Ethereum (ETH) has just made history with a development that could reshape its market trajectory. For the first time, the Ethereum exchange balance has become negative, which means that more tokens are removed from the trading platforms than deposited. This structural change in the dynamics of the offer has analysts by calling it as a key bull The next market rally.

Ethereum exchange balance = negative

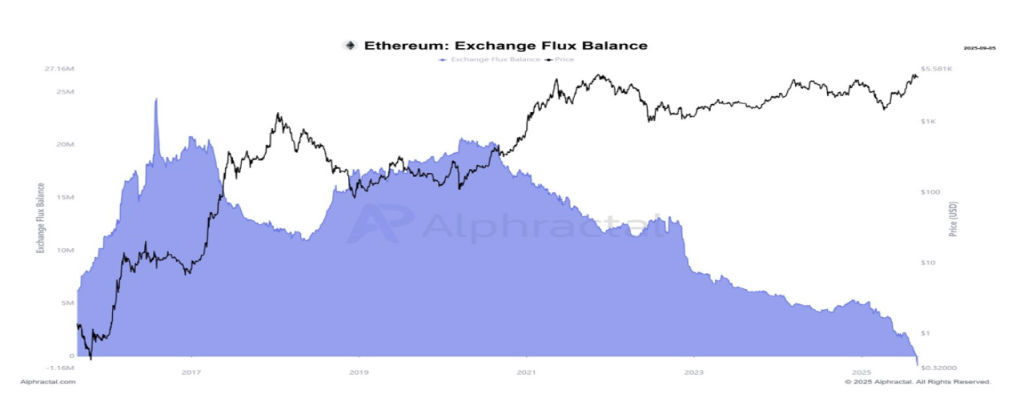

Case market expert case abbe common A new report showing that Ethereum’s exchange flow has slipped into the negative territory for the first time recorded. He suggests that the last development could be optimistic for ETH, because it reports Reduction of sales pressure and the growing confidence of investors.

Related reading

Historically, the metric of the balance of exchanges was one of the lightest indicators of Investor behavior. When the sales increase, this generally indicates the assembly of the sale pressure, while the traders move parts for liquidation purposes. Conversely, when they fall, this indicates that The parts are removed from private walletswhich are less likely to be sold.

The analyst’s graph illustrates a clear and accelerated drop in Ethereum exchange sales in recent years, leading to this historic hollow. Billions of Eth ethn have been removed from centralized platforms, coinciding with the active advance towards a target greater than $ 5,500. This indicates a clear reduction in liquid supply for already increased request.

According to Abbe, the importance of this decline cannot be overestimated. He noted that Market tops In crypto generally occurs after the starters are recovered in these centralized platforms, not when the sales are draining to new stockings. In other words, Ethereum may not be positioned for a sale but for accumulation.

As the sales pressure lights up, long -term holders exercise greater control over food, creating conditions for potentially strong Upward price momentum. If history is a guide, Abbe suggests that the exchange balance in narrowing could prepare the ground The next stage of Ethereum.

The analyst costs $ 7,000 like the next ethn target

While the Ethereum exchange offer hits the Uncharted Bas, technical analysts and cryptocurrencies are more and more optimistic about its price. The market expert announcement in a post on X that ETH has officially released a long -term corner modelwhich has forced prices since 2021.

The accompanying board illustrates that ETH finally pierced resistance after years of Trading laterally. Crypto Goos indicates the level of rupture around $ 3,600, and with Ethereum who is now negotiating considerably above, this decision appears.

Related reading

Although Ethereum has experienced a number of price swings in recent weeks, cryptocurrencies are convinced that he can reach a New top of all time soon. The projection of the analyst of the rupture targets the region of $ 7,000, which represents an increase of increase of approximately 62% compared to the current price levels above $ 4,300. If the momentum persisted, cryptocurrency could extend even beyond the $ 7,000 milestone.

Felash star image, tradingView graphic

(Tagstranslate) Altcoins

Source link