After weeks of high pressure of sale and persistent negative feeling, Ethereum finally shows signs of life. The bulls are retreating, try to recover the critical price levels and reverse the downward trend that has defined in the last months. Despite the renewed dynamics, ETH is still negotiated below the key brand of $ 2,000 – a level which must be violated to confirm a significant change in the market structure and prepare the ground for a sustained recovery.

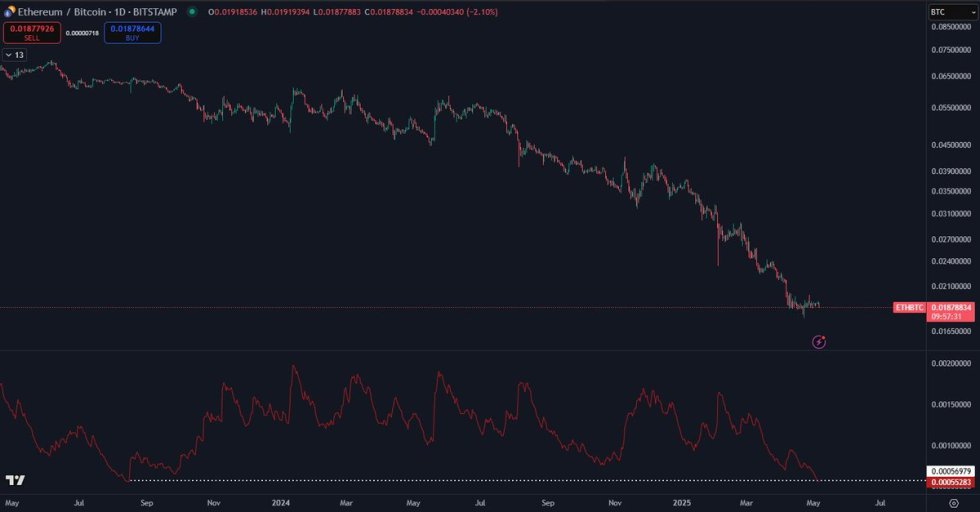

While traders assess Ethereum’s prospects, attention also turns to the ETH / BTC ratio, which has reached its lowest level of volatility in more than two years. According to Top Daan’s analyst, this metric has been in a prolonged downward trend, but has now been in a standstill for more than a month. Historically, such periods with low volatility often precede net directional movements, because the market strengthens the pressure and is preparing for a rupture or a rupture.

While the price of Ethereum remains technically fragile, the combination of reduced volatility, a long -term support on the ETH / BTC pair and a bull -up momentum renewed on the USD graph creates a prudently optimistic configuration. The next few days will be crucial because Eth tests resistance. A confirmed escape greater than $ 2,000 could be the signal that the next stage of Ethereum is about to start.

Ethereum fights below $ 1,900 as risk and uncertainty dominate

Ethereum faces renewed pressure after failing to break over $ 1,874 on May 1, leaving the bulls with the urgent task of recovering the momentum before volatility. The asset is currently negotiating critical support, unable to establish a clear direction because the world markets remain fragile. Ethereum still down more than 55% compared to its summits in December, the lowering price structure remains intact and any other weakness could trigger a deeper drop.

Market volatility is fueled by macroeconomic uncertainty, in particular while the United States and China continue to engage in high issues with high issues. Investors are cautious, and Ethereum’s inability to show its strength in a broader crypto resumption raises concerns concerning its short -term prospects.

Adding to complexity, Daan stresses that the ETH / BTC ratio is now at its lowest level of volatility in more than two years. Although the ratio was in the long term down, it blocked in the last month, which suggests that an escape (or a breakdown) could be close.

Historically, such periods of compression often precede net movements. However, Daan notes that the trend of the low delay has not yet reversed Haussier, and until it does it, any gathering must be treated with caution. For the moment, Ethereum remains stuck in the limbo.

Price action details: ETH test

Ethereum is traded at $ 1,831, showing a modest force after rebounded by recent support nearly $ 1,780. On the 4 -hour board, ETH tries to establish an optimistic and recovery momentum, but it always faces a strong resistance below the key of $ 1,874 more from May 1. The price is consolidated just above the EMA of 200 periods at $ 1,787 and the SMA of 200 periods at $ 1,699 – two levels which served as dynamic support and resistance areas during recent trading sessions.

This lateral action highlights indecision while ETH fights to free itself from its range, with the compress of volatility and the remaining silent volume. A net break greater than $ 1,874 could point out the start of an upward leg targeting the $ 2,000 psychological bar. However, non-compliance with the region from $ 1,780 to $ 1,750 would probably invalidate the structure and open the door for more decline.

The technical indicators suggest that the momentum is built, but not yet confirmed. Until Ethereum recover the range from $ 1,900 to $ 2,000, the wider downward trend remains at stake. For the moment, the ETH is in a critical area where bulls and bear have a case, which makes the next pivot sessions to determine if Ethereum continues to recover or resume its downward trend.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.