The data show that discussions on social media linked to Ethereum have increased recently, which can be positive for the price of ETH in difficulty.

Ethereum Social Dominance has climbed in the last day

According to data from the Santiment Analysis Society, Ethereum social domination has just seen a significant increase. “Social domination” here refers to an indicator based on another metric known as social volume.

Social volume essentially tells us about the number of discussions that a given subject or term receives on the main social media platforms. Metric calculates its value by counting the single total number of messages / messages / threads on these platforms making the term.

It may seem strange that metrics not only count the mentions themselves, but the reason behind it is that the other methodology can sometimes paint an inaccurate image of the situation on social networks.

This can happen when there is not much activity on platforms, but there are some messages of enthusiasts. These messages can contain a notable number of mentions, enough to distort the social volume by themselves.

By following only the messages themselves, the indicator only exempts when the discussion is more distributed on social networks (that is to say that there are a high number of users participating in talks ).

Now, the real indicator of relevance here, social domination determines what part of the discussions related to cryptocurrency of which a given token takes into account. The metric uses the social volume of the assets and that of the 100 best parts by market capitalization to make the comparison.

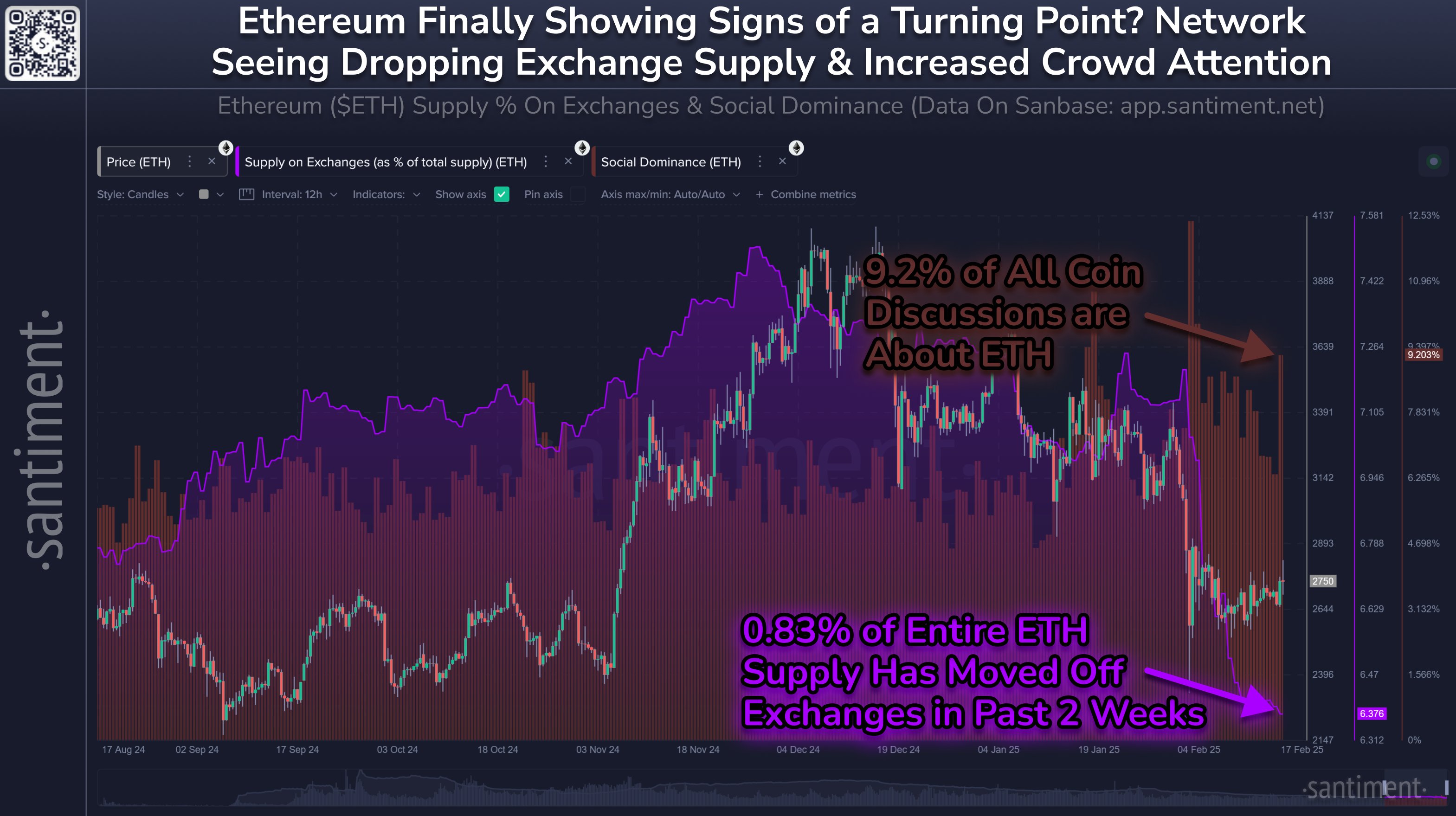

You will find below the graph shared by Santiment, which shows the tendency to the social domination of Ethereum in recent months:

Looks like the value of the metric has witnessed a sharp jump recently | Source: Santiment on X

As it is visible in the graph, Ethereum social domination has just obtained a peak, which means that the share of discussions on social networks occupied by the asset has triggered.

After this increase, the indicator is now at 9.2%, which means that almost a tenth of discussions linked to the cryptocurrency sector imply ETH in one form or another. The price of the assets had difficulties recently, so this renewed interest in social media users can be a positive sign for things to come in the week.

The trend of social domination is not the only bullish development that Ethereum has seen, as the data of the other indicator attached in the graph showed by the analytical society show.

It seems that the supply on exchanges has plunged in the past two weeks, which suggests that investors have made net withdrawals from the centralized discussion medal. In total, 0.83% of ETH’s offer left exchanges during this period, which leaves only 6.38% still sitting on these platforms.

Ethn price

At the time of writing the editorial staff, Ethereum is negotiated at around $ 2,700, up 1% last week.

The trend in the ETH price over the last five days | Source: ETHUSDT on TradingView

Dall-e star image, Santiment.net, TradingView.com graphic