Ethereum is negotiated at a critical level after several days of sale of mounting and speculation of assembly, with bulls which find it difficult to maintain the momentum as Bitcoin and the wider cryptography market become lower. The price action has moved to a cautious phase, and ETH is now faced with the challenge of defending the key demand zones that could determine the coming weeks.

Related reading

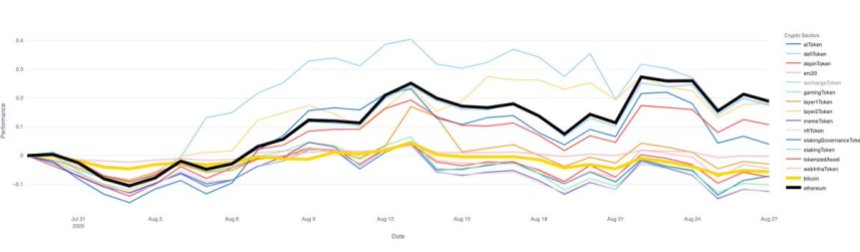

Despite this decline, Ethereum remains the interpreter off competition on the market. New data from Glassnode reveal that over the course of last month, no Altcoin sector has outlined the ETH, although the DEFI ecosystems and layer 2 have come closer. This resilience underlines the domination of Ethereum even in period of wider weakness of the market, strengthening its role as a skeleton of decentralized finance and blockchain infrastructure.

The trend also suggests that the market is entering into what many analysts describe as a “Ethereum season”, where ETH leads the performance and rotation of Bitcoin capital in Altcoins is starting to accelerate. With the institutions, whales and retail investors who look closely, Ethereum’s ability to hold the ground while other weakens highlights its strength before the next stage of the cycle.

Ethereum directs the market as the rotation of capital accelerates

According to Glassnode, Ethereum has established itself as the clear market leader in the last month. No Altcoin sector has managed to surpass the ETH during this period, with only the ECOSYSYTEMS DEFI and CLAIR 2 getting closer. In particular, most of the Altcoin sectors have finished the month of decline, strengthening the relative force of Ethereum in a volatile environment.

These performances indicate a clear change in the rotation of capital, while the flows begin to move away from Bitcoin and Ethereum, marking what many analysts consider the start of a new stage of the cycle.

The rotation of capital has long been a characteristic of the dynamics of the cryptographic market. Traditionally, the rallies begin with the domination of Bitcoin before liquidity spread to Ethereum, then, finally, in smaller altcoins. The latest data shows that ETH occupies the front of this process, attracting both the institutional interest and the accumulation of whales. This suggests that investors consider Ethereum as the next growth engine, supported by fundamental solids and increasing adoption in the use of DEFI, NFTS and business.

However, the feeling remains divided. Some analysts argue that this cycle is structurally longer, stretched by institutional products such as ETF Spot and increased overall adoption, which means that Ethereum could continue to outperform for months. Others remain cautious, warning that the current market weakness could be the early signal of a wider bearish trend.

Regardless of these opposite opinions, Ethereum leadership in performance and its ability to exceed almost all Altcoin sector highlights its growing importance in the definition of the next stage of the cryptography market. For many, the ETH sets the tone for the capital where the capital flow – and the opportunities – then go.

Related reading

ETH retires after an explosive rally

Ethereum is negotiated about $ 4,366 after a sharp weekly decrease by almost 9%, after its recent push towards new peaks close to $ 4,800. The weekly graphic highlights a powerful rally that started earlier this summer, ethn eth of $ 2,000 to almost double its value in a few months. However, the last red candles show that sellers intervene while the market digests this steep rupture.

Despite the correction, the ETH remains firmly above its major mobile averages. The 50 weeks of moving medium ($ 2,863), 100 weeks ($ 2,819) and 200 weeks ($ 2,446) are all trendy, confirming that the long -term structure is still optimistic. These levels are now used as strong support layers if deeper retractions occur.

Related reading

In the short term, Ethereum tests the request area from $ 4,200 to $ 4,300, which aligned with previous resistance levels from 2022 and at the beginning of 2024. The holding of this zone would strengthen the case of consolidation before another attempted termination of $ 4,800. A failure, however, could open the door for a return to $ 3,800.

Dall-e star image, tradingview graphic

(Tagstranslate) Altcoins

Source link