting bullish momentum for Ethereum and a wider range of altcoins.

The next few days will be crucial for Ethereum price action as the market awaits signals that could define the direction of this potential rally. Investors remain optimistic, anticipating that ETH could lead the market into its next major bullish phase.

Ethereum tests crucial supply

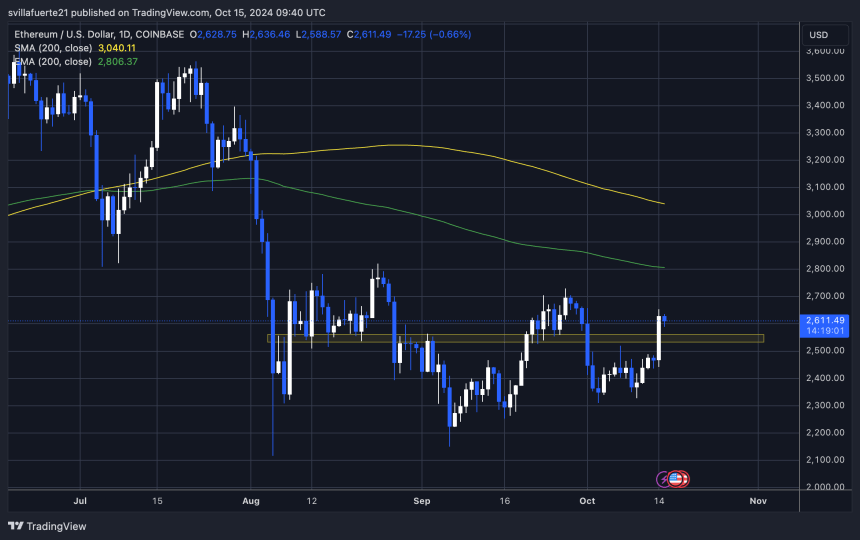

Ethereum has been trading in a bullish triangle formation since early August, and the moment of truth for a potential breakout could be near.

ETH has underperformed BTC throughout the year, leading many investors and traders to question the strength of ETH during this cycle. This trend led to a shift in confidence as Bitcoin continued to dominate, leaving Ethereum behind.

However, during yesterday’s market rally, Ethereum showed renewed strength, outperforming Bitcoin for the first time in some time, signaling a possible shift in market dynamics.

Prominent cryptocurrency analyst Carl Runefelt recently shared technical analysis on X, highlighting Ethereum’s imminent exit from the bullish triangle pattern.

According to Runefelt, Ethereum is approaching a key moment, and a break from this trend could lead to a major rally. He suggests that once ETH breaks through, the next supply zone to target will be around $3,400, which represents a significant upside from current levels.

Related reading

This optimistic outlook comes from renewed positive market sentiment and improving Ethereum price action. Traders and investors are closely watching the coming days as a successful breakout could mark the start of Ethereum’s long-awaited uptrend and restore its strength against Bitcoin.

ETH Technical Levels to Watch

Ethereum is trading at $2,611 after a notable 7% rise yesterday. This bullish momentum has allowed the price to surpass the $2,500 mark, a critical resistance level pushing the price lower since early October.

Now, Ethereum is less than 8% away from the 200-day exponential moving average (EMA), currently at $2,806.

For bulls to take control and establish a sustained uptrend, ETH must reclaim this 200-day EMA and close above the $2,800 level. This would signal continued bullish momentum and pave the way for a potential rally towards higher price levels.

On the other hand, if Ethereum fails to sustain above the $2,500 support level, a deeper correction could be on the horizon. In this case, the price could return to $2,300, where stronger demand could help stabilize the market.

Related reading

The next few days will be crucial for Ethereum as traders and investors closely monitor whether the price can maintain its recent gains and break through key resistance levels.

Featured image of Dall-E, chart by TradingView