- Ethereum’s price drops by 10.40%, almost $ 2,000, while whales accumulate ETH, signaling a potential rebound.

- The following movement depends on this level; Ventilation could trigger new liquidations

Ethereum (ETH) was caught in a lower spiral, giving off 10.40% last week and approaching the crucial level of support of $ 2,000.

The last decrease of 10.40% raised concerns among investors, as macroeconomic pressures and market -scale sales continue to weigh on assets.

While short -term merchants come out of their positions, the big whales Ethereum have adopted an approach against, accumulating 330,000 ETH in just 48 hours.

This divergence between price action and whale behavior raises an important question-assist us at the start of a deeper correction, or is it a strategic accumulation phase before a potential rebound?

Ethereum prices and key levels

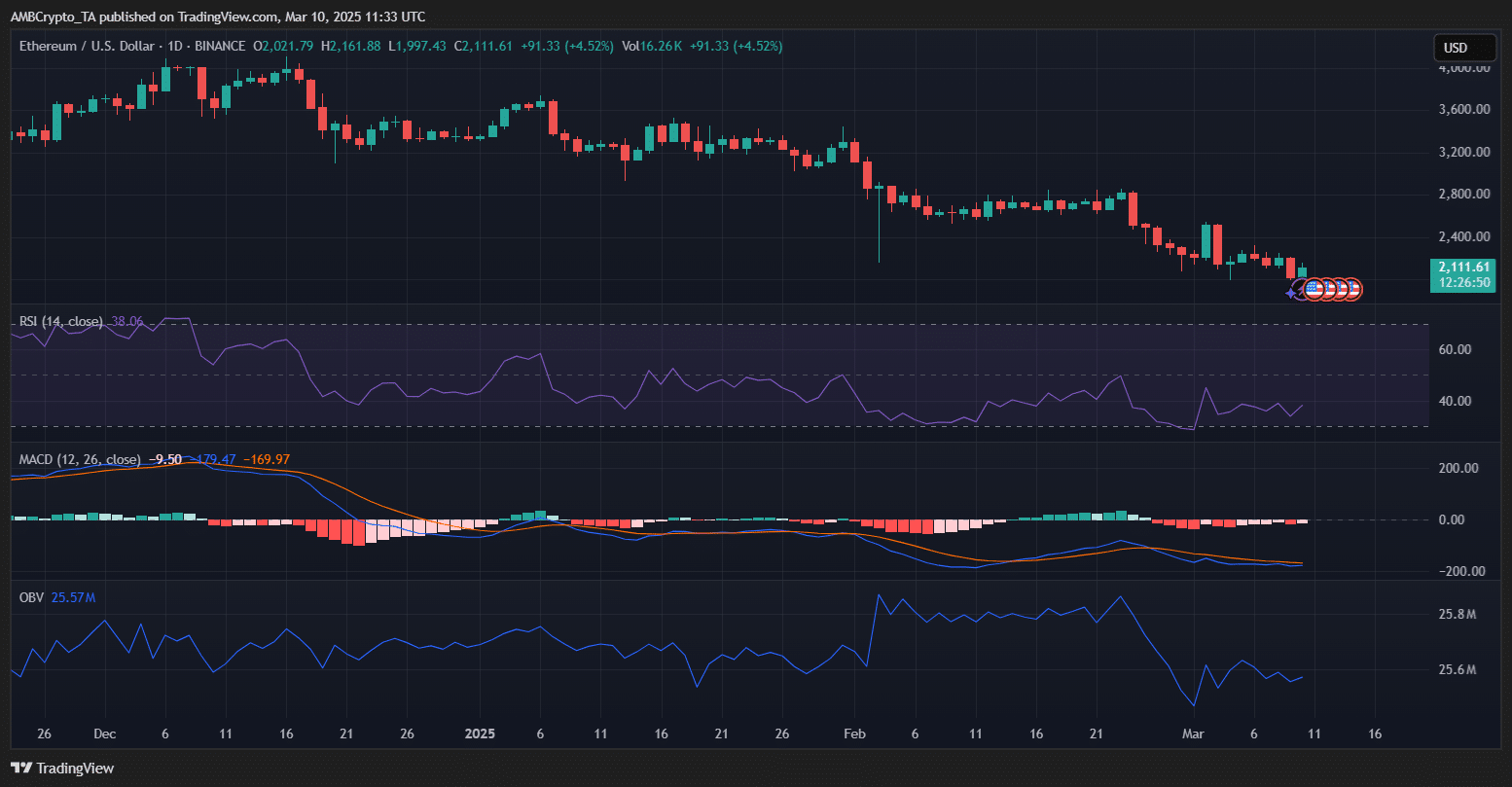

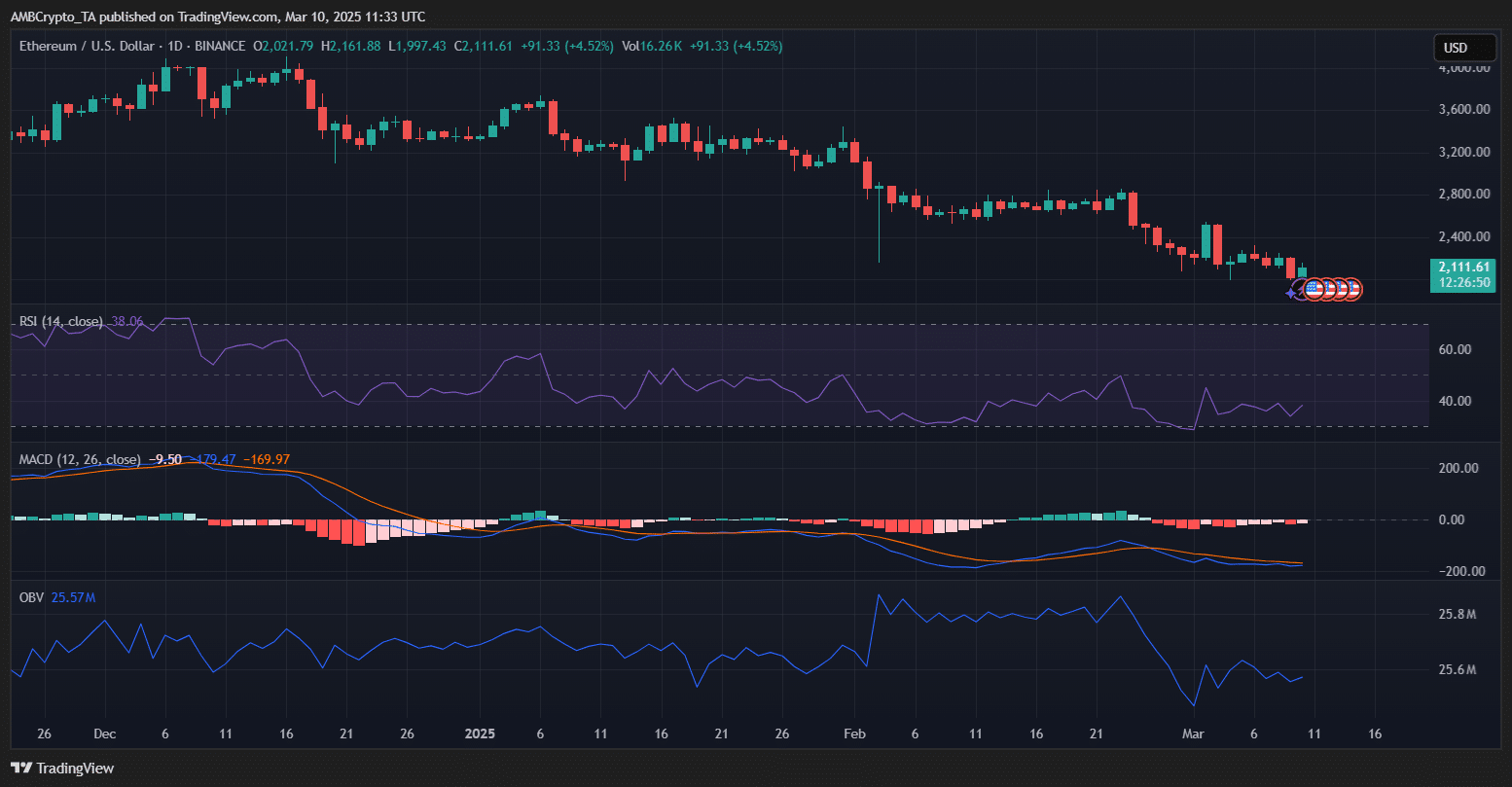

The recent weekly decrease of 10.40% Ethereum is reflected in the main technical indicators indicating a lower momentum.

The RSI was seated at 38.06 at the time of the press, approaching the surveillance region, suggesting that the sale pressure was dominant, but a potential reversal could emerge if buyers intervene.

Source: tradingView

The MacD indicator has remained in negative territory, with the MacD line at -9.50 and the signal line below zero, strengthening the downward trend.

In addition, the OBR has shown a slight decrease, indicating a reduced purchase activity and lower demand.

Ethereum must contain the level of support of $ 2,000, because the previous data suggest that the loss of this area could trigger cascade liquidations.

However, if buyers capitalize on the current whale accumulation, a recovery around $ 2,200 may be possible.

Accumulation of whales: sign of confidence or prudence?

The price of Ethereum has dropped considerably, but the data on the chain reveal that the big holders have accumulated 330,000 ETH in the last 48 hours.

There was a strong increase in the sales held by portfolios with more than 100,000 ETH, indicating strategic purchases by deep investors.

Source: X

These main players could include institutions, long -term holders or market manufacturers positioning themselves before potential price oscillations.

The timing suggests that whales could buy the decline, expect a recovery or coverage against new volatility.

Historically, such an accumulation of whales has preceded price rebounds, but with Ethereum hovering around the critical level of $ 2,000, the next decision will depend on the workforce or wider market conditions forcing another leg down.

Metrics and chain market feelings

Source: cryptocurrency